It Is The Bonafide Mistake Of Taxpayer Paying To Railways Instead Of GST Department: Bombay High Court

Live LawThe Bombay High Court has held that the taxpayer has made a mistake and instead of paying the Government of India through the CGST authorities and the State of Maharashtra through the SGST authorities, the entire amount was paid to the Government of India through Indian Railways. Petitioner addressed communications dated February 3rd, 2022 and February 23rd, 2022 to the office of respondent seeking intervention on getting the issue of GST payment resolved for the last five years. The petitioner realised that though he was paying 18% GST to the railways, that amount was not being paid by the railways to the concerned authorities, i.e., 9% to the Central Government and 9% to the State Government. "As and when the railway deposits the amount, and we have already observed that it will be done within two weeks from today, the CGST and SGST authorities will give an input tax credit to Petitioner," the court said.

History of this topic

Towards a simple and rational GST

Hindustan Times

55th GST council meeting in Jaisalmer on December 21, 2024: Finance Minister Nirmala Sitharaman media briefing

The Hindu

Council may increase GST rate on all kinds of used cars to 18 per cent

New Indian Express

GST | Delhi HC Orders Refund Of Service Tax Paid On Ocean Freight, Cites Gujarat HC Judgment Declaring It Unconstitutional

Live Law

GST rate hike claims are ‘premature, speculative’

The Hindu

GST Council Meeting: what is cheaper and costlier

The Hindu

Commercial property rentals now under Reverse Charge Mechanism: GST Council

Hindustan Times

Enhancing oversight: The Hindu Editorial on the GST Council meet and issues

The Hindu

A fresh start: On the Goods and Services Tax Council meet

The Hindu

Regularisation Of Non-Levy Or Short Levy Of GST: 53rd GST Council Meeting

Live Law

GST dilemma: The burden of related party transactions

New Indian Express

GST Needs A Robust Dispute-Resolution Mechanism - News18

News 18

BJP Government Did Not Rectify Injustice Meted out To Karnataka Alleges CM In His Budget

Deccan Chronicle

CBIC Notifies Creation Of Principal Bench Of GSTAT At New Delhi

Live Law

Company Taking Calculated Business Risk Cannot Challenge Root Of Contract Merely Due To Change In Tax Laws: Calcutta HC Denies GST Refund

Live Law

Centre notifies 18% GST on corporate guarantees

Live Mint

Siemens files writ petition at Bombay HC challenging GST show cause notice

Live Mint

Dabur gets GST demand notice of ₹320.6 crore

Live Mint

Tax Cases Weekly Round-Up: 8 To 14 October, 2023

Live Law

Recipient Of GTA Services Not Liable To Pay Service Tax Which Was Already Paid By Transport Agency: CESTAT

Live Law

CESTAT Upholds Service Tax Demand Against The Service Provider Based On ONGC’s Reply

Live Law

GST Council To Meet On August 2 On Online Gaming, Casino Rules: Reports

News 18

GST Council to meet on August 2 to finalise 28% online gaming tax: Report

India Today

Output Tax Was Paid Using ITC, Railway Can’t Deny GST Reimbursement On Price Variation: Gauhati High Court

Live Law

State GST Dept. Doesn’t Have Jurisdiction To Retain Amount Of Tax On Export Transactions: Bombay High Court

Live Law

GST Council to impose 28% tax on online gaming firms

The Hindu

GST Council to weigh tax cuts on select items

Live Mint

Rs 15,000 crore tax evasion detected, over 4,900 fake GST registrations cancelled

Op India

An incomplete reform: on six years of the Goods and Services Tax

The Hindu

Tax Cases Weekly Round-Up: 28 May to 3 June, 2023

Live Law

Reform reluctance: On the 49th GST council meeting

The Hindu

Centre will clear GST dues of states, TS to get Rs.1835 cr in arrears

Deccan Chronicle

GST Council clears setting up tribunals, ad valorem cess on pan masala

Live Mint

GST Council: Pending GST compensation of ₹16,982 cr for June will be cleared

Live Mint

100 Important High Court Judgments of GST in 2022

Live Law

GST Council may take call on online game tax

Deccan Chronicle

Parking Services Of Cycle, Scooters Doesn't Attract Service Tax: Punjab & Haryana High Court

Live Law

All India Tax Cases Half Yearly Digest: January To June 2022

Live Law

Tax Cases Weekly Round-Up: 16 October To 22 October, 2022

Live Law)

CBIC extends GSTR 3B filing return due date amid glitches in GSTN portal

Firstpost

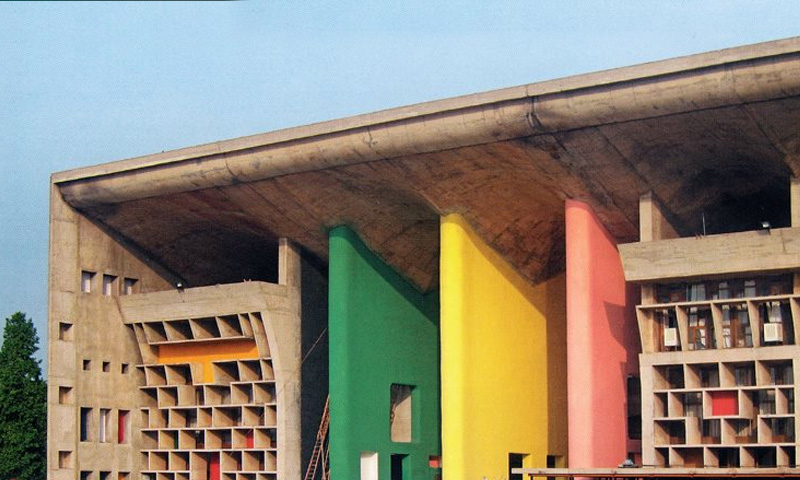

GST Registration Cancellation: Madras High Court Directs Changes In Architecture Of GST Portal

Live Law)

Tata Play found guilty of alleged GST-related profiteering, ordered to pay Rs 450 crore

Firstpost

GST On Liquidated Damages, Compensation And Penalty Arising Out Of Breach Of contract: CBIC

Live Law

GSTN Portal To Remain Open During September-October for Pre-GST Credit Forms, Directs SC

News 18

Critics are wrong, GST has strengthened federalism

Live Mint

GST Council bites the bullet

Hindustan Times

GST Council meeting | Extend compensation period, urge States

The Hindu

GST Council meet: What FM said on rate rationalisation, tax on casinos, lottery

Live Mint

GST Council Meet: Pre-Packed Items Under GST; 28% Tax On Casino Deferred; Key Decisions

News 18Discover Related