SC panel puts six entities under lens for alleged trading in Adani shares

Hindustan TimesSix entities including four foreign portfolio investors are under lens for suspicious trading in Adani group shares prior to the release of the damning Hindenburg report, the Supreme Court-appointed expert committee has said. There was a build up of short positions in the Adani scips prior to the January 24 release of the Hindenburg report, and substantial profits were booked thereafter as stocks crashed, the 178-page report said. "The trading pattern here is suspicious because of the build up of short positions by these entities in the Adani scrips prior to the Hindenburg report, and substantial profits earned by them by squaring off their short positions after publication of the Hindenburg report on January 24, 2023," the expert committee said. The report said an analysis in trading of apples-to-port group's flagship firm, Adani Enterprises Ltd shares in four patches between March 1, 2020 and December 31,2022, a month before publication of the Hindenburg report and meltdown of Adani shares, showed the state-owned LIC was the biggest loser as it sold offs 50 lakh shares of the company when prices hovered around ₹300 and bought 4.8 crore shares when the prices ranged between ₹1,031 and ₹3,859.

History of this topic

Adani Group seeks SEBI settlement for shareholding violation charges to avoid regulatory action: Report

Live Mint

Top Investor Mark Mobius Calls US DoJ's Action Against Adani A 'Wasted Expense'

ABP News

Adani CFO refutes US allegations: ‘Individuals accused in bribery case to clarify matter in 10 days’

Live MintAdani Group Faces Global Scrutiny While SEBI Stands Silent: What’s at Stake?

The Hindu

Adani Total Gas share price jumps 16% in early trade. What's driving the rally?

India Today

Adani Group’s 2 stocks placed under ASM stage-1 category: Here’s what it means for shareholders

Live Mint

Adani Group says it lost nearly $55 billion since US indictment: Report

Hindustan Times

Adani Group stocks gain up to 17% after clarification on US bribery charge

India Today

Adani Group shares rally after clarification on US bribery charges. Is the worst over?

India Today

Gautam Adani ‘bribery’ case: GQG refuses to sell Adani shares; here’s why

Live Mint

Adani bonds slide to year low as investors and lenders weigh bribery allegations

Live Mint

US bribery case against Adani reaches Supreme Court, Sebi in the dock

India Today

Adani Group CFO on US indictment: 'None of portfolio companies subject to any legal case'

Hindustan TimesNone of Adani portfolio firms subject to any legal case: Group CFO

The Hindu

Adani Group CFO Jugeshinder Singh Responds To Bribery Allegations — Here Is What He Said

ABP News

Adani shares rally in India after founder's US charges

Deccan Chronicle

Sebi investigating if Adani group flouted disclosure rules

Live Mint

Adani Group stocks in trouble again! What should investors do now?

Live Mint

Gautam Adani news: Adani shares extend selling for second straight session; lose up to 28% in two days

Live Mint

Déjà vu moment for Adani Group after Hindenburg allegations

Deccan Chronicle

Adani Group: U.S. Department of Justice allegations baseless

The Hindu)

Adani stocks tumble after US indictment, combined mcap dips by Rs 2.45 lakh crore

FirstpostShares in India’s Adani Group plunge 20% after US bribery, fraud indictments

Associated Press

Allegations and scandals against the Adani Group: A timeline

The Hindu

Adani Group Shares Crash 20 Per Cent Amid US SEC Bribery And Fraud Allegations

ABP News

Adani indicted | Opposition seeks probe into US charges: ‘Vindicates Congress’s demand’

Hindustan Times

India’s Adani Group sees $22 billion in value wiped off after US indictments

Live Mint

Adani Group stocks go into a tailspin, crash up to 20% after US indicts Chairman and 7 others on bribery charges

Live Mint

Adani Group stocks nosedive after US indictment over alleged bribery, investor fraud

New Indian Express

Adani Group shares in free fall today. What should investors do?

India Today

Adani Group stocks see worst day since Hindenburg crisis, lose Rs 2 lakh crore

India TodayIndia's Adani Group unit raises 19.5 billion rupees via bond issue, say bankers

The Hindu

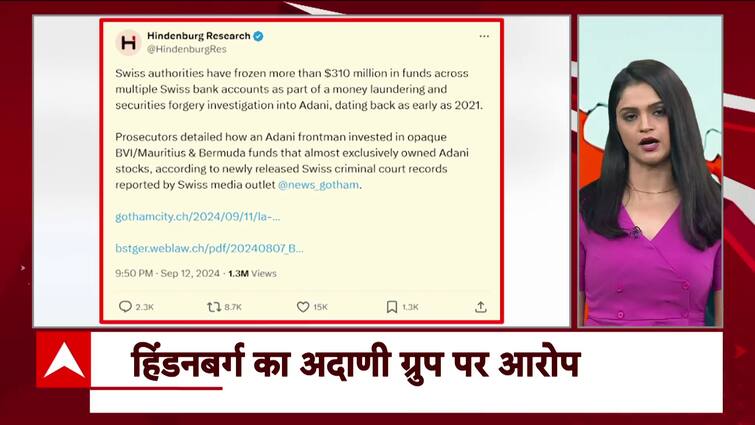

Hindenburg Report: Adani Group Denies Allegations, Watch Big Updates Of The Hour Only On ABP News

ABP News

Adani Group Denies Hindenburg Allegations, Claims All Accusations are False | ABP News

ABP News

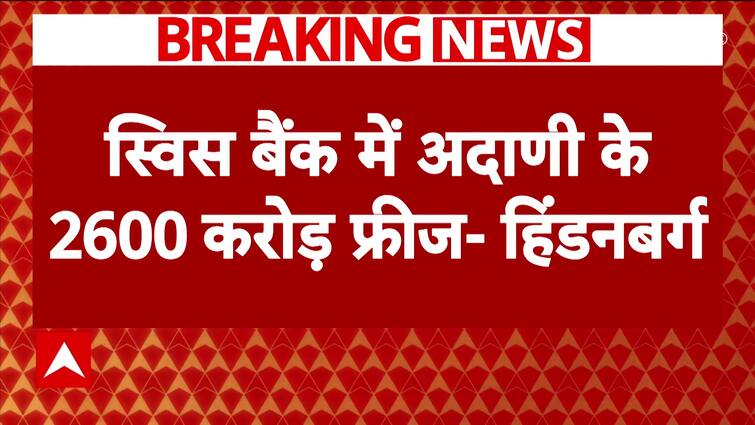

'No Swiss court proceedings, no account frozen': Adani Group rejects another claim made by US-based short seller Hindenburg

Op India

Adani Group shares drop after Hindenburg's fresh allegations

India Today

Adani Group stocks plunge up to 17% following Hindenburg's latest claims

India Today

Adani Group rocked by Hindenburg allegations against SEBI

Al Jazeera

360 One Wam refutes claims made by Hindenburg in fresh attack on Adani group

Op India

'Baseless Allegations': Sebi Chief Madhabi Buch, Husband 'Strongly' Deny Hindenburg Report

ABP News

Hindenburg vs Adani: US firm's serious charge against Sebi chief; Congress says end ‘conflict of interest’ | 10 points

Hindustan Times

Hindenburg report: Cong urges Centre to remove ‘all conflict of interest’ in Adani probe

Hindustan Times

‘Something big soon India’: After Adani Group, Hindenburg Research hints at new report

Hindustan Times

Hindenburg shared Adani report with client two months before publishing it: Sebi

India TV News

Hindenburg Research gets ‘show cause’ notice from SEBI over Adani Group report

Hindustan Times

Adani Group case: Hindenburg Research gets show cause notice from SEBI, US firm terms it 'nonsense'

India TV News

New twist in clash between US short seller Hindenburg and India’s Adani

Al Jazeera

Adani Enterprises stock recovers $30 billion lost after Hindenburg report

Hindustan TimesSEBI said to find Adani offshore investors in violation of disclosure rules

The Hindu

Sebi finds Adani offshore investors in disclosure rules violation: Report

Hindustan TimesDiscover Related