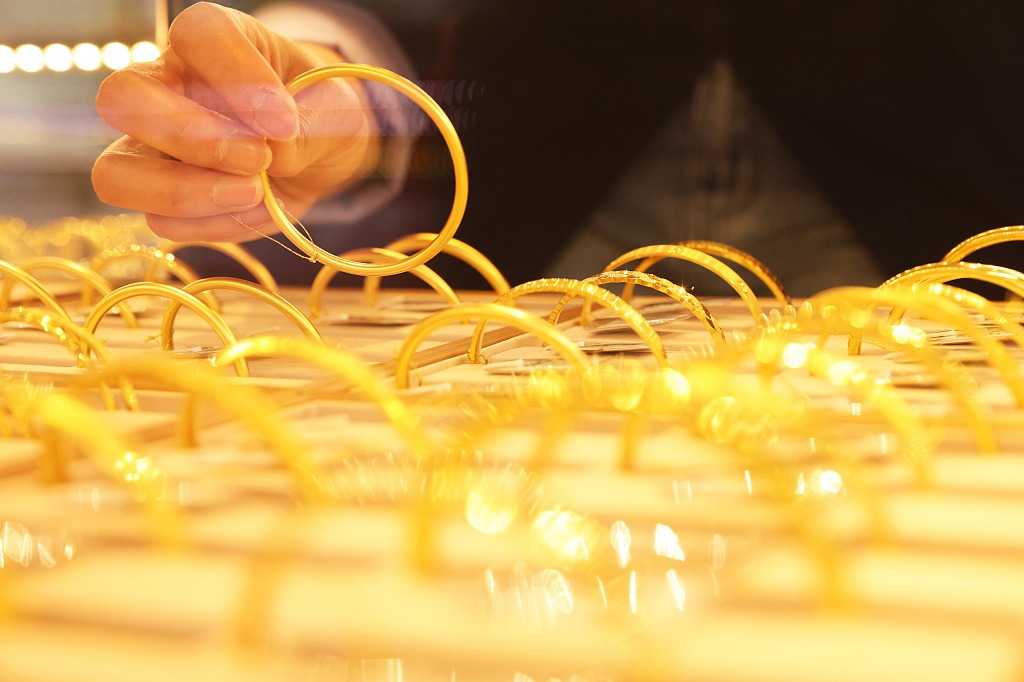

Near term gold prices likely to remain under pressure: Buy or wait?

Live MintGold prices have been under pressure as major global central banks tightened monetary policy. So in near term gold prices may remain under pressure but from last 6 months more than investors central banks remain major buyers in gold for diversification. Kunal Shah said “The reasons now gold is a strategic investment as rapid rise in balance sheet of central banks due to huge printing at the times of pandemic and now deleveraging of balance sheet brings central bank at uncharted territory as never ever in the history of financial market such monetary experiments has been done so nobody knows what will happen, coupled with Cold War like scenarios across the globe. We remain very bullish from two years horizon in gold and $2200 remains our target.” Colin Shah, MD, Kama Jewelry said “Gold prices have been under pressure due to the monetary policy tightening by major global central banks. Rajesh Rokde Vice Chairman - All India Gem and Jewellery Domestic Council said “As we know History shows near future,as per today's situation Gold still looks bullish and every deep in the Gold Rate is good opportunity to buy gold by mcx or by phiscal, one should also keep an close eye on Gold market as we are aproching march end.”

History of this topic

Gold price today: Rates lacklustre ahead of US Fed policy decision; experts unveil strategy for MCX Gold

Live Mint

WGC sees modest demand for gold in 2025, central bank demand crucial

New Indian Express

Gold, silver price today, December 13, 2024: Precious metals witness dip on MCX

India Today

Gold rises for fifth day

Live Mint

Gold price today: Rates jump 1% ahead of US inflation data; experts reveal trading strategies, key levels for MCX Gold

Live Mint

Gold prices subdued as traders brace for US payrolls data

Live Mint

Gold, silver price today, December 3, 2024: Precious metals record hike on MCX

India Today

Gold price dips ₹2000 per 10 gm this month. Should you buy on escalating Russia-Ukraine war, wedding season in India?

Live Mint

Gold is bouncing back. Is now the time to dig in for big returns?

Live Mint

Gold drops over 1% on profit-booking, Trump’s Treasury Secretary pick

Live Mint

Gold near 3-week high on softer US dollar, geopolitical concerns

Live Mint

Gold price today: Rates move up on elevated geopolitical tensions; experts share strategy for MCX Gold

Live Mint

Goldman's bullish call: Why gold is set to outshine by 2025

India Today

Is it a good time to buy gold? 3 things you should know

India Today

Gold price today: Rates jump almost 1% on positive global cues; experts share strategy for MCX Gold

Live Mint)

Gold’s glitter fades: What’s behind the post-Trump slump?

Firstpost

Gold, silver price today, November 12, 2024: Precious metals record hike on MCX

India Today

Gold prices lack fresh triggers; what should be your near-term strategy for yellow metal?

Live Mint

Gold price today: Yellow metal declines after Fed cuts rates by 25 bps; experts share key levels for MCX Gold rate

Live Mint

How low could gold go?

Live Mint

Gold Soars Higher, Outperforming Equities in Samvat 2081

Live Mint)

Gold Prices Soar, But Experts Say It's Still a Wise Investment for Dhanteras

Firstpost

Gold Prices Soar to New Heights, Fueled by Speculation and Central Bank Interventions

China Daily

After gaining 29% so far this year, gold may sizzle at Rs 8,000 per gram by December

New Indian Express)

Gold prices hit record high: Why is the cost of the yellow metal rising?

Firstpost

Gold price today: Precious metal declines 2% from all-time high on profit booking; silver drops 3%

Live Mint

Gold price today: Yellow metal surges to new all-time high on Fed rate cut expectations; silver falls 1.2%

Live Mint

Gold climbs 1% to two-week high on increased Fed rate cut expectations; silver rises 2%

Live Mint

Gold maintains glitter as haven for investors

China Daily

China influencing global gold prices with robust demand

Hindustan Times

Gold prices: Precious metal rates stabilised, hovering around ₹72,000 per 10 gram; Is it right time to invest?

Live Mint

Gold prices rise for sixth week on rising Iran-Israel war fears. US Fed rate, US dollar price in focus

Live Mint

Gold prices jump after escalation in Iran-Israel tensions. Should you buy in this rally?

Live Mint

Rush for gold spurs price to peak; related assets climb

China Daily

Gold rate today, 5th April 2024: Gold price dips 0.5%, silver price crashes over ₹1000/kg as US dollar rate rebounds

Live Mint

Gold rate today hits record high of $2,263 on US Fed rate cut buzz, geopolitical tension. Buy, sell or hold?

Live Mint

Gold prices rocket to a new high after US Fed rate decision: Is it a good time to buy?

Hindustan Times

Explained: Why are gold prices rising across the globe? What to expect in March

Hindustan Times

Gold rate today under pressure as US dollar index hits 2-month high

Live Mint

Global Gold Demand Slips 5% In 2023, China Leads With 17% Demand For Jewellery After Pandemic: WGC

ABP News

Gold lags Nifty 50 in last 6 months; what’s the future outlook for bullion?

Live Mint

Elections in major economies to support gold's performance: WGC

Deccan Chronicle)

Will gold continue to shine? Depends on what India does this festive season

Firstpost

Gold prices decline on higher US dollar and bond yields

Live Mint

Gold, silver rate today under pressure as US dollar continues to gain strength

Live Mint

Gold prices remain volatile after US Fed rate hike, US GDP data. Buy or wait?

Live Mint

Gold Prices Rise as Cooling US Inflation Raises Hopes of Fed Rate Hike Pause

News 18

Gold Remains Firm Amid Lower Treasury Yields and Dollar Strength

News 18)

Gold is going to be record costly and de-dollarisation is the reason

Firstpost

Gold price today: Rates inch up in early trade; what should be your strategy?

Live MintDiscover Related