Central bank work on lowering prices in delicate balance

New Indian ExpressThe Reserve Bank of India appears to be in its final leg of bringing inflation to heel. Though headline inflation is showing steady signs of easing, the central bank’s six-member Monetary Policy Committee is steadfast on retaining repo rate at 6.5 percent as any “premature move may undermine the success achieved so far”. As we navigate the ‘last mile’ of disinflation, the policy imperative is to ensure a durable decline in price rise and aligning not just headline, but also core inflation, to the 4 percent target. If declining global commodity prices and higher government capex are positive signs for growth, the government’s fiscal consolidation drive will help lower inflationary pressures and the evolving trajectory of current account deficit suggest that India is well placed in terms of macro-financial stability. That said, consumption demand revival holds the key in sustaining the current growth momentum, which in turn depends on falling unemployment and rising household income.

History of this topic

Policymakers, economists pin hopes on government spending to propel economic recovery amid sluggish growth

Live Mint

Growth to pick up in coming quarters on govt capex, says MPC member Nagesh Kumar

Live Mint

RBI’s monetary policy panel divided over timing of rate action

Live Mint)

India’s wholesale inflation dips to 1.89% in November after hitting four-month high in October

Firstpost

Growth slowdown: Why lay a deeper economic malaise at RBI’s door?

Live Mint

Why RBI is central to the country’s economy

New Indian Express

Mint Quick Edit: Lower inflation raises the likelihood of an RBI rate cut

Live Mint

DC Edit | FM, new RBI chief signal cut

Deccan Chronicle

Retail inflation slows slightly at 5.48%

Hindustan Times

India’s retail inflation moderates to 5.48% in November, IIP expands to 3.5% in October

Live Mint

Retail inflation eases to 5.48% in November from above 6% in October

India Today

Inflation likely eased to 5.5% in November: Mint poll

Live Mint

Staying the course: On the RBI and inflation

The Hindu

DC Edit | RBI still cautious, but cuts CRR

Deccan Chronicle

Stalled demand, sluggish growth

Hindustan Times

Home loans may become more affordable and boost the real estate sector, experts say

Hindustan Times

RBI cuts GDP growth projection to 6.6%, repo rate unchanged at 6.5%

Deccan Chronicle

RBI monetary policy: MPC projects FY25 inflation at 4.8%

Live Mint

Amid high inflation, RBI keeps repo rate unchanged at 6.5%

The Hindu

RBI to Announce Interest Rate Decision Amid High Inflation

Deccan Chronicle

RBI MPC verdict today: Repo rate to GDP, inflation forecasts— here are 5 key indicators to watch

Live Mint

RBI keeps interest rate unchanged at 6.5%, lowers GDP projection to 6.6%, cuts CRR to 4%

New Indian Express

Lower GDP forecast to CRR boost: 6 key takeaways from RBI MPC

India Today

RBI MPC announcement: Will RBI Governor Shaktikanta Das cut key lending rates?

India Today

RBI keeps repo rate unchanged for 11th time in a row at 6.5 per cent

India TV News

RBI must restore balance between inflation, growth

New Indian Express

RBI keeps key lending rate unchanged at 6.5%, focus remains on tackling inflation

India Today

RBI cuts growth forecast to 6.6 per cent, revises inflation estimate to 4.8 per cent for FY25

India TV News

RBI must restore balance between inflation, growth

New Indian Express

RBI MPC Meeting: What happens if the central bank cuts interest rates tomorrow? D-Street experts weigh in

Live Mint

RBI MPC Meeting: What does India’s Q2 GDP print mean for the monetary policy? Experts weigh in

Live Mint

RBI Policy: MPC meeting begins today; will the central bank cut the repo rate? Experts weigh in

Live Mint

RBI MPC meet: Growth needs a boost, but will inflation hold back rate cut?

India Today

Monetary policy review: RBI should stick to its price stability mandate

Live Mint

RBI MPC: FX, not inflation, curbing degrees of policy freedom

Live Mint

Is MPC doing enough on inflation? Consumers are divided

Live Mint

RBI committee meeting: A cut in cash reserve ratio likely, but not in repo rate

New Indian Express

India rates market signals easing, likely via liquidity, after weak growth data

Live Mint

From RBI policy to pre-budget rally - experts highlight 3 near-term key triggers for Indian stock market

Live Mint

Monetary policy: Emotive choices and immediate response mechanism

Live Mint

Will RBI cut key interest rates on December 6? 3 things to know

India Today

RBI to keep repo rate unchanged at meeting next week, chances of rate cut in Feb increased: Report

Live Mint

RBI’s GDP projections on test as India’s Q2 GDP growth falls short

Live Mint

RBI Likely To Hold Interest Rates Amid Inflation Surge; Economists Push Rate Cut Forecast To February

ABP News

Finance Ministry ‘cautiously optimistic’ on India’s economic outlook; geopolitical fragility remains a concern

Live Mint

India Expects Relief in Food Inflation with Strong Kharif Harvest

Deccan Chronicle

India’s central bank should adhere to its inflation-targeting mandate

Live Mint

Why Nirmala Sitharaman, Piyush Goyal would like RBI to slash interest rates

India Today

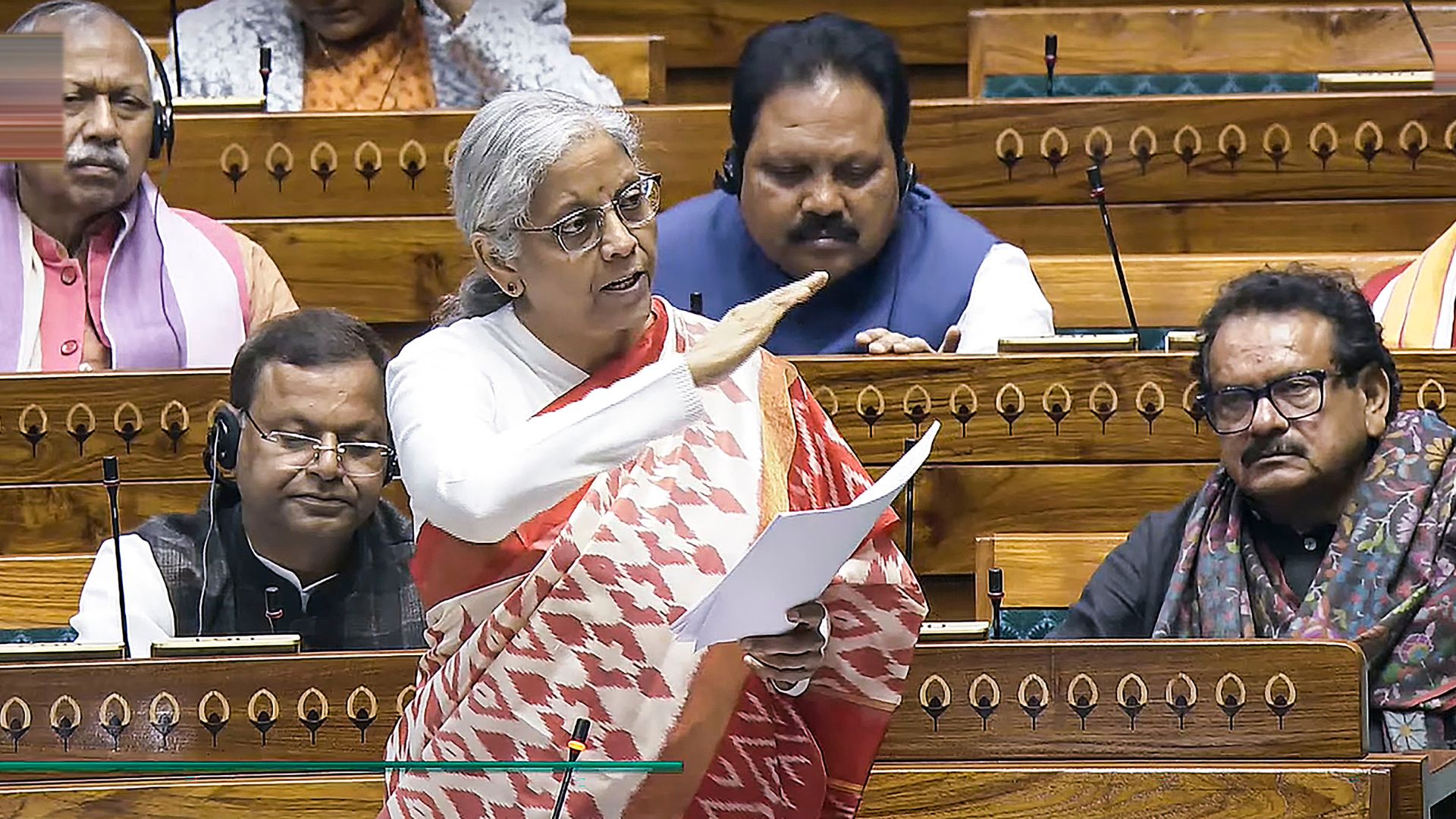

Nirmala Sitharaman calls for 'affordable' interest rates after Piyush Goyal

India Today

Inflation behaving more like a magician who tricks you again and again

New Indian ExpressDiscover Related

)