Net Zero By 2070: Why India Must Focus On Transition Finance, Decoupling Emissions From Growth

ABP NewsBacked by a vibrant private sector, innovative technologies, and an enabling policy environment, India has made great strides in its transition towards a low-carbon economy. All this would require innovative financing and capital towards scaling up energy efficiency, renewable energy capacity, upgradations of grid network, assistance for enhanced energy access to last mile end user communities, and a just transition of workers that are affected in the process, like decommissioned coal plants. Unlocking investments capable of decoupling emissions from growth is critical and fuelling such a transition finance intervention can be achieved by: Leveraging innovative financing that draws in private capital at speed Innovative tools like impact investing, credit enhancements, blended finance, or developmental assistance have worked, but not at the scale required. Replacing direct lending with risk-mitigation mechanisms by national development banks and international finance institutions would accelerate private capital’s entry into transition finance. While Indian-owned banks manage 96.2% of total credit, the complexity of climate sectors often inhibits capital flows due to the difficulty in structuring finance, assessing transition risks, or restricted access to risk-mitigation mechanisms.

History of this topic

Need to address the $4 trillion financing gap, says Sitharaman

Hindustan Times

India assessing need for more measures to slow unsecured lending, cenbank chief says

Hindustan Times

’Indian equities to benefit from macro backdrop, Nifty EPS to grow 18% in FY24’

Live Mint

Economy at risk from move to clean energy: study

The Hindu

Addressing Climate Change: Policy Interventions And Sustainable Financing In India

Live LawCOP26 draft says climate finance is insufficient

The Hindu)

New NPA Cycle, Privatisation Among Ailments in Banking that Union Budget 2021 is Expected to Address

News 18)

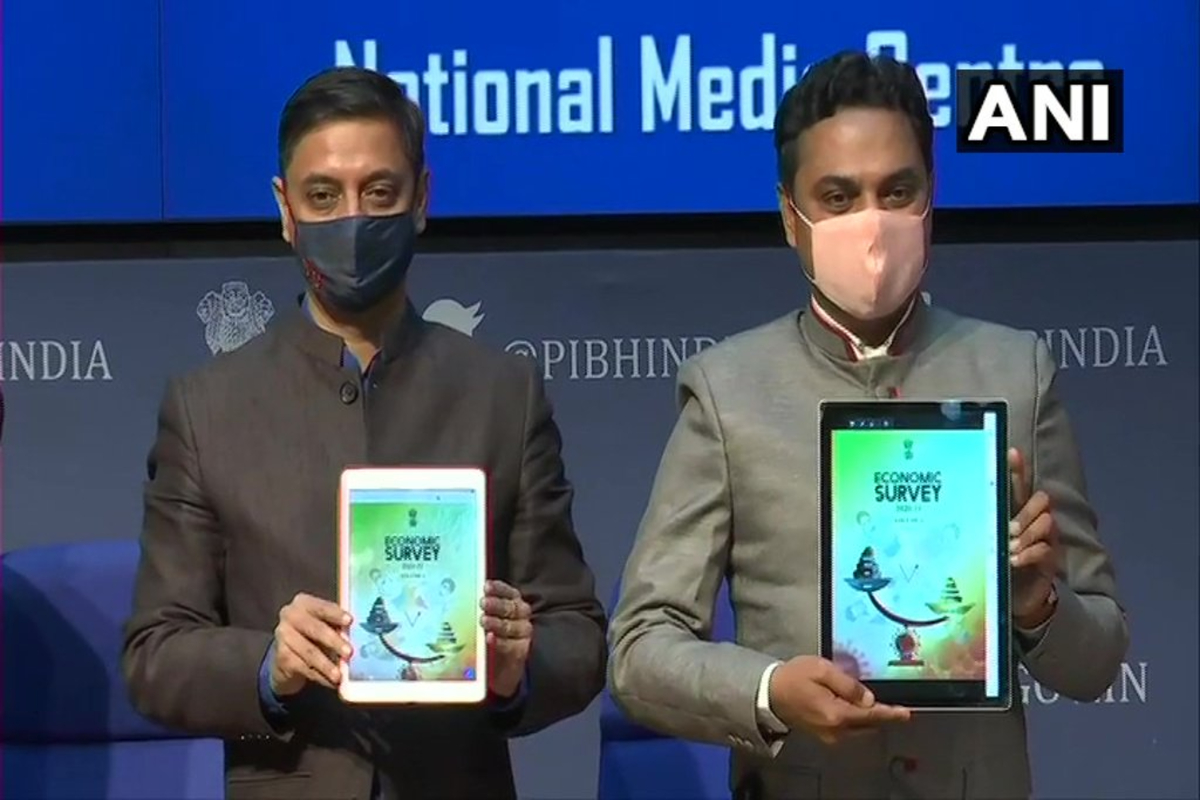

Economic Survey 2021: Under-Capitalisation of Banks Will Hamper Economic Growth in Long Run

News 18)

New NPA Cycle, Privatisation Among Ailments in Banking that Union Budget 2021 is Expected to Address

News 18

India considers creating bank with $13.7 billion equity capital to fund roads

Hindustan TimesPolicy roll-back may dent banks’ health, says RBI

The HinduDiscover Related

)