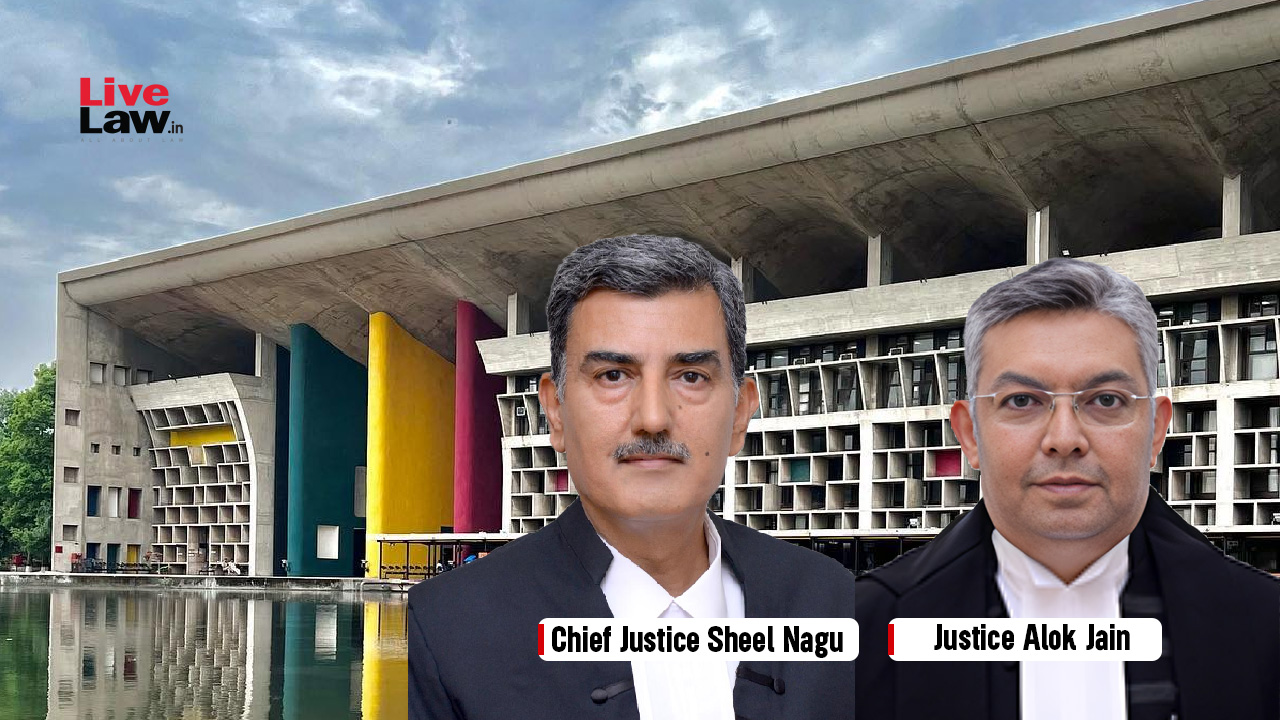

Punjab & Haryana High Court Weekly Round Up: April 22 - April 28, 2024

Live LawNominal Index Rakesh Das v. State of Haryana & Ors. Punjab & Haryana HC Refers To Larger Bench Title: Simran Kaur versus Union of India and others Citation: 2024 LiveLaw 126 The Punjab & Haryana High Court has referred the issue of whether a writ petition under Article 226 of the constitution would be maintainable against the Army Welfare Society or against the Army Public School, to the larger bench. S.36A NDPS Act | Public Prosecutor Not Part Of Investigating Agency, Expected To Apply Mind For Seeking Extension: Punjab & Haryana HC Reiterates Title: Pradeep Kumar v. State of Haryana Citation: 2024 LiveLaw 127 The Punjab and Haryana High Court has granted default bail to an accused in a drugs case whose plea was rejected by the Trial Court which granted an extension to the investigating agency to probe the matter. No Fresh Material Can Be Produced Before Trial Court Without Making Application Under CrPC: Punjab & Haryana High Court Title: XXX v.XXX Citation: 2024 LiveLaw 130 The Punjab and Haryana High Court has made it clear that no fresh material can be exhibited in the trial court without moving an application under relevant provisions of the Criminal Procedure Code The Court set aside the trial court's order allowing complainant's application to give specimen of signature to compare with the confessional statement of the accused booked for sexual assault under POCSO Act after conclusion of prosecution evidence. No Addition Is Permitted On Account Of Estimated Profit U/s 41 Simply Based On Assumptions: Punjab & Haryana High Court Case Title: M/s Shree Digvijaya Woollen Mills Ltd Verses Commissioner of Income-Tax Citation: 2024 LiveLaw 132 The Punjab & Haryana High Court deleted the addition made by the AO u/s 41 of the Income tax Act on account of sale of copper wire, finding that the AO had made additions under the said provision simply on basis of presumption regarding the said sale, even after finding no stock in the premises.

History of this topic

Bombay High Court Weekly Round-Up: December 16 - December 22, 2024

Live Law

Punjab & Haryana High Court Monthly Digest: November 2024

Live Law![Delhi High Court Monthly Digest: November 2024 [Citations 1193 - 1304]](https://www.livelaw.in/h-upload/2022/02/01/408682-delhi-high-court-monthly-digest.jpg)

Delhi High Court Monthly Digest: November 2024 [Citations 1193 - 1304]

Live Law

Karnataka High Court Weekly Round-Up: December 09 - December 15, 2024

Live Law

Karnataka High Court Weekly Round-Up: December 09 - December 15, 2024

Live Law

Supreme Court Weekly Round-up: December 9, 2024 To December 15, 2024

Live Law![Karnataka High Court Monthly Digest: November 2024 [Citations: 454 - 489]](https://www.livelaw.in/h-upload/2023/03/01/461349-408717-karnataka-high-court-monthly-digest.jpg)

Karnataka High Court Monthly Digest: November 2024 [Citations: 454 - 489]

Live Law

Rajasthan High Court Monthly Digest: November 2024

Live Law

Calcutta High Court Monthly Digest: November 2024

Live Law

Himachal Pradesh High Court Weekly Roundup: December 2 - December 8 2024

Live Law

Supreme Court Weekly Round-up: December 02, 2024 To December 08, 2024

Live Law

Kerala High Court Weekly Round-Up: December 2 - 8, 2024

Live Law

Karnataka High Court Weekly Round-Up: December 02 - December 08, 2024

Live Law

Bombay High Court Monthly Digest: November 2024

Live Law

Madras High Court Monthly Digest - November 2024

Live Law

Jammu and Kashmir and Ladakh High Court Monthly Digest: November 2024

Live Law

Madhya Pradesh High Court Monthly Digest: November 2024

Live Law

Supreme Court Monthly Round-up: November 2024

Live Law

Supreme Court Weekly Round-up: November 25, 2024 To December 01, 2024

Live Law

Jammu & Kashmir And Ladakh High Court Weekly Roundup November 25 - December 1, 2024

Live Law

Madras High Court Weekly Round-Up: November 25 - December 1, 2024

Live Law

Kerala High Court Weekly Round-Up: November 25 - December 01, 2024

Live Law

Bombay High Court Weekly Round-Up: November 25 - December 01, 2024

Live Law

Kerala High Court Weekly Round-Up: November 18 – November 24, 2024

Live Law

Delhi High Court Weekly Round-Up: November 18 To November 24, 2024

Live Law

Bombay High Court Weekly Round-Up: November 18 - November 24, 2024

Live Law

Infrastructure Of District Courts In Punjab & Haryana Not Disabled Friendly, High Court Asks Building Committees To Take Action

Live Law

Delhi High Court Weekly Round-Up: November 11 To November 17, 2024

Live Law

Jammu & Kashmir And Ladakh High Court Weekly Round-Up: November 11 To 17th, 2024

Live Law

Supreme Court Weekly Round-up: November 11, 2024 To November 17, 2024

Live Law

Karnataka High Court Weekly Round-Up: November 11 - November 17, 2024

Live Law

Madras High Court Weekly Round-Up: November 11 - November 17, 2024

Live Law

Kerala High Court Weekly Round-Up: November 11-November 17, 2024

Live Law![Gujarat High Court Monthly Digest: October 2024 [Citations 144-163]](https://www.livelaw.in/h-upload/2023/08/05/484777-gujarat-high-court-monthly-digest.jpg)

Gujarat High Court Monthly Digest: October 2024 [Citations 144-163]

Live Law

Madhya Pradesh High Court Monthly Digest: October 2024

Live Law

Supreme Court Weekly Round-up: November 4, 2024 To November 10, 2024

Live Law

Supreme Court Weekly Round-up: November 4, 2024 To November 10, 2024

Live Law

Calcutta High Court Weekly Round-Up: November 4th To November, 10th, 2024

Live Law

Himachal Pradesh High Court Weekly Round-Up November 4 - November 10 2024

Live Law

Karnataka High Court Weekly Round-Up: November 4 To November 10, 2024

Live Law

Madras High Court Weekly Round-Up: November 4 to November 10, 2024

Live Law

Kerala High Court Weekly Round-Up: November 4 – November 10, 2024

Live Law

Jammu & Kashmir And Ladakh High Court Monthly Digest: October 2024

Live Law

Bombay High Court Monthly Digest: October 2024

Live Law

Rajasthan High Court Monthly Digest: October 2024

Live Law

Rajasthan High Court Monthly Digest: October 2024

Live Law

High Court Clarifies on Jurisdiction, Legal Flaws, and Burden Shifting in Jammu & Kashmir Cases

Live Law

High Court Rejects Plea to Dismiss Murder Case, Says Prosecution Must Follow Due Process

Live Law

Jammu & Kashmir And Ladakh High Court Weekly Roundup: September 9 - September 15, 2024

Live Law

Karnataka High Court Weekly Round-Up: September 9 To September 15, 2024

Live LawDiscover Related

![Arbitration Weekly Round Up [9th December To 15th December 2024]](https://www.livelaw.in/h-upload/2024/05/24/541379-weekly-round-up-arbitration.jpg)