Inheritance tax: An economic blunder

New Indian ExpressThis has also been protested by small businesses and farmer’s unions, such as the National Farmers Union, that has been advocating for the simplification of the estate tax. Impact on Entrepreneurship and Wealth Acquisition in India The concept of inheritance tax would be suicidal for a country like India, as there is already certain amount of discontent amongst the honest taxpayers that they do not get any significant benefits like some of the western countries and further they rarely use the facilities provided by the Government; in effect indicating that tax collected from them is used for benefits and schemes for other segments of the society. Now coming to the wealthier sections of the society; if “inheritance tax” is thrust on them, it is certainly going to deter their entrepreneurial spirits; investments and we would certainly be headed for a capital flight and loss of smart and skilled talent as they might seek to relocate to other jurisdictions to secure and manage their wealth better. The other concern with “inheritance taxes” would further be non-declaration of wealth, evasion of taxes and ultimately the introduction of a parallel economy in the country. Way forward & Conclusion In a fast developing economy like India, where infrastructure and social security systems are still evolving, incentivizing private investment and entrepreneurship should take precedence over imposing additional taxes on wealth transfer.

History of this topic

‘India must impose more taxes on super-rich’: Economist Thomas Piketty as top 1% hold over 40% of nation’s wealth

Live Mint

Why farmers are fretting across the world

Hindustan Times

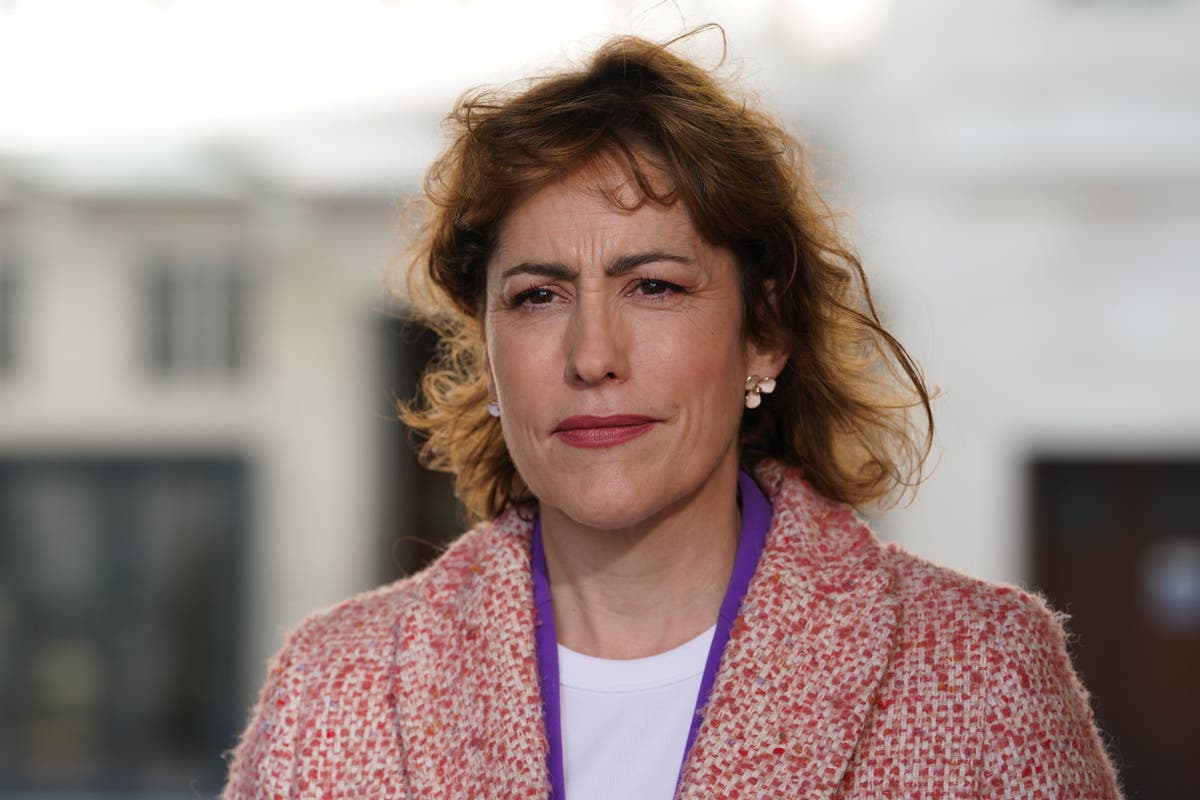

Farmers exaggerating impact of inheritance tax raid on land, Environment Secretary suggests

The Telegraph

My 250-acre farm has been in our family for four generations, but we now face a £400,000 inheritance tax bill and may be forced to give it up... this is the final nail in the coffin

Daily Mail

Labour considering inheritance tax raid to ‘redistribute’ wealth

The Telegraph

Economist Gautam Sen on inheritance tax: Unrealistic, will unleash economic chaos

Hindustan Times

Should India take from the rich, give the poor? A new election flashpoint

Al JazeeraAn inheritance tax will help reduce inequality

The Hindu

Sanjeev Ahluwalia | Will ‘Robin Hood’ taxes be the answer for India?

Deccan Chronicle

The case for inheritance tax: Combating inequality and promoting social mobility

The Hindu

Inheritance Tax, Wealth Redistribution Will Push India Away From Growth Path

News 18

Mint Primer | Redistribution: Can it benefit India’s poor?

Live Mint

Pavan K. Varma | Our inequality is inherited, curable only by solid policy

Deccan Chronicle

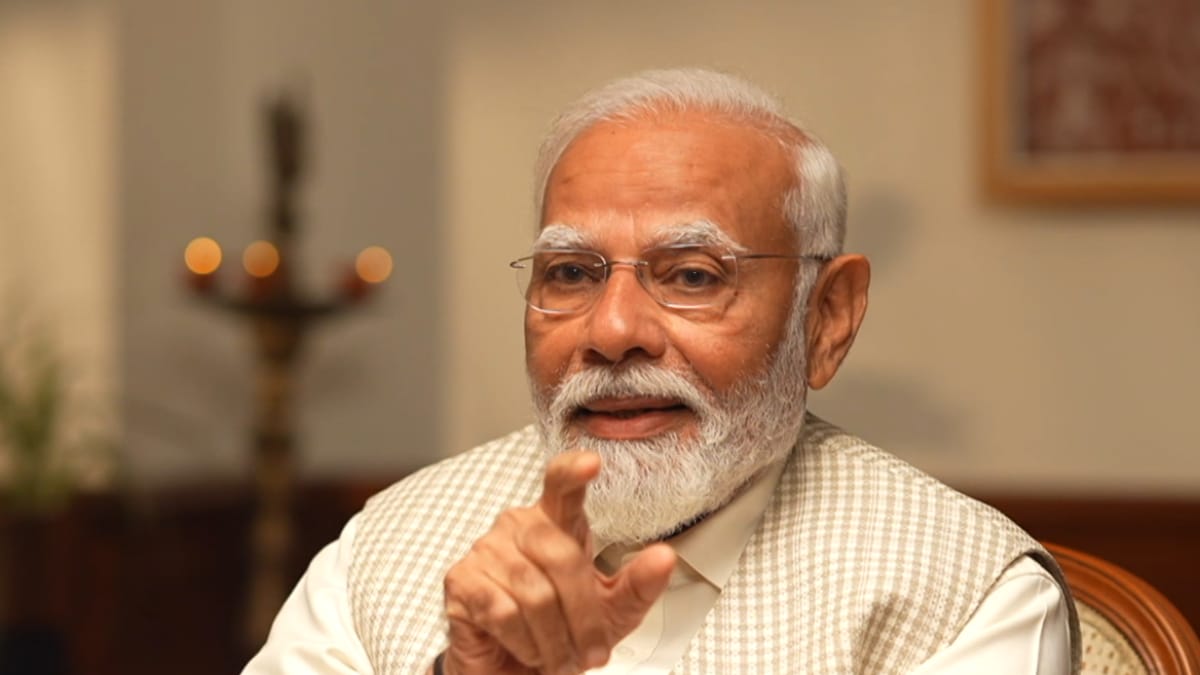

Inheritance tax could nullify India's decade of progress, says Nirmala Sitharaman

The Hindu

Inheritance tax row: Nirmala Sitharaman warns India ‘will go back to era when Congress imposed…’

Live Mint

Zerodha's Nikhil Kamath backs inheritance tax? Old video goes viral: Watch

Hindustan Times

Ashneer Grover says ’taxpayers are minority in elections’ amid inheritance tax row: ‘You can get away saying…’

Live Mint

Sam Pitroda’s ‘Inheritance’ Of Loss For Congress: Tax Worry May Hurt Lok Sabha Poll Prospects

News 18

A pledge to abolish inheritance tax would be an irresponsible measure

The Independent

Why are India’s poorest people being left behind?

Al Jazeera

Institute for Fiscal Studies says rising inheritance will hit social mobility. What’s the solution?

The IndependentDiscover Related

)