'Not all money, only up to ₹ 1 lakh insured in banks,' RBI-owned subsidiary says

India TV NewsHaving more than Rs 1 lakh in a bank account? After Reserve Bank of India put restrictions on PMC Bank depositors, “Is my money safe with banks?, “Is keeping money in the bank in savings/deposit account akin to lending to a bank? "Under the provisions of Section 16 of the DICGC Act, 1961, if a bank fails/gets liquidated, the DICGC is liable to pay to each depositor through the liquidator, the amount of his deposit up to Rs one lakh as insurance cover, for both principal and interest amount held by him in the same right and same capacity at all the branches of a bank taken together," it said. Asked whether there is any proposal or move under consideration to raise the limit of Rs 1 lakh insured in the bank in wake of the recent PMC Bank fraud, the DICGC said, "The corporation does not have the requisite information." "According to Reserve Bank of India, frauds as per year of reporting, as reported by Public Sector Banks, during the period from April 1, 2019 to September 30, 2019 is 5,743 involving a total amount of Rs 95,760.49 crore," Finance Minister Nirmala Sitharaman said in the Rajya Sabha last month.

History of this topic

RBI fines IndusInd Bank ₹27 lakh over non-compliance

Live Mint

RBI imposes monetary penalty on Axis Bank and HDFC Bank—here’s why

New Indian Express

DICGC Launches Online Tool to Track Deposit Claims

Deccan Chronicle

RBI alarmed at lakhs of bank accounts being used for fraud: Report

Live Mint

RBI imposes 1.45 crore fine on Central Bank of India, 96.4 lakh fine on Bangladesh's Sonali Bank

Hindustan Times

Company, CEO Vijay Shekhar Sharma not being investigated by ED for money laundering: Paytm

India TV News

RBI imposes fine on 3 banks for non-compliances, check details

Live Mint)

DICGC asks 21 stressed cooperative banks to prepare list of account holders

Firstpost

Depositors of THESE banks to get up to Rs 5 lakh back

India TV News

Bank FD Holders: Cabinet Clears Amendments To Deposit Insurance Act, Know What It Means For Investors

ABP News

Small finance bank to take over PMC Bank: RBI tells Delhi HC

India TV News)

RBI Paves Way for Takeover of Crisis-hit PMC Bank, Allows Centrum to Set Up Small Finance Bank

News 18

Centrum-BharatPe to take over PMC Bank

Live Mint

RBI Doubles Payments Bank Balance Limit To Rs 2 Lakh. Know What It Means For Customers

ABP News

Fixing the banking mess

India Today)

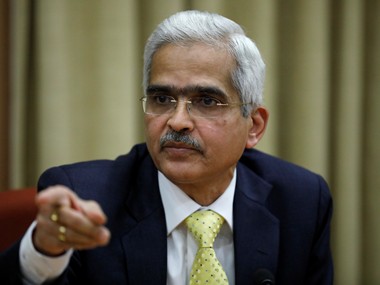

Initial Response Looks 'Positive' for PMC Bank Resolution, Says RBI Governor

News 18)

RBI Appoints New PMC Bank Administrator, Says Huge Losses Posing Challenges to Revival

News 18)

Fraud-hit PMC Banks Approaches Banks Over Possible Merger, Reveals Report

News 18

Fraud-hit PMC asked other major banks for merger: Bank tells Delhi HC

India Today

No funds available: Depositors at India's PMC Bank survive on loans, charity

India Today)

Withdrawal Limit of Rs 1 Lakh on PMC Bank Can't be Increased Due to Lack of Liquidity, RBI tells Delhi HC

News 18

PMC Bank: RBI cites liquidity issues for not raising withdrawal limit beyond ₹1 lakh

Live Mint

Plea to release ₹5 lakh to PMC bank depositors during COVID-19; HC seeks Centre, RBI

Live MintUrban, multi-State cooperative banks to come under RBI supervision

The Hindu

PMC Bank: RBI extends restrictions for 6 months; withdrawal limit now ₹1 lakh

Live Mint)

PMC Bank fallout: Cabinet clears amendment to banking laws to strengthen cooperative banks; RBI nod to be made mandatory for appointments

Firstpost

PMC Effect: Deposit insurance raised to Rs 5 lakh

India TV News

Budget 2020: BIG relief for bank depositors! Insurance cover hiked from ₹ 1 lakh to ₹ 5 lakh, says Sitharaman

India TV News

Bad news for depositors! RBI restricts operations of this bank, caps withdrawals at ₹35,000

India TV News)

PMC Bank fallout: RBI proposes to tighten lending norms for UCBs, says exposure to single borrowers leads to credit concentration risk

Firstpost

PMC Bank Crisis: Bombay HC Dismisses Petitions Challenging Withdrawal Restrictions Imposed By RBI

Live Law

PMC Bank crisis: HC junks PMC Bank depositors' plea for lifting of restrictions

India TV News)

PMC Bank scam: Nearly 78% depositors can withdraw entire deposits, says govt; efforts underway to repay customers money

Firstpost)

PMC Bank scam: Distressed depositors hold day-long protest at RBI office in Delhi

Firstpost)

PMC Bank scam: RBI employees unions want govt to hike deposit insurance cover to Rs 10 lakh

FirstpostRBI should be given full power to regulate co-op banks: Satish Marathe

The Hindu

PMC Bank crisis: Depositors of scam-hit bank meet Mumbai police chief

India TV News

PMC Bank scam: Maharashtra Sikhs unable to go on Kartarpur pilgrimage

India TV News)

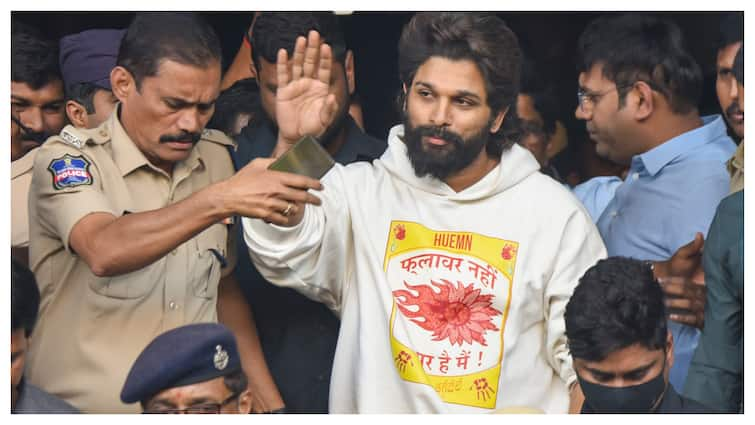

PMC Bank scam: RBI governor Shaktikanta Das says closely monitoring situation, forensic audit underway

Firstpost)

PMC Bank scam: Depositors gather outside RBI Delhi office, demand assurance on return of their savings

Firstpost)

PMC Bank scam: RBI increases withdrawal limit to Rs 50,000 per account; over 78% of depositors covered

Firstpost

What steps taken to help PMC Bank depositors, Bombay HC asks RBI

Live Mint)

PMC Bank scam: Bombay HC asks RBI what steps were taken to help depositors; next hearing on 19 November

Firstpost

PIL Seeking Protection Of Depositors Of PMC Bank: Delhi HC Issues Notice To Central Govt, RBI

Live Law

PIL in HC seeks lifting of restriction on cash withdrawal from PMC bank

India TV News)

PMC Bank scam: Depositors continue with their protests by agitating outside RBI office, seek payback of stuck money

Firstpost)

PMC Bank crisis impact: Odisha govt cautions departments against depositing money in banks

Firstpost

PMC Bank crisis: Unable to withdraw Rs 90 lakh savings, second customer dies in under 24 hours

New Indian Express

RBI hikes PMC Bank withdrawal limit to ₹40,000

Live MintDiscover Related

![Kerala High Court Monthly Digest: December 2024 [Citations: 766 - 828]](https://www.livelaw.in/h-upload/2024/09/03/559124-750x450519604-750x450456553-408710-kerala-high-court-monthly-digest.jpg)

![Kerala High Court Monthly Digest: December 2024 [Citations: 766 - 828]](https://www.livelaw.in/h-upload/2024/09/03/559124-750x450519604-750x450456553-408710-kerala-high-court-monthly-digest.jpg)

![Consumer Cases Weekly Round Up:[ 23rd December – 29th December 2024]](https://www.livelaw.in/h-upload/2024/07/14/549673-1500x900481610-consumer-law-weekly-round-up.jpg)