How Will Budget 2024 Impact The Aam Aadmi?

ABP NewsUnion Budget 2024: Every year, when the day of the budget comes near, the middle class, or tax-paying citizens of India, fix their eyes on the government. New Income Tax Slabs The following are the new income tax slabs that Budget 2024 proposes: Up to Rs 3 lakh: Nil Rs 300,001 to Rs 7 lakh: 5% Rs 700,001 to Rs 10 lakh: 10% Rs 100,001 to Rs 12 lakh: 15% Rs 120,001 to Rs 15 lakh: 20% Above Rs 15 lakh: 30% Furthermore, under the new regime, the standard deduction has increased from Rs 50,000 to Rs 75,000, and the deduction on pensioners' family pensions has increased from Rs 15,000 to Rs 25,000. Budget 2024: Cheaper And Pocket-Friendly Clothes and shoes X-ray equipment Electric cars and lithium batteries Copper and leather goods Solar sets Mobile phones, parts, batteries, and chargers 25 essential minerals Cancer medicines Gold, silver, and platinum jewellery Fish and fish products Budget 2024: Costlier And Expensive Specific telecom equipment Plastic goods Budget 2024: Job Market And Job-Seekers To meet the demands of an expanding workforce, the Indian economy must create almost 7.85 million jobs annually until 2030. Budget 2024: Home Buyers And Renters With an investment of Rs 10 trillion, PM Awas Yojana 2.0, which aims to address the housing needs of 1 crore urban poor and middle-class families, received major investments from the Budget. Budget 2024: Free Power And Electricity Ten million households will receive up to 300 units of free electricity per month under PM Surya Ghar Muft Bijli Yojana.

History of this topic

Budget 2024: Prioritising inclusivity and fiscal prudence

The Hindu

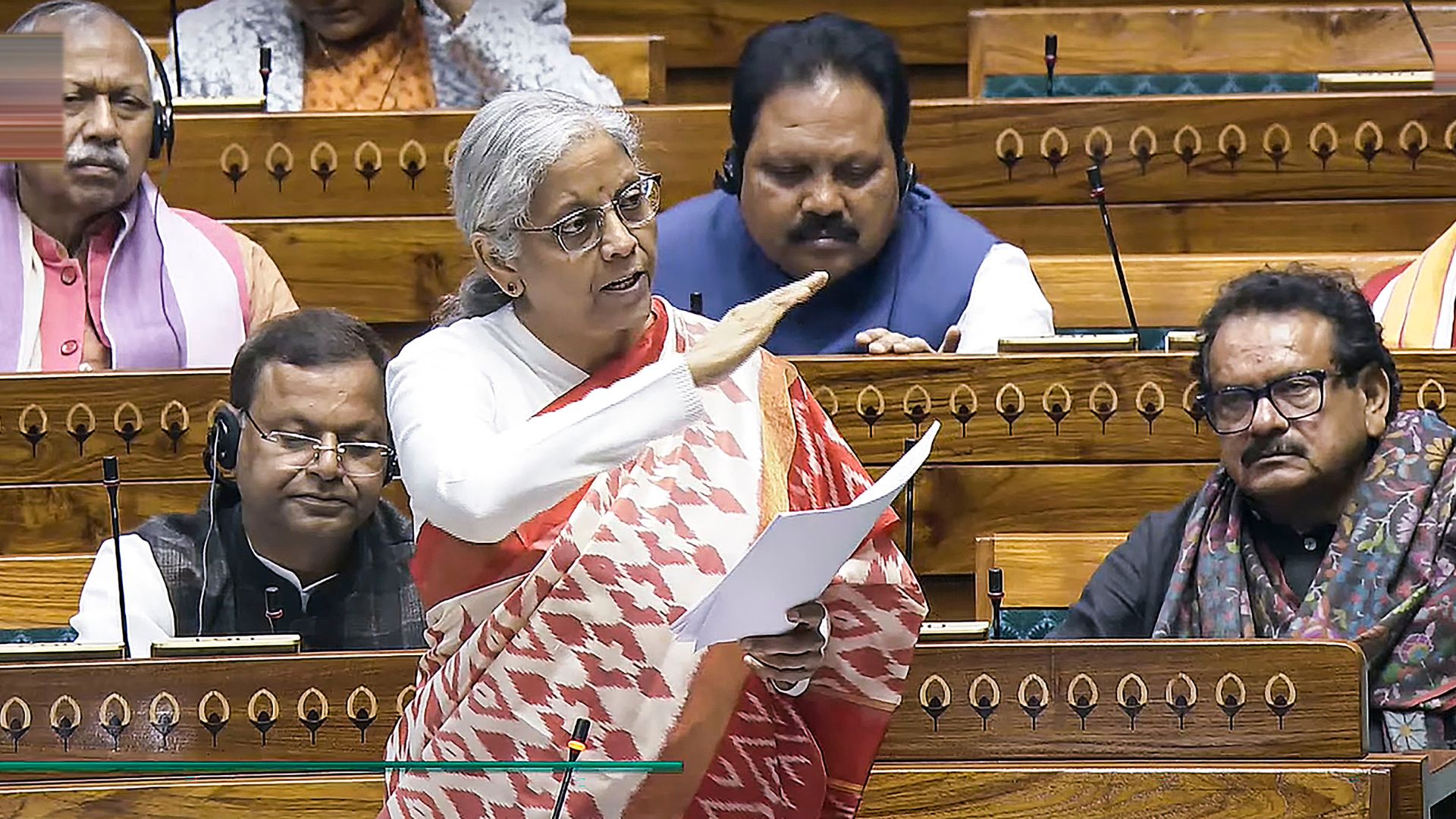

Union Budget 2024: INDIA Alliance to Protest Against Budget Today | ABP News

ABP News

Budget 2024: Placing thrust on infrastructure

The Hindu

Budget 2024: Government keeps focus on critical areas

The Hindu

Budget 2024: Centre to launch PM Janjatiya Unnat Gram Abhiyaan for tribal welfare

The Hindu

Budget 2024: The Indian middle class expected more

Hindustan Times

The budget echoes the Developed India vision

Hindustan Times

What's in Budget 2024 for students, women and professionals | A quick guide

India Today

Union Budget 2024: Here Are The Major Announcements From FM Sitharaman

ABP News

Union Budget 2024: Sector-Wise Allocation Puts Defence At The Top. Full Details Inside

ABP News

Budget 2024: Just a political exercise to protect interests of Modi govt, says Kerala Finance Minister

The Hindu

Budget 2024: How will it impact the common people and consumers? CHECK here

India TV News

Union Budget 2024: Where does Centre spend the most money?

Hindustan Times

Budget 2024: Govt to connect 25,000 more villages in phase 4 of rural roads scheme

Live Mint

Budget 2024: Modi govt reduces fiscal deficit target to 4.9 per cent of GDP for FY25

India TV News

What Budget means for taxpayers: 10 points

Hindustan Times

Budget 2024: Nirmala Sitharaman announces financial aid for student loans up to ₹10 lakh

Hindustan Times

Union Budget 2024 India: Sitharaman Announces 5 Schemes Focusing On 4.1 Crore Youth Over Next 5 Years

ABP News

Union Budget 2024: 7 key figures to gauge Indian economy's health under Sitharaman

Hindustan Times

Union Budget 2024: What politicians expect - addressing unemployment and inflation issues, increasing fund assistance

Live Mint

Union Budget 2024 Highlights: Record High Capex In Budget Will Drive The Economy, Says PM Modi

ABP News

Income Tax Budget Highlights: Govt proposes tax cuts, more standard deduction

Hindustan Times

Budget 2024 HIGHLIGHTS: Andhra Pradesh, Bihar major gainers; special focus on jobs, new tax regime

India TV News

Union Budget 2024: Read Finance Minister Nirmala Sitharaman's full speech

India Today

Budget 2024 Highlights: FM disappoints investors, rewards (some) taxpayers

Hindustan Times

Budget 2024: Date, key timings and what to expect from budget speech

India Today

Budget 2024 Expectations Highlights: Will Govt Bring Changes In Old and New Tax Regimes?

News 18

Sitharaman to present Budget 2024: Understanding the Budget, its impact on India's economy

India TV News

Budget 2024: Will FM Nirmala Sitharaman fulfill your income tax wishes?

India Today

Budget 2024 Expectations: Will Nirmala Sitharaman announce tax relief?

Hindustan Times

Budget 2024: Will Nirmala Sitharaman bring cheer to middle-class with income tax changes?

Hindustan Times)

Union Budget 2024: A look at 5 big themes before Sitharaman reveals cards

Firstpost

Union Budget 2024 Expectations LIVE: Will FM Nirmala Sitharaman Increase Section 80C Deduction Limit?

News 18

Budget 2024: These are 7 demands by government employees' union for Centre

Hindustan Times

Odisha CM Majhi to present first budget in June assembly session

New Indian Express

Delhi budget: Special focus on development of roads in rural pockets

The Hindu

Budget 2024 on welfare schemes: Expenditure cut or remain stagnant, say Left parties

The HinduInterim Budget 2024 — in campaign mode

The Hindu

Interim Budget 2024: A little more for all labharathis? Focus on ‘core of core’ schemes

Hindustan Times2024 Interm Budget | Allocations for Social Justice and Tribal Affairs Ministries see a marginal increase

The Hindu

2024 Interim Budget | Allocation for Minority Ministry remains same

The Hindu

Budget 2024: It’s tax buoyancy that shrank the deficit

Live Mint

Key takeaways from interim Budget 2024-25 in charts

The Hindu

Budget 2024: Spending on rural development increases marginally, but not all schemes benefit | Data

The Hindu

Budget 2024: Highlights of Finance Minister Nirmala Sitharaman’s Interim Budget

The Hindu

Budget 2024: No major change in prices; Check list of what’s cheaper & dearer

Live Mint

Budget 2024: More Power to Infrastructure as Capex Outlay Increased to Rs 11.11 Lakh Crore

News 18

Budget 2024: Govt vows to launch new scheme to bolster deep-tech for defence sector

India TV News

Budget 2024: Women, farmers, youth, poor are top priority for NDA

Live MintDiscover Related