Adani FPO: What saved the issue on the last day of bidding?

Live MintJust about a week ago, the Street was awaiting India's largest follow-on-public offer which was about to be floated by one of the India's biggest conglomerates. Investors - retail and institutional - were waiting for the issue to open to buy shares of Adani Enterprises at a bit of a discount from the market price. On January 25, the company raised ₹5,984.9 crore for the anchor investor portion from 33 foreign and domestic institutional investors including the likes of Singapore based Maybank Securities Pte Ltd, insurance behemoth LIC, SBI Employees Pension Fund, SBI Life Insurance Co, HDFC Life Insurance Co, Abu-Dhabi-based sovereign wealth fund ADIA, Goldman Sachs Investment and Morgan Stanley Asia. Read all Adani-related stories here At the end of the third and final day of bidding, the retail investors were missing as they could easily buy the company's shares at much cheaper rate. The demand on first two days of bidding for the FPO was nearly nil, but the turning point for the FPO was Abu Dhabi's International Holding Company on Monday announced that will invest $400 million in Adani Enterprises' ₹20,000-crore follow-on public offer via its subsidiary Green Transmission Investment Holding RSC.

History of this topic

Adani Power Share Price Today on 29-11-2024: Adani Power share price are down by -1.11%, Nifty up by 0.88%

Live Mint

Adani Power Share Price Today on 28-11-2024: Adani Power share price are up by 8.2%, Nifty down by -0.78%

Live Mint

Adani Power Share Price Today on 27-11-2024: Adani Power share price are up by 5.28%, Nifty down by -0.08%

Live Mint

Adani Total Gas Share Price Today on 26-11-2024: Adani Total Gas share price are down by -1.2%, Nifty down by -0.05%

Live Mint

Adani Power Share Price Today on 26-11-2024: Adani Power share price are down by -0.66%, Nifty down by -0.09%

Live Mint

Adani Power Share Price Today on 25-11-2024: Adani Power share price are up by 1%, Nifty up by 1.67%

Live Mint

Friday’s relief rally after Adani shock leaves investors richer by ₹7.27 trillion

Live Mint

Adani stocks crash over 20% after Gautam Adani indicted by US over alleged $250 million bribe plot

Hindustan Times

Explained: Why Adani Enterprises shares fell 15% today

India Today

Adani Power share price rises 7% : Should you Buy, Sell or Hold the stock?

Live Mint

Adani Wilmar Shares: A Pricey Climb and a Pricey Dip

Live Mint

Adani Power Soars 3% on ₹5,000 Crore Fundraise Move

Live Mint

Adani Energy Solutions may launch $600 million share sale this week: Report

Hindustan Times

Gautam Adani raises stake in Adani Enterprises, buys more from open market

Hindustan Times

India's Adani Energy Solutions to raise up to $1.5 billion

The Hindu

Multibagger stock: Adani Power share price touches lifetime high. Experts see 25% more upside

Live Mint

Adani Group stocks down 13%, ₹90,000 cr wiped off in market-cap. Top loser is…

Hindustan Times

Adani Group to raise $3.5 billion through share sale in 3 companies

Live Mint

Adani Enterprises Shares Drop 8% as Traders Book Profit; What Should you Do Now?

News 18

Adani stocks soar; market cap jumps by ₹63,000 crore in a day

Live Mint

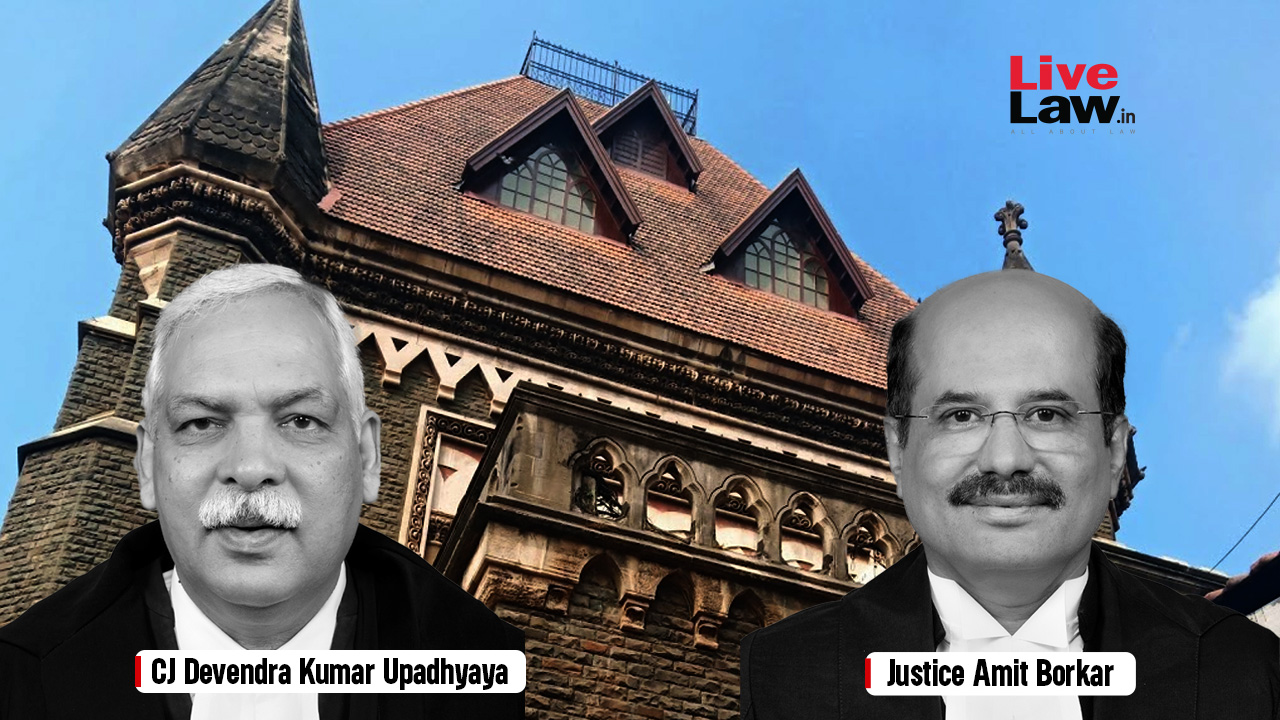

Adani stocks jump on SC panel report findings

Live Mint

Months after cancelled FPO, crisis-hit Adani to consider fundraising on May 13

Live Mint

How have Adani Group’s stocks behaved over the last month? - The Hindu

The Hindu

Congress questions the addition of five Adani stocks to NSE indices

The Hindu

Adani Group stocks post worst day in two weeks as investors lose ₹51,294 crore

Live MintGUEST COLUMN | End of a roll: The curious rise and fall of Adani stocks

The Hindu

DSP MF buys more shares of these 6 Adani stocks in January amid Hindenburg rout

Live Mint

Adani group says no refinancing issues in bid to calm jittery investors

Hindustan Times

India’s Adani tries to pacify investors as watchdog probes report

Al Jazeera

Selling pressure in some Adani group stocks eases

Live Mint

Adani prepays $1,114 million to release the Group companies’ shares

The Hindu

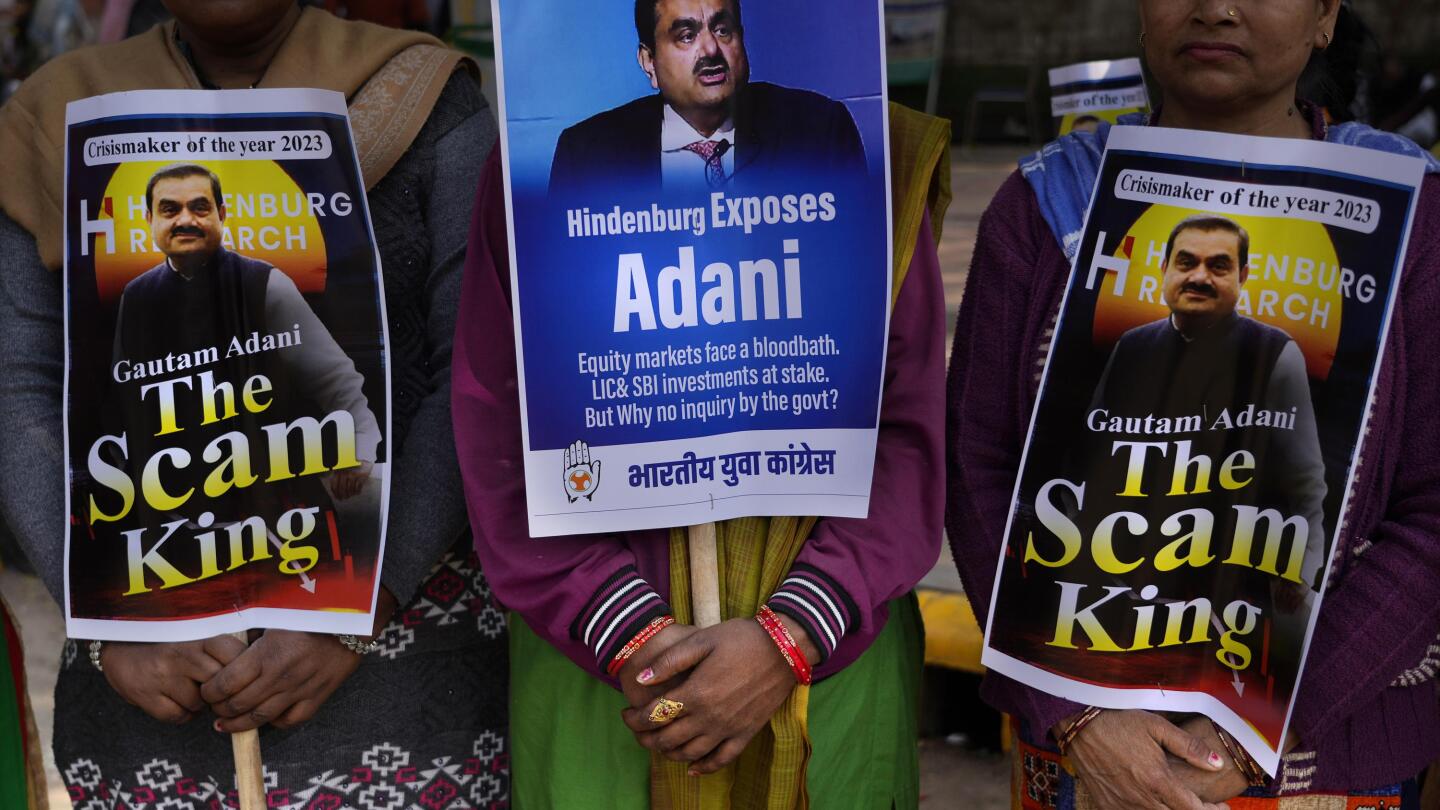

Adani woes spur protests as stock turmoil turns political

Associated PressAdani Group stocks fall further in morning trade

The Hindu

Adani-Hindenburg row: Aswath Damodaran pin points this flaw in global eco system

Live Mint

Adani sell-off continues amid protests by India’s opposition

Al Jazeera

Aswath Damodaran values Adani Enterprises stock at ₹947 per share

Live MintExplained | What made the Adani Group call off its FPO?

The Hindu

Inside the 19-hour Adani embroglio that led to scrapping of $2.5 billion FPO

Hindustan Times

Adani crash stalls Parliament; Opposition seeks JPC probe

The Hindu

Adani Group crisis updates: Adani Enterprises shares at lowest since Mar'22

Hindustan Times

Adani stocks continue to plunge after FPO removal

The Hindu

$2.5 billion share sale cancelled; Adani Enterprises tumble over 28%

Hindustan Times

Interest of my investors is paramount, says Gautam Adani after calling off FPO

Deccan Chronicle

Withdrew FPO to insulate investors from potential losses: Adani

Live Mint

Adani Enterprises calls off fully subscribed FPO, to return money to investors

Deccan Chronicle

Gautam Adani speaks for first time after scrapping FPO amid Hindenburg row

Live Mint

'Too expensive at ₹3,200 when you can...': Mahua Moitra's jibe at Adani FPO

Hindustan Times

'Investors' Interest Paramount': Adani Withdraws FPO as Stocks Continue to Tank

The Quint

Adani group company’s bonds fall to distressed levels after FPO withdrawal

Live Mint

Gautam Adani says, "Interest of investors is paramount and everything else is secondary" – India TV

India TV NewsDiscover Related