)

RBI to Restore Cash Reserve Ratio in Two Phases to 4 Pc

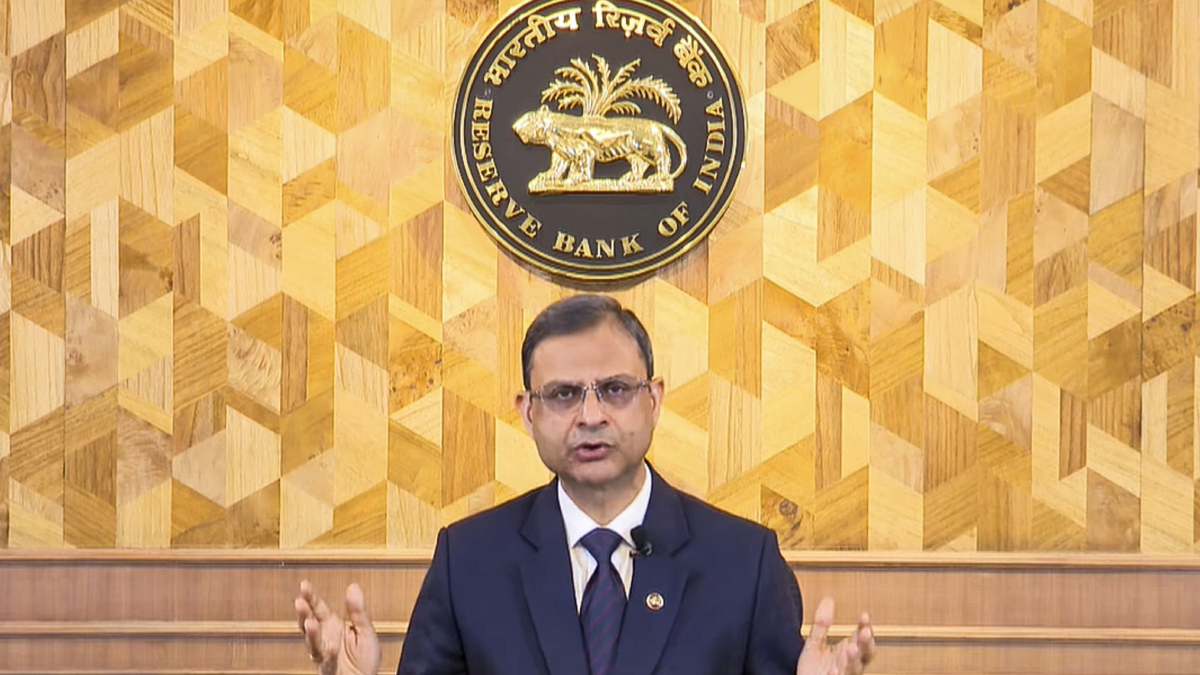

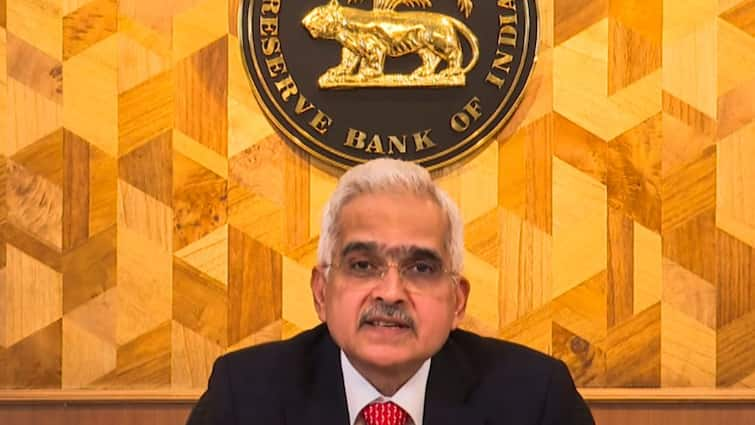

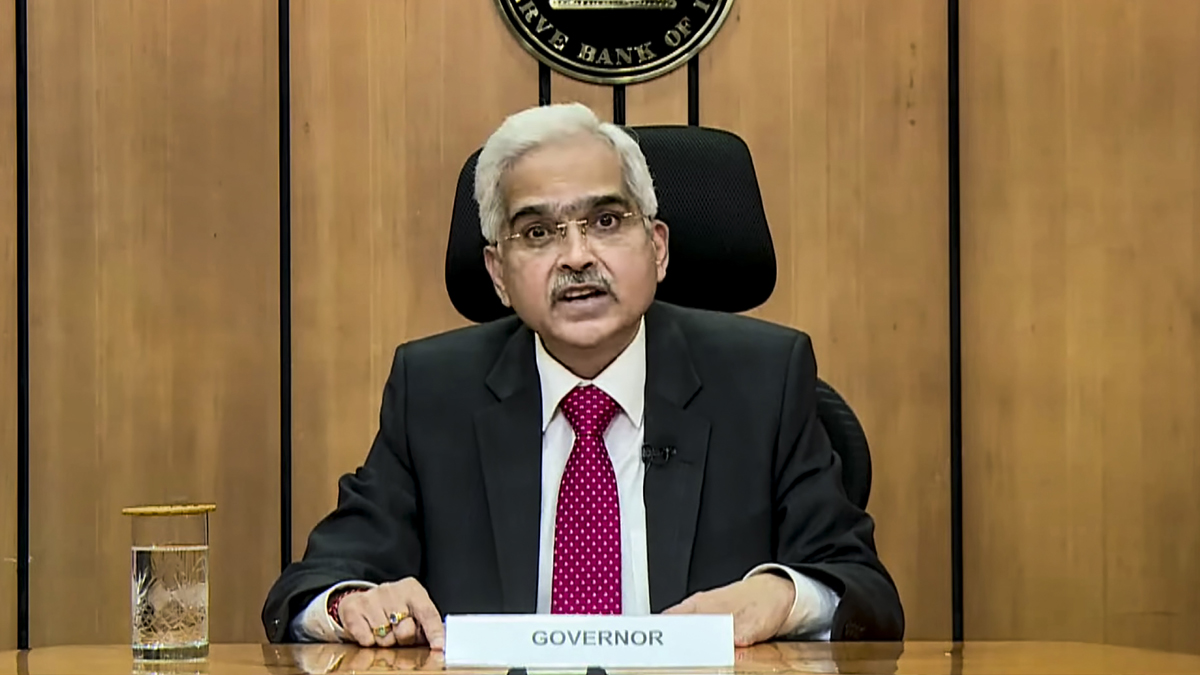

News 18The Reserve Bank on Friday decided to restore the cash reserve ratio in a phased manner to 4 per cent in light of improved liquidity condition in the market. To help banks tide over the disruption caused by COVID-19, the CRR of all banks was reduced by 100 basis points to 3.0 per cent of net demand and time liabilities effective from the reporting fortnight beginning March 28, 2020. Banks would now be required to maintain the CRR at 3.5 per cent of NDTL effective from the reporting fortnight beginning March 27, 2021 and 4.0 per cent of NDTL effective from fortnight beginning May 22, 2021,” RBI Governor Shaktikanta Das said. RBI on March 27, 2020 allowed banks to avail funds under the marginal standing facility by dipping into the Statutory Liquidity Ratio up to an additional one per cent of net demand and time liabilities, i.e., cumulatively up to 3 per cent of NDTL.

History of this topic

Key takeaways from the RBI’s monetary policy committee conference

Live Mint

Indian banks’ liquidity crunch is partly RBI’s own doing

Live Mint

Indian Banks Said to Ask RBI to Delay April Liquidity Rule

Live Mint

CRR cut may boost bank margins, but tight liquidity challenges persist: Report

Live Mint

RBI MPC Dec 2024: Central Bank Slashes CRR By 50 Bps, Here's What It Means

ABP News

RBI MPC Dec 2024: Repo Rate Remains Unchanged, CRR Slashed; Here's What The Experts Have To Say

ABP News

RBI cuts CRR to 4 pc; will unlock ₹1.16 lakh cr bank funds

Live Mint

RBI Policy Outcome: RBI cuts cash reserve ratio by 50 bps to 4%

Live Mint

RBI to Announce Interest Rate Decision Amid High Inflation

Deccan Chronicle

What is Cash Reserve Ratio? Understanding RBI's liquidity management tool

India Today

RBI cuts CRR to 4%: How this liquidity boost will benefit economy

India Today

Lower GDP forecast to CRR boost: 6 key takeaways from RBI MPC

India Today

RBI reduces CRR to 4% for liquidity boost. 3 things to know

India Today

CRR cut in focus at RBI MPC meet: What it means for the economy

India Today

Central Bank's new framework can shave 10-30 percentage points off bank LCRs

New Indian ExpressSBI in talks with RBI to lower cash reserve ratio requirement on green deposits

The HinduRBI decides to discontinue I-CRR in a phased manner

The Hindu

MPC holds rates, raises FY24 inflation forecast to 5.4%; retains GDP growth projection at 6.5%

The Hindu

RBI’s incremental CRR decision spooks banking stocks; Nifty Bank falls over 1%

Live Mint

RBI MPC Meeting: Here are key takeaways from RBI policy decision

Live Mint

RBI MPC meet: Central bank brings in ‘temporary’ ICRR to balance liquidity

Live Mint

A Mint poll says this is what RBI is likely to do this week

Live Mint

RBI Raises Repo Rate By 40 Basis Points To 4.40 Per Cent To Check Inflation

ABP News

RBI hikes interest rate by 40 basis points to 4.40%, CRR to 4.50% in unscheduled policy review

India TV NewsRBI to ensure adequate liquidity in system; cuts reverse repo rate by 25 basis points

The HinduLiquidity floodgates opened

The HinduRBI cuts rates, allows moratorium on auto, home loan EMIs

The Hindu

Good News! You Home Loan, Car Loan EMIs May Get Cheaper Despite No Rate Cut By RBI; Know How

ABP News

RBI announces incentive for lending to MSME, home, auto sectors

India TV NewsUrjit Patel makes a statement with his CRR remark

The Hindu

RBI eases cash reserve rules to ease liquidity

India TV News)

Reserve Bank of India eases cash reserve rules to ease liquidity; banks can 'carve out' up to 15 percent of holdings

Firstpost

What is CRR or cash reserve ratio?

India Today

Demonetisation: RBI eases cash balance requirement for banks

India TV News

RBI stipulates additional CRR to suck out surplus liquidity

Hindustan Times

RBI cuts key lending rate by 25 basis points

ABP NewsRBI lowers repo rate to 7.25 per cent

The HinduRBI cuts SLR by 50 basis points to provide liquidity

The HinduRBI keeps key rate unchanged

The HinduRBI keeps interest rates unchanged

The Hindu

RBI relaxation to help banks meet Jan 2015 LCR target: Crisil

India TV NewsRBI unlikely to cut policy rate

The HinduRBI leaves rates unchanged

The HinduCRR, SLR could come down further: Subbarao

The Hindu

CRR, SLR could come down further: D. Subbarao

India TV News

RBI policy review: highlights

The HinduReserve Bank leaves rates unchanged, warns of inflation risk

The HinduRBI keeps interest rate, CRR unchanged

The Hindu

The dilemma remains

The HinduDiscover Related

)