Troubles at Sam Bankman-Fried’s Alameda began well before crypto crash

Live MintAlameda was applying Wall Street-style wizardry to the crypto world—and outsiders thought it was winning big. When one prospective lender asked about Alameda’s financials, Mr. Bankman-Fried’s lawyer explained that the firm often handled large amounts of bitcoin but offered no detailed financial information, according to a document viewed by the Journal. Mr. Bankman-Fried devised a plan for Alameda to borrow funds from the exchange, according to recent lawsuits by the Securities and Exchange Commission and the Commodity Futures Trading Commission, the nation’s top market regulators. Mr. Bankman-Fried also made sure that Alameda’s collateral on FTX wouldn’t automatically be sold if its value fell below a certain level, the SEC said. Mr. Bankman-Fried ordered Ms. Ellison, with whom he had been romantically involved, to use Alameda’s buying power to artificially inflate the value of a cryptocurrency the trading firm was borrowing against, the SEC said.

History of this topic

FTX's Gary Wang avoids prison after cooperating in crypto fraud case

Salon

How Sam Bankman-Fried’s ex-girlfriend helped topple the crypto king

The Independent

Top FTX executive jailed over connections to collapsed crypto empire

The Independent

Ryan Salame, part of the 'inner circle' at collapsed crypto exchange FTX, sentenced to prison

The IndependentRyan Salame, part of the ‘inner circle’ at collapsed crypto exchange FTX, sentenced to prison

Associated Press

What happened to FTX? The collapse of Sam Bankman-Fried’s crypto ‘house of cards’

The IndependentA timeline of the downfall of Sam Bankman-Fried and the colossal failure of FTX

Associated Press

A timeline of the downfall of Sam Bankman-Fried and the colossal failure of FTX

The IndependentThe Bankman-Fried verdict, explained

Associated Press

FTX founder Sam Bankman-Fried sentenced to 25 years for multi-billion dollar crypto fraud

Hindustan Times

FTX Founder Sam Bankman-Fried Sentenced to 25 Years in Prison

WiredFallen crypto mogul Sam Bankman-Fried sentenced to 25 years in prison

Associated Press

Fallen crypto mogul Sam Bankman-Fried sentenced to 25 years in prison

LA Times

Ex-crypto mogul Sam Bankman-Fried due to be sentenced for defrauding FTX

Al Jazeera

Dethroned crypto king Sam Bankman-Fried to be sentenced for defrauding FTX investors

New Indian Express

Dethroned crypto king Sam Bankman-Fried to be sentenced for defrauding FTX investors

New Indian Express

“Lack of any remorse”: Judge tears into Sam Bankman-Fried as he sentences him to 25 years

SalonFTX chief executive blasts Sam Bankman-Fried for claiming fraud victims will not suffer

Associated Press

FTX chief executive blasts Sam Bankman-Fried for claiming fraud victims will not suffer

The IndependentProsecutors seek from 40 to 50 years in prison for Sam Bankman-Fried for cryptocurrency fraud

Associated Press

Failed crypto exchange FTX’s debtors and liquidators reach a global settlement

The Hindu

Sam Bankman-Fried’s downfall is complete

Hindustan Times

PROFILE | Sam Bankman-Fried: Fraud conviction in FTX crash caps stunning fall for ‘Crypto King’

The Hindu

FTX fraudster Sam Bankman-Fried convicted of all charges in $8bn case

The Independent

FTX’s Sam Bankman-Fried found guilty. A timeline of the events

Live Mint

Sam Bankman-Fried: All you need to know about FTX founder

Live Mint

Ex-crypto mogul Sam Bankman-Fried convicted for FTX collapse, faces 110 years in prison

Hindustan Times

What to know about the Sam Bankman-Fried trial verdict

Al Jazeera

Crypto tycoon Sam Bankman-Fried found guilty on all charges in fraud trial

Al Jazeera

FTX founder Sam Bankman-Fried is found guilty of all charges including fraud

NPRFTX founder Sam Bankman-Fried convicted of defrauding cryptocurrency customers

Associated Press

Sam Bankman-Fried created a 'pyramid of deceit' prosecutor tells jury

Daily Mail

Sam Bankman-Fried created a 'pyramid of deceit' because he 'thought he was smarter and better', prosecutor tells jury in closing statements of his $8 BILLION fraud trial

Daily MailClosing arguments next in FTX founder Sam Bankman’s fraud trial after his testimony ends

Associated Press

Disgraced FTX founder Sam Bankman-Fried testifies during his trial over crypto collapse that he thought company was 'okay'

Daily MailProsecutor takes aim at Sam Bankman-Fried’s credibility at trial of FTX founder

Associated Press

Sam Bankman-Fried Built a Crypto Paradise in the Bahamas—Now He's a Bad Memory

WiredFTX founder Sam Bankman-Fried acknowledges in court that customers were hurt but denies fraud

The Hindu

FTX’s Bankman-Fried admits ‘mistakes’, denies fraud at trial

Al Jazeera

Sam Bankman-Fried DENIES stealing $10billion from FTX customers but admits he made 'large mistakes' in managing risks as he testifies in his own defense in fraud trial

Daily MailFTX founder Sam Bankman-Fried denies that he defrauded anyone

Associated Press

FTX case: Sam Bankman-Fried to testify in fraud trial after onslaught from inner circle

Live Mint

Sam Bankman-Fried gave fortunes to celebrities and politicians. Nishad Singh saw it up close.

SlateSam Bankman-Fried's lawyer says FTX investments were not 'reckless'

The HinduSam Bankman-Fried’s lawyer fails to hurt credibility of the government’s star witness at fraud trial

Associated Press

Opinion: Why Sam Bankman-Fried’s aversion to ‘grownups’ will likely prove to be criminal

LA TimesSam Bankman-Fried stole customer funds from the beginning of FTX, exchange's co-founder tells jury

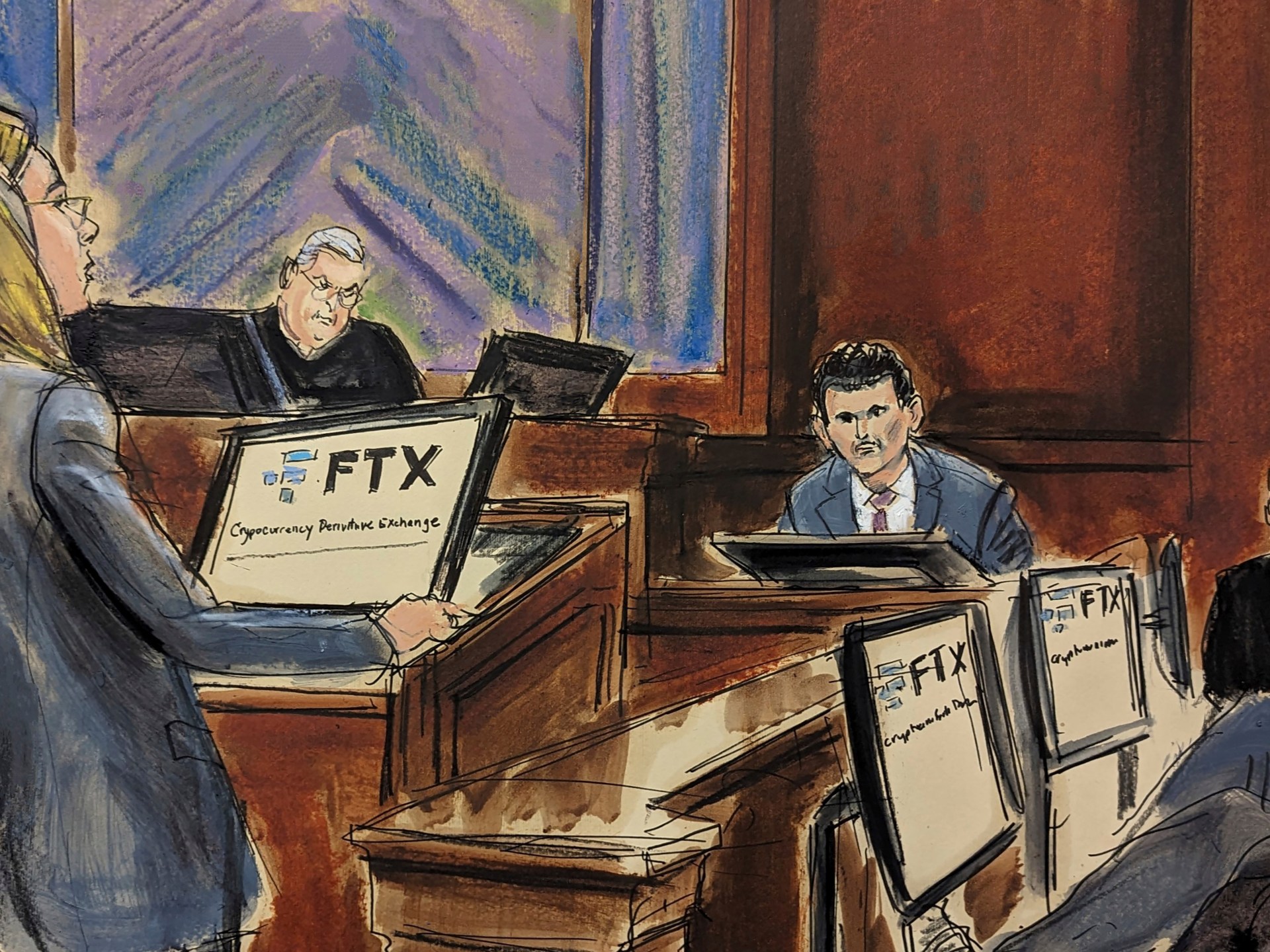

The HinduSam Bankman-Fried stole customer funds from the beginning of FTX, exchange’s co-founder tells jury

Associated PressFTX co-founder testifies against Sam Bankman-Fried, saying they committed crimes and lied to public

Associated Press

Sam Bankman-Fried's trial is shown dozens of photos of the luxurious Bahamas penthouse where the FTX founder lived with eight other employees who each paid $15k a MONTH

Daily MailDiscover Related