Army of lobbyists helped water down banking regulations

Associated PressWASHINGTON — It seemed like a good idea at the time: Red-state Democrats facing grim reelection prospects would join forces with Republicans to slash bank regulations — demonstrating a willingness to work with President Donald Trump while bucking many in their party. But the measure also included provisions sought by midsize banks that drastically curtailed oversight once the Trump Fed finished writing new regulations necessitated by the bill’s passage. Less than a month after the bill was passed out of the Senate, Tester met Greg Becker, the CEO for the now-collapsed Silicon Valley Bank, according to his schedule. Lobbyists with the firm the Franklin Square Group, which had been retained by Silicon Valley Bank, donated $10,800 to Tester’s campaign, record show. That’s the question that needs to be resolved.” In a statement issued last week, Tester did not directly address his role in the legislation, but he pledged to “take on anyone in Washington to ensure that the executives at these banks and regulators are held accountable.” Cam Fine, who led the Independent Community Bankers of America trade group during the legislative push, said the overall the bill was a good piece of legislation that offered much needed relief to struggling community banks.

History of this topic

Chuck Schumer, Maxine Waters Rid Themselves Of Silicon Valley Bank Contributions

Huff Post

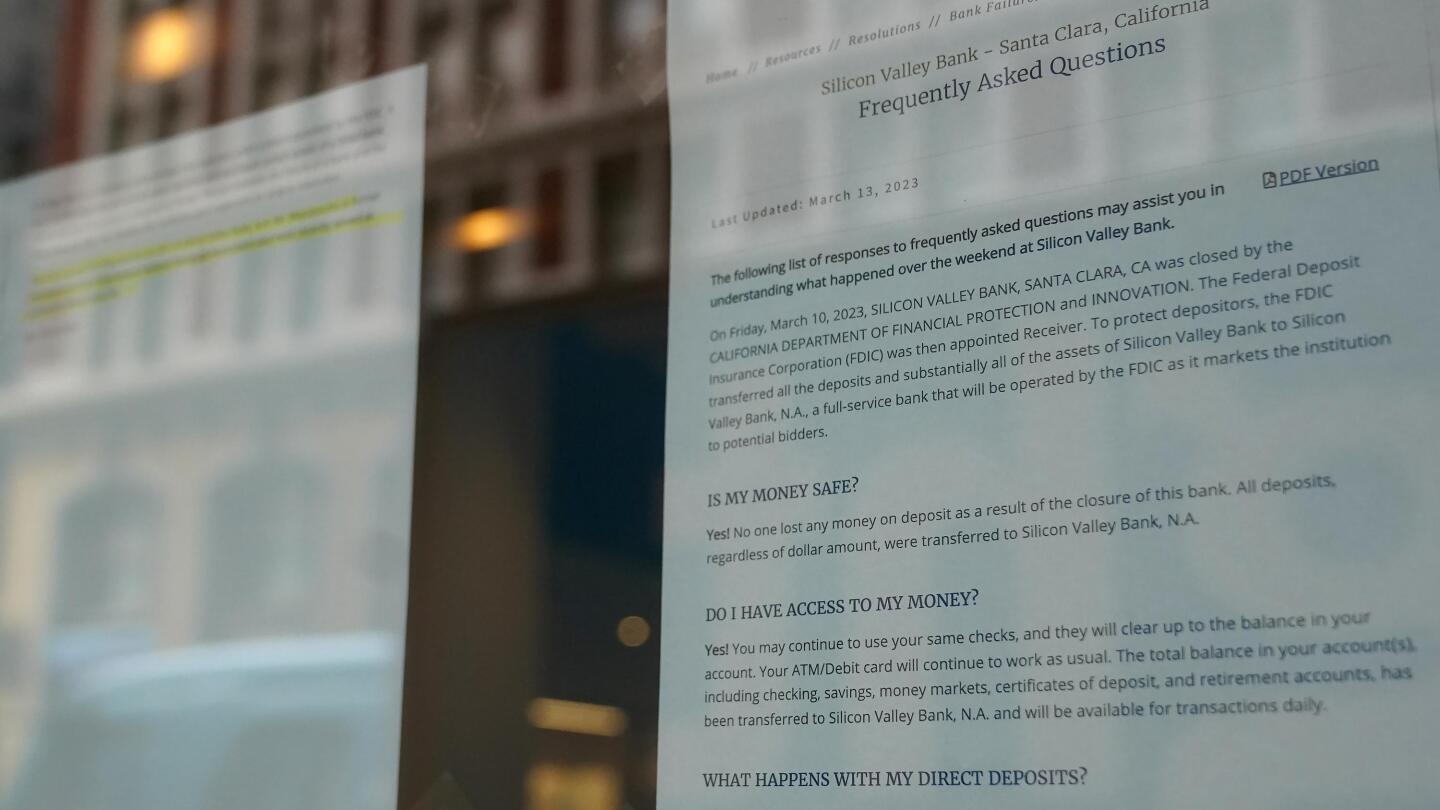

Silicon Valley Bank’s demise disrupts the disruptors in tech

Associated PressSilicon Valley Bank parent, CEO and CFO are sued by shareholders. Here's why

Hindustan TimesDiscover Related

)

)

)