Big relief for homeowners as government gives options on long term capital gains tax

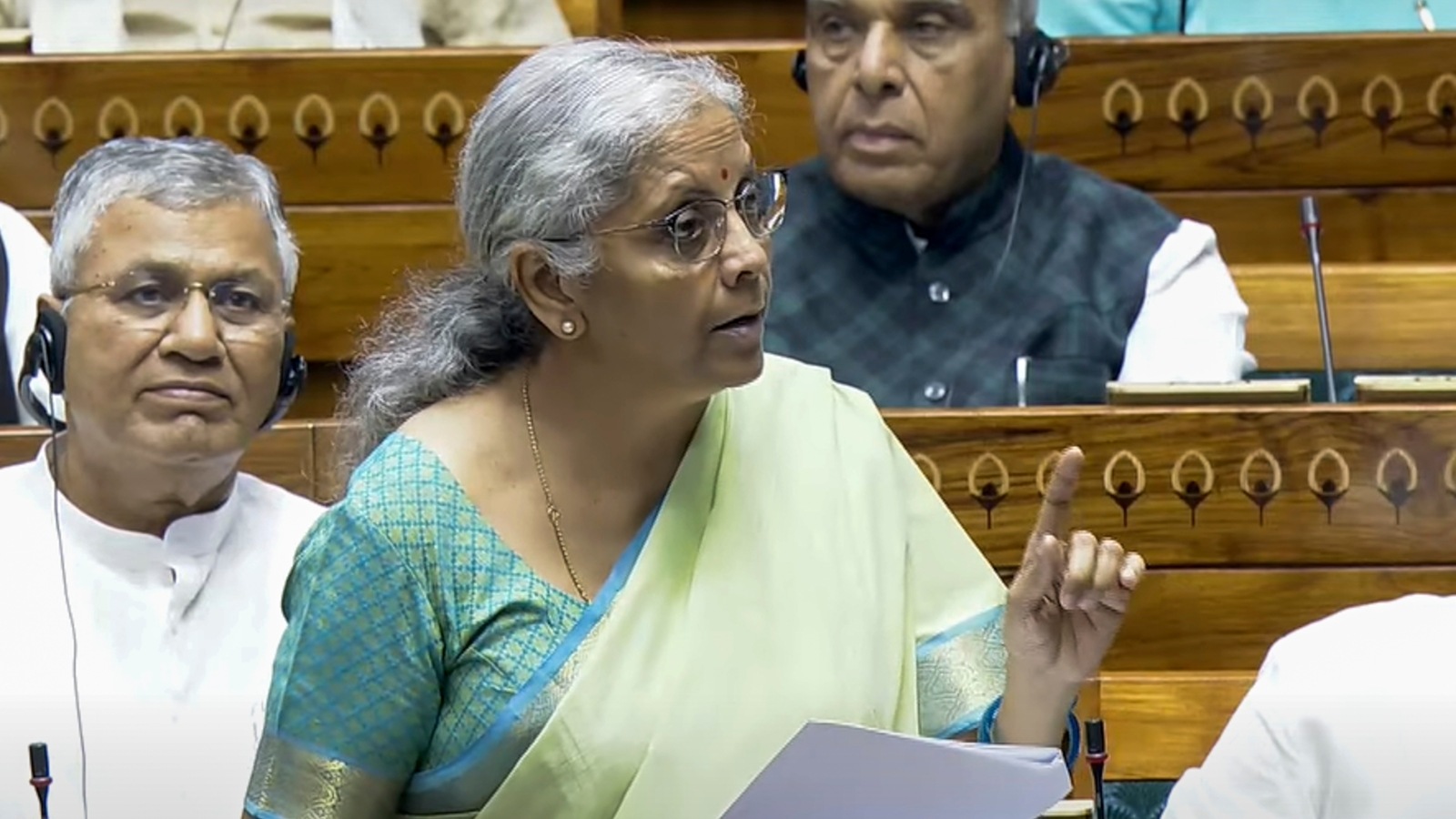

Hindustan TimesThe Lok Sabha on August 7 passed the Finance Bill 2024 and amended the long term capital gains tax provision on immovable properties giving taxpayers an option to switch to a new lower tax rate or stay with the old regime that had higher rate with indexation benefit. The government's revised budget announcement allows taxpayers to pick between a 12.5% Long-Term Capital Gains tax rate without indexation and a 20% rate with indexation, for properties purchased before July 23, 2024. Finance Minister Nirmala Sitharaman, who in her Budget for 2024-25 proposed to lower the long-term capital gains tax on real estate to 12.5% from 20% but without the indexation benefit, moved an amendment to the finance bill on August 7 to give the option to tax payers. The Finance Bill 2024 will now go to the Rajya Sabha for discussion Finance Minister Nirmala Sitharaman on August 7 said that the current amendment with regard to the long term capital gains tax proposal on real estate is to ensure there will be no additional tax burden with regard to LTCG tax on real estate sale.

History of this topic

Nirmala Sitharaman on LTCG amendment: 'We have courage to change'

Hindustan Times

FM Nirmala Sitharaman announces amendment to LTCG tax proposal, offers new options

Hindustan Times

Relief for homeowners: Realty experts welcome Centre’s decision to ease long term capital gains tax for sale of property

Hindustan Times

Centre to ease long term capital gains tax for sale of properties

Hindustan Times

Budget 2024: How removing indexation benefits for capital gains tax on property may impact the Mumbai real estate market

Hindustan Times

Budget 2024: How removing indexation benefits for capital gains tax on property may impact the Mumbai real estate market

Hindustan Times

On discarding indexation for long-term capital gains | Explained

The Hindu

Budget 2024 shake-up: How new rules impact homebuyers, property investors and developers

Live Mint

Changes in long-term capital gain tax to benefit most real estate investors: Revenue Secy

Hindustan Times

Removal Of Indexation Benefit: Homeowners Who Acquired Properties After 2001 May End Up Paying Higher Taxes

ABP News

Govt has no plan to reconsider real estate LTCG tax changes, says report

Live Mint

Budget 2024: Planning to sell a property bought after 2001? Here are 7 things that you should know

Hindustan Times

2001: The year that divides property sellers under new Budget tax rules

Hindustan Times

Indexation benefits on property removed, sparks concern. What it means for you?

India Today

Budget 2024: Capital gains taxes hiked, indexation benefit discontinued for property sale

Hindustan Times

Budget 2024: Capital gains taxes hiked, indexation benefit discontinued for property sale

Hindustan Times

Budget 2024: No indexation benefit for property sales; new LTCG rate fixed at 12.5%

Live Mint

Budget 2024: Selling old property to attract more tax. Here's why

India Today

Budget 2024 expectations: Realty sector calls for policy tweaks, tax reliefs

Live Mint

Budget 2023: Here’s what the real estate sector is expecting from FM Sitharaman

Hindustan Times)

Union Budget 2023-24: Why favourable policies for realty sector can assist in growth, economic sustainability

Firstpost

Budget 2022: More Tax Benefits on Home Loans, Affordable Housing, Real Estate Changes to Expect

News 18

Opinion | How will LTCG benefit work as per new laws

Live Mint

Budgetary sops notwithstanding, demand revival in real estate sector remains elusive

Live MintDiscover Related