Supreme Court Asks Madras HC To Decide Constitutional Validity Of Section 40(a)(iib) Of Income Tax Act

Live LawThe Supreme Court has directed the Madras High Court to decide the constitutional validity of Section 40 of the Income Tax Act.Tamil Nadu State Marketing Corporation Ltd. had approached the Apex Court challenging the High Court order dismissing the writ petition filed by it challenging the validity of Section 40 of the Income Tax Act, 1961.This provision deals with disallowance. Tamil Nadu State Marketing Corporation Ltd. had approached the Apex Court challenging the High Court order dismissing the writ petition filed by it challenging the validity of Section 40 of the Income Tax Act, 1961. The High Court, however, dismissed the said writ petition without deciding the validity of Section 40 of the Income Tax Act by observing that the issue of raising a challenge to the vires of the provision at this stage need not be entertained as the matter is still sub judice before the Income Tax Authority. The bench comprising Justices Ashok Bhushan, R. Subhash Reddy and MR Shah observed: "When the vires of Section 40 of the Income Tax Act were challenged, which can be decided by the High Court alone in exercise of powers under Article 226 of the Constitution of India, the High Court ought to have decided the issue with regard to vires of Section 40 on merits, irrespective of the fact whether the matter was sub judice before the Income Tax Authority.

History of this topic

![[Income Tax] No Substantial Question Of Law Arises If Perversity Cannot Be Shown In Order Passed By Tribunal: Allahabad High Court](https://www.livelaw.in/h-upload/2024/10/31/568956-allahabad-high-court-prayagraj.jpg)

[Income Tax] No Substantial Question Of Law Arises If Perversity Cannot Be Shown In Order Passed By Tribunal: Allahabad High Court

Live Law![[Direct Tax Vivaad Se Vishwas Act] Review Plea Against SLP Constitutes "Disputed Tax" U/S 2(i)(j): Delhi High Court](https://www.livelaw.in/h-upload/2024/09/11/560539-justice-yashwant-varma-justice-ravinder-dudeja-delhi-high-court.jpg)

[Direct Tax Vivaad Se Vishwas Act] Review Plea Against SLP Constitutes "Disputed Tax" U/S 2(i)(j): Delhi High Court

Live Law![[Direct Tax Vivaad Se Vishwas Act] Review Plea Against SLP Constitutes "Disputed Tax" U/S 2(i)(j): Delhi High Court](https://www.livelaw.in/h-upload/2024/09/11/560539-justice-yashwant-varma-justice-ravinder-dudeja-delhi-high-court.jpg)

[Direct Tax Vivaad Se Vishwas Act] Review Plea Against SLP Constitutes "Disputed Tax" U/S 2(i)(j): Delhi High Court

Live Law

Recourse To Section 147 Of Income Tax Act Not Barred In Cases Where Assessing Officer Is Empowered To Proceed U/S 153C: Delhi High Court

Live Law

Direct Tax Cases Weekly Round-Up: 02 To 08 June 2024

Live Law

SC adjourns Serum Institute's plea challenging 2016 amendment to I-T Act till May 17

New Indian Express

Income Tax Authority Should Refrain From Over Analysis Which Leads To Paralysis Of Justice: Bombay High Court

Live Law![[Income Tax Act] Supreme Court Decision In UOI v. Ashish Agarwal Applicable To Parties Who Challenged Notice U/S 148: Allahabad High Court](https://www.livelaw.in/h-upload/2022/07/19/426550-allahabad-high-court-prayagraj-live-law.jpg)

[Income Tax Act] Supreme Court Decision In UOI v. Ashish Agarwal Applicable To Parties Who Challenged Notice U/S 148: Allahabad High Court

Live Law

Direct Tax Cases Quarterly Digest 2024

Live Law

Delhi High Court Interprets Rule 11UA For Determination FMV Of Shares U/S 56(2)(viib)

Live Law

Direct Tax Cases Weekly Round-Up: 31 March To 6 April 2024

Live Law

Delhi High Court Interpretes Rule 11UA For Determination FMV Of Shares U/S 56(2)(viib)

Live Law

Delhi High Court rejects Congress’s plea against tax reassessment

The Hindu

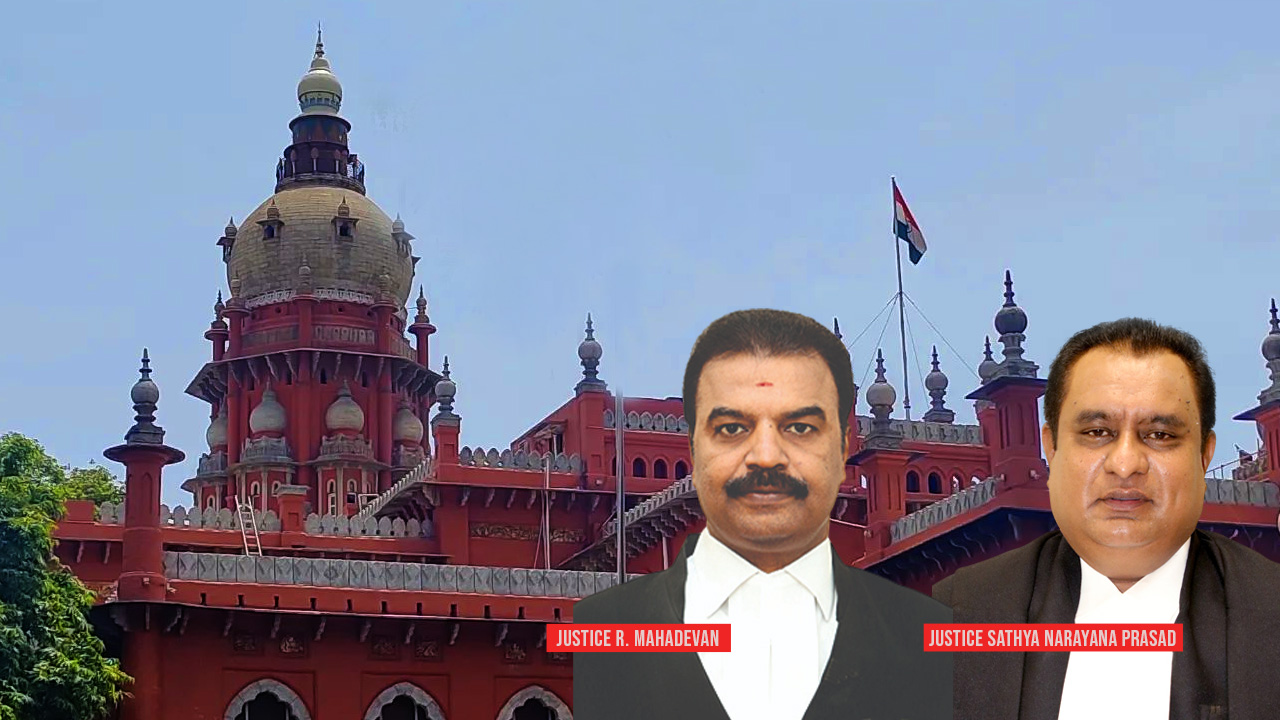

Assessing Officers Are Not Governed By Strict Rules Of Indian Evidence Act, 1872 In Case Of Assessment Proceedings: Madras High Court

Live Law

AO Competent To Invoke Section 154 Jurisdiction If Glaring Mistake Of Fact/Law Is Committed While Passing Assessment Order: Madras High Court

Live Law

Direct Tax Cases Monthly Round Up: February 2024

Live Law

Madras High Court Quashes Revision Order Passed Under TNGST Act Against Renault Nissan For Travelling Beyond The Scope Of Revision Proceedings

Live Law

Direct Tax Cases Monthly Round Up: January 2024

Live Law

Delhi High Court Upholds Constitutional Validity Of Section 115BBE Of Income Tax Act

Live Law

Bombay High Court Dismisses Petition Filed By Serum Institute Of India Challenging 2016 Amendment To Income Tax Act

Live Law

Dept.’s Personal Opinion Not Tangible Material For Reopening Assessment: Calcutta High Court Quashes Reassessment

Live Law

Section 245C(5) Of Income Tax Act Is Read Down By Removing Retrospective Last Date Of 1st Feb 21 As 31st March 21: Madras High Court

Live Law

Bombay High Court Quashes Income Tax Assessments Against Agriculturist And Rickshaw Driver For Improper Sanction

Live Law

Income Tax Adjudication Proceedings And Criminal Prosecution Are Independent To Each Other: Madras High Court

Live Law

Wrong Mention Of Section In Title Of Application Can’t Be Held Against Assesee: Allahabad High Court

Live Law

Director Proves Lack Of Control On Financial Affairs: Bombay High Court Quashes Income Tax Recovery

Live Law

Section 16-B Of Himachal Pradesh General Sales Tax Act Is Not Ultra Vires Any Provision Of Law: Supreme Court Reiterates

Live Law![Madras High Court Monthly Digest - March 2023 [Citations 68 to 108]](https://www.livelaw.in/h-upload/2022/02/01/408688-madras-high-court-monthly-digest.jpg)

Madras High Court Monthly Digest - March 2023 [Citations 68 to 108]

Live Law

Income Tax Act | Writ Petition Can Be Entertained To Examine If Conditions To Issue Section 148 Notice Are Satisfied : Supreme Court

Live Law

Section 260A IT Act -Appeal Only Lies Before High Court Within Whose Jurisdiction The Assessing Officer Is Situated: Supreme Court

Live Law

Tax Cases Weekly Round-Up: 30 October To 5 November 2022

Live Law

In The Absence Of A Full And True Disclosure, Reassessment Is Not Barred By Limitation: Madras High Court

Live Law

Amendment To Section 36(1)(va) Of Income Tax Act Is Prospective In Nature: Delhi High Court

Live Law

Tax Cases Monthly Round-Up: July 2022

Live Law

Tax Cases Weekly Round-Up: 24 July To 30 July, 2022

Live Law

Twin Conditions In Section 10B (8) Income Tax Act Has To Be Fulfilled To Claim Exemption Relief: Supreme Court

Live Law

Period Of Limitation Under S.153 Of Income Tax Act Applies To Remand Proceedings : Madras HC

Live Law

Delhi High Court Quashes Assessment Order For Not Giving Opportunity To File Objection To SCN

Live Law

Assessee Should Be Given Opportunity To Produce Evidence Which Has Impact On Tax Liability : Calcutta High Court

Live Law

Setting Aside Of Assessment Orders By ITAT On Technical Grounds Will Not Lead To Automatic Quashing Of Criminal Complaint: Madras High Court

Live Law

Monthly Digest Of Tax Cases: May 2022

Live Law

Weekly Round-Up of Tax Cases: May 15 To May 21

Live Law

Assessment Can't Be Reopened On Mere Change Of Opinion Of AO: Bombay High Court

Live Law

What the new ruling on taxation entails

Hindustan Times

Taxation Relaxation Act Doesn't Sanction Applying Repealed Provisions : Madras HC Sets Aside Reassessment Notices U/S 148 Of Old Income Tax Act

Live Law

Rajasthan High Court Quashed Notices Issued by the Assessing Officers U/S 148 of the Income Tax Act, 1961 for Reopening Assessments for Various Assessment Years

Live Law

SC Refuses To Stay Proceedings Against DK Shivakumar's On Tax Evasion Charges, IT Dept. To File Reply

Live LawDiscover Related