3 years, 3 months ago

Don't let asset monetization end up as a Potemkin show

Live MintAsset monetization is not a new concept in India. With its debt nearing 60% of gross domestic product, India’s government has no option but to look for alternate means of raising capital to fund infrastructure development. While the finer details of the model that India’s government plans to adopt are still unknown, New Delhi has stated that it intends not to sell public assets outright, but to retain ownership. The government could adopt both measures of selling and leasing assets, depending on the nature of each asset and also the associated risk and return, etc. The case of India’s insolvency code shows how weak judicial infrastructure and a poor debt market can pose a challenge to the success of a well-designed law.

India

Infrastructure

Assets

End

Asset

Public Private

Nmp

Monetization

infrastructure

nmp

monetization

india

potemkin

indias

assets

end

dont

asset

public

private

let

weak

History of this topic

3 years, 3 months ago

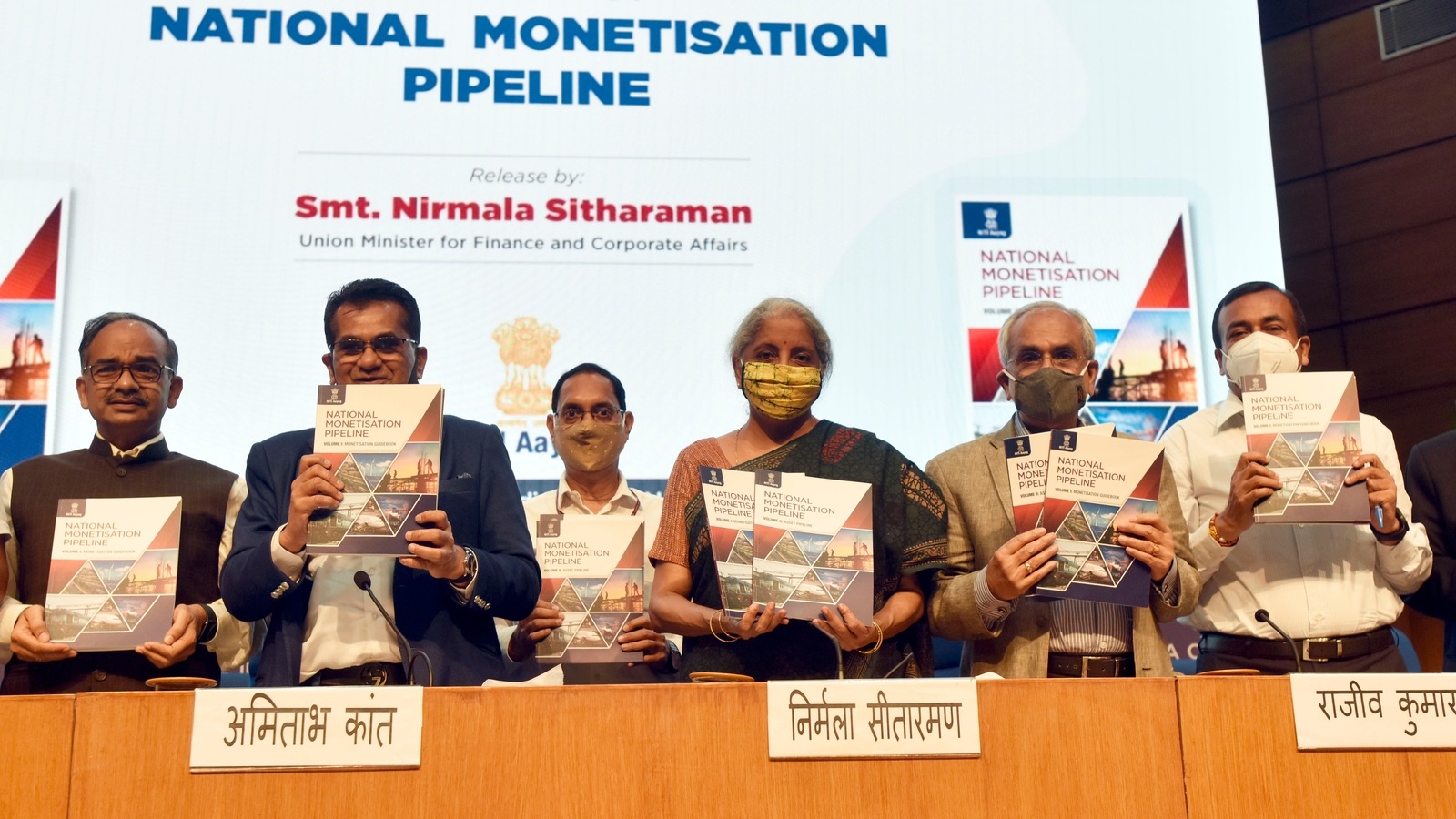

OPINION: Demystifying National Monetisation Pipeline and Why India Needs It

News 18

3 years, 3 months ago

How the National Monetisation Pipeline works

Hindustan Times

3 years, 3 months ago

Asset Monetization a Great Idea, but Govt Must Take These 3 Steps to Ensure It’s a Success

News 18

3 years, 3 months ago

Success of Modi Govt’s Asset Monetization Plan Does Not Depend on Political Consensus

News 18

3 years, 4 months ago

Asset monetisation is the only way the country will move forward: Niti Aayog CEO

India Today

3 years, 10 months ago

Nirmala Sitharaman interview: ‘Important to back asset creation’

Hindustan TimesDiscover Related

5 days, 13 hours ago

6 days, 5 hours ago

6 days, 5 hours ago

6 days, 17 hours ago

1 week ago

1 week, 3 days ago

1 week, 4 days ago

1 week, 5 days ago

1 week, 6 days ago

Trending News

2 weeks ago

2 weeks, 2 days ago

2 weeks, 2 days ago

2 weeks, 4 days ago

2 weeks, 4 days ago

2 weeks, 6 days ago

3 weeks ago

3 weeks, 2 days ago

3 weeks, 4 days ago

3 weeks, 4 days ago

4 weeks, 1 day ago

4 weeks, 1 day ago

1 month ago

1 month ago

Trending News

1 month ago

1 month ago

1 month, 1 week ago

1 month, 1 week ago

1 month, 1 week ago

1 month, 1 week ago

1 month, 1 week ago

1 month, 1 week ago

1 month, 2 weeks ago

)

1 month, 2 weeks ago

2 months, 3 weeks ago

3 months, 1 week ago

3 months, 2 weeks ago

3 months, 4 weeks ago

4 months, 1 week ago

4 months, 1 week ago

4 months, 2 weeks ago

4 months, 2 weeks ago

4 months, 2 weeks ago

4 months, 3 weeks ago