H1-B income tax: Here's how to file your taxes and what documents are required

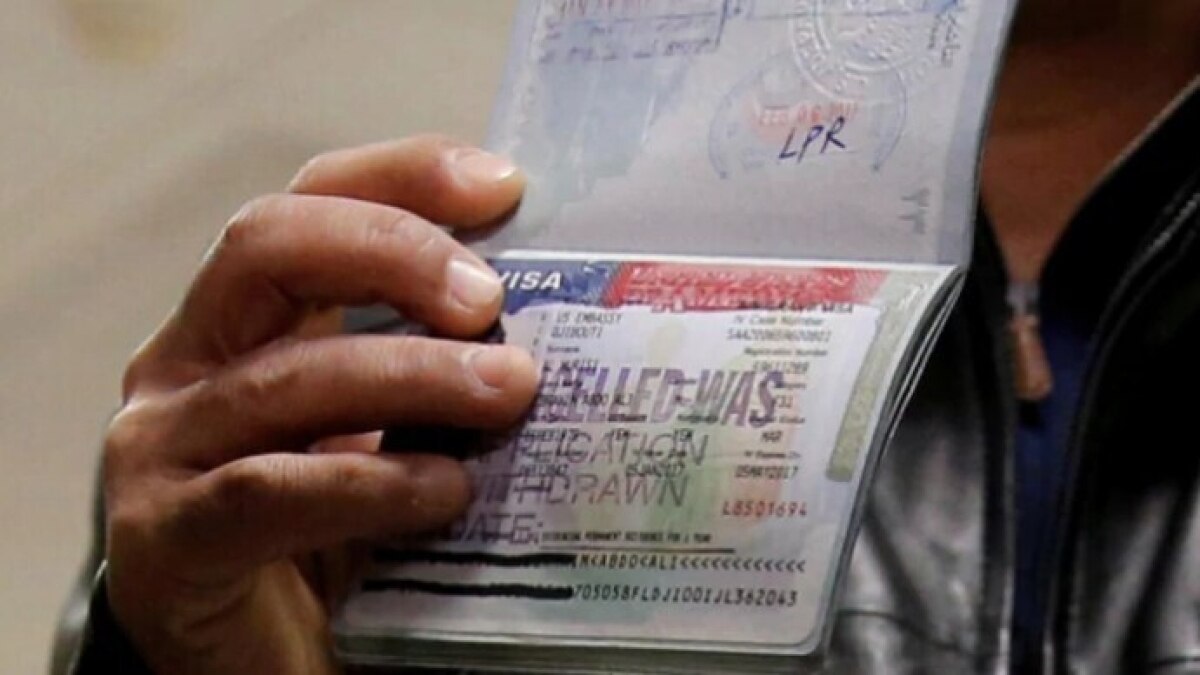

Hindustan TimesThe H1-B status allows a qualified non-immigrant alien, or an alien who does not hold a lawful residency permit, to work in the United States as a specialist occupation worker. For federal income tax purposes, an alien in H-1B status—referred to as a "H-1B alien"—will often be considered a resident of the United States provided they satisfy the Substantial Presence Test. Form 1040-NR must be filed by H-1B visa holders who are categorised as non-resident aliens on the last day of the tax year in order to disclose income, while resident aliens must submit Form 1040. Before filing, holders of H-1B visas should collect all required tax documentation, such as their Form W-2, social security card, investment income statements, any forms from the 1099 series, and other pertinent income data. Here are the steps one must follow to file H-1B taxes Check your tax residency status: To find out if you are a resident or non-resident alien for tax reasons, use the Substantial Presence Test.

History of this topic

US hits H1B visa limit for 2024, here's what's next for businesses and foreign workers

Hindustan Times

Legislation Introduced in US Senate to Reform and Stop Abuse of H-1B Visa System

News 18)

Changes in H1B Work Visa Will Attract Best and Brightest Minds: US Official

News 18Discover Related

)

)