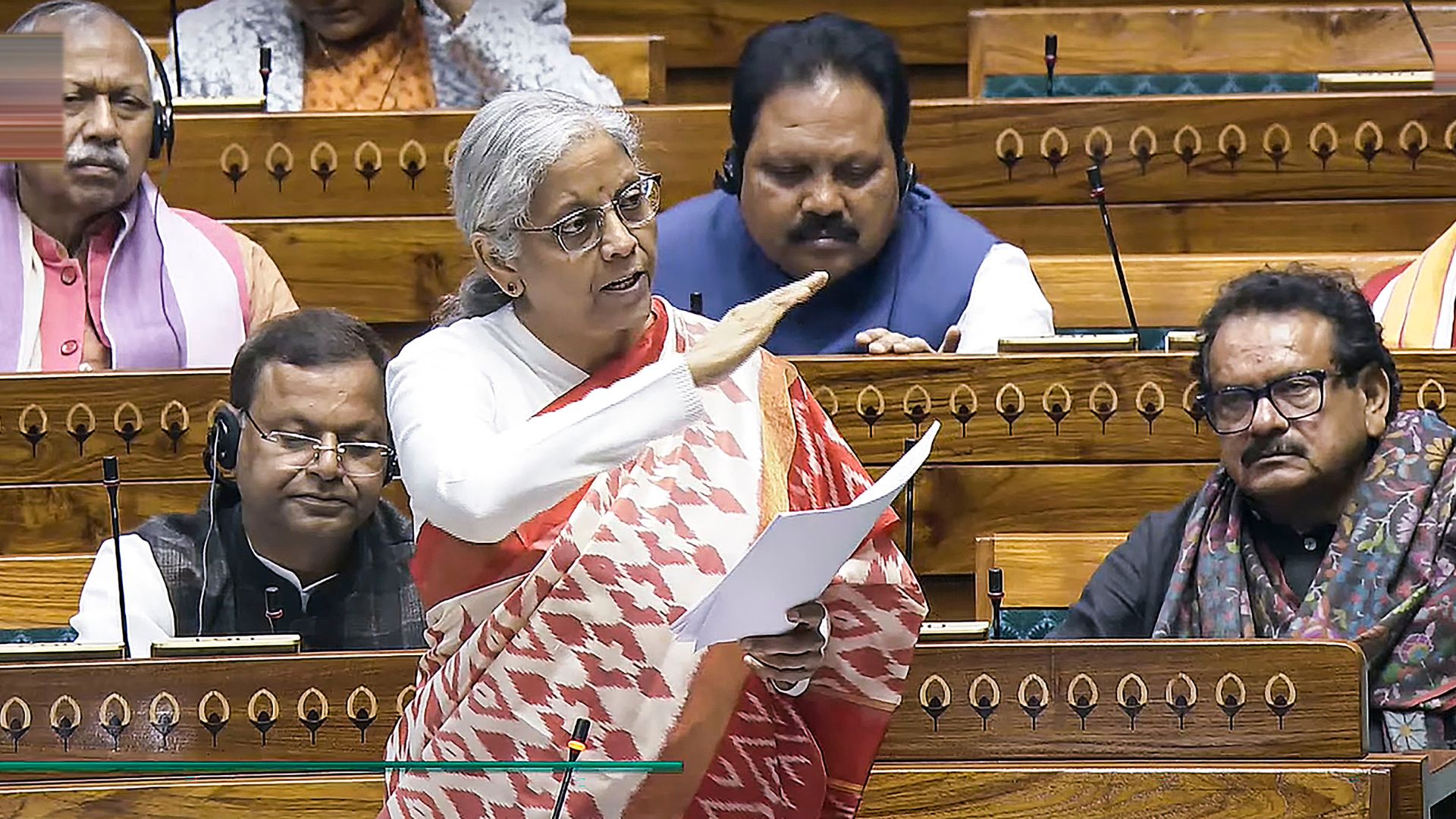

FM says new tax regime has been made \'very attractive\'

Deccan ChronicleNEW DELHI: Finance minister Nirmala Sitharaman on Friday said that the government chose the capital expenditure route to revive the economy as it has a great multiplier effect. She also said the new tax regime has been made “very attractive”, emphasising on moderation in personal taxes for the middle classes in the country. “In the new tax regime, offering a rebate on annual income of up to Rs 7 lakhs will leave higher disposable income in the hands of the people,” she added. Also, income between Rs 3-6 lakh will be taxed at five per cent; Rs 6-9 lakhs at 10 per cent, Rs 9-12 lakhs at 15 per cent, Rs 12-15 lakhs at 20 per cent and income of Rs 15 lakhs and above will be taxed at 30 per cent,” she said, adding no tax will be levied on annual incomes of up to Rs 7 lakhs. Premachandran's remark that the new tax regime will not be beneficial for a person earning Rs 9 lakhs annually and having an investment of Rs 4.5 lakhs in tax savings instruments, Ms Sitharaman said for a person saving Rs 4.5 lakh will be an “effort-ridden exercise” and for a person earning Rs 9 lakhs, it is not always possible to have Rs 4.5 lakhs as saving and then also have enough money to spend on your family,” she said.

History of this topic

Budget 2025: FM should introduce new tax slab for individuals who adopt renewable energy, reduce carbon emissions

Live Mint

Tax action in the Union budget for 2025-26 could set the course for Viksit Bharat

Live Mint

Relief to middle class? Inflation offsets hike in tax exemption limit

New Indian Express)

State of income tax in India: Rich pay more, middle class less

Firstpost

Income Tax Returns data shows that 5 times more people are earning over 50 lakhs per year since PM Modi came to power, pay over 75% of taxes

Op India

Can you expect major income tax changes in Budget 2025? Check details

India Today

Income Tax Department Sees Doubled Number of Income Taxpayers in 10 Years

New Indian Express

Union Budget 2024 reforms of the new tax regime may reduce tax burden and allow option to choose again

Hindustan Times

Budget 2024: Is the new income tax regime beneficial for all salaried taxpayers?

Hindustan Times

New income tax regime: Check how much tax you will pay now

India Today

Budget 2024: Time to opt out of old tax regime? Explained

Hindustan Times

Budget 2024 | Old or new tax regime: Which will be more beneficial for you? Know here

India TV News

The rationale for the tax proposals

The Hindu

Income tax benefits, capital gains tax hike, cheaper phones | Key Budget takeaways

Hindustan Times

Budget 2024: How the changes in new tax regime will benefit the salaried, explained

Hindustan Times)

Union Budget 2024: Should you pick new tax regime? How can you save Rs 17,500 in income tax every year?

Firstpost

Budget 2024: How the new tax regime announced by Sitharaman will impact taxpayers?

India TV News)

Calculation: Will you pay more income tax or less after Budget 2024 changes?

Firstpost

Budget 2024: How will it impact the common people and consumers? CHECK here

India TV News

Old vs proposed income tax slabs under new regime. What has changed?

Hindustan Times

Budget 2024: Income tax slabs changed, standard deduction increased. Read details

Op India

Budget 2024 Highlights on income tax: FM Sitharaman revises personal income tax slabs; taxation rates remain unchanged

The Hindu

FM Says Salaried Employees Under New Tax Regime To Save Rs 17,500 Annually, Here's How

News 18

Budget 2024 Boost To New Tax Regime: Standard Deduction Raised To Rs 75k From Rs 50k

News 18

Budget 2024: Will common man and salaried class get income tax relief? | Here's what we know

India TV News

New tax regime slabs revised, standard deduction hiked to Rs 75,000. Details here

India Today

Budget 2024 announcements on new tax regime: Standard deduction increased, check new tax slabs

India TV News

Budget 2024 HIGHLIGHTS: Andhra Pradesh, Bihar major gainers; special focus on jobs, new tax regime

India TV News

Budget 2024: Will FM Nirmala Sitharaman fulfill your income tax wishes?

India Today

Budget 2024: Will Nirmala Sitharaman bring cheer to middle-class with income tax changes?

Hindustan Times

Budget 2024: Taxpayers, you can expect these 6 income tax benefits on July 23

Hindustan Times

Budget 2024: What income tax benefits can taxpayers expect on July 23?

India Today

Budget 2024: This change to old income tax regime can provide relief to millions

India Today

Budget 2024: Low-income individuals likely to get big tax relief, says report

India Today

Budget 2024: Exemption limit under new tax regime may be hiked to Rs 5 lakh, says report

India Today

Budget 2024: Which income categories can expect tax relief?

India Today

New Tax regime rules to come into effect from today: Check deductions, rebates, changes in tax slab

India TV News

Major Income Tax Reforms Effective From April 1: What You Need To Know

ABP News

No concessions for you and me but expectations remain high

Live Mint

Budget 2024: No change in tax regime this year; check old, new tax slabs

India TV News

Budget 2024: 6 key changes taxpayers want from FM Sitharaman

India Today

Interim Budget 2024: Will new income tax regime get another makeover?

India Today

Robust revenues: On direct tax collection target and fiscal consolidation

The Hindu

Tax collection on course to grow 3 times to over ₹19 lakh crore in 10 years of Modi Government

The Hindu

More Than 5 Crore Taxpayers Opt for New Tax Regime 2023

News 18

Direct tax collections rise 16% to ₹6.53 lakh crore so far this fiscal

Hindustan Times

Income-tax collections grow 20% in one year, nears ₹20 lakh crore mark

Hindustan Times

From new Tax regime, to costlier cars- Changes to kick in from April 1

India TV News

10 Income Tax Rules That Are Changing From April 1, 2023

News 18Net direct tax growth for 2022-23 to slow to 15%

The HinduDiscover Related

)