China’s Evergrande defaults on dollar debt

Al JazeeraChina Evergrande Group has officially been labeled a defaulter for the first time, the latest milestone in a months-long financial drama that paves the way for a massive restructuring of the world’s most indebted developer. ‘Reckless expansion’ “The downgrade may not have an overt or immediate impact on the Chinese process, but may subtly increase pressure on the company to quickly reveal initial restructuring proposals,” said Brock Silvers, chief investment officer at Kaiyuan Capital in Hong Kong. The ratings cut may also trigger cross defaults on the developer’s $11.2 billion of outstanding dollar debt. The People’s Bank of China reiterated on Friday that risks posed to the economy by Evergrande’s debt crisis can be contained, citing the developer’s “own poor management” and “reckless expansion” for the problems it faces.

History of this topic

China may pare its US debt holdings

China Daily

Evergrande: China property developer and founder accused of £60bn fraud

The IndependentChina Evergrande is ordered to liquidate, with over $300 billion in debt. Here’s what that means

Associated Press

China's top-selling to world's most indebted developer: What is Evergrande crisis

Hindustan TimesChina Evergrande has been ordered to liquidate. The real estate giant owes over $300 billion

Associated Press

Why China Property Giant Evergrande Faces Liquidation

Bloomberg

Chinese developer Evergrande risking liquidation if creditors veto its plan for handling huge debts

The Independent

China Evergrande’s founder under investigation, shares halted

Al Jazeera

What does China Evergrande’s debt restructuring entail?

Live Mint

Debt-ridden China developer Evergrande files for bankruptcy in US

Al Jazeera

Can China’s Evergrande Group survive amid mounting debts, depleting resources?

Live MintChina Evergrande reports its debt rose to $340 billion in 2022. It plans meetings with creditors

Associated Press

Chinese property giant Evergrande to pay $1.1 billion following indebtedness

Hindustan TimesChina's mortgage boycott is escalating. Now Evergrande suppliers have stopped paying bank loans

ABC

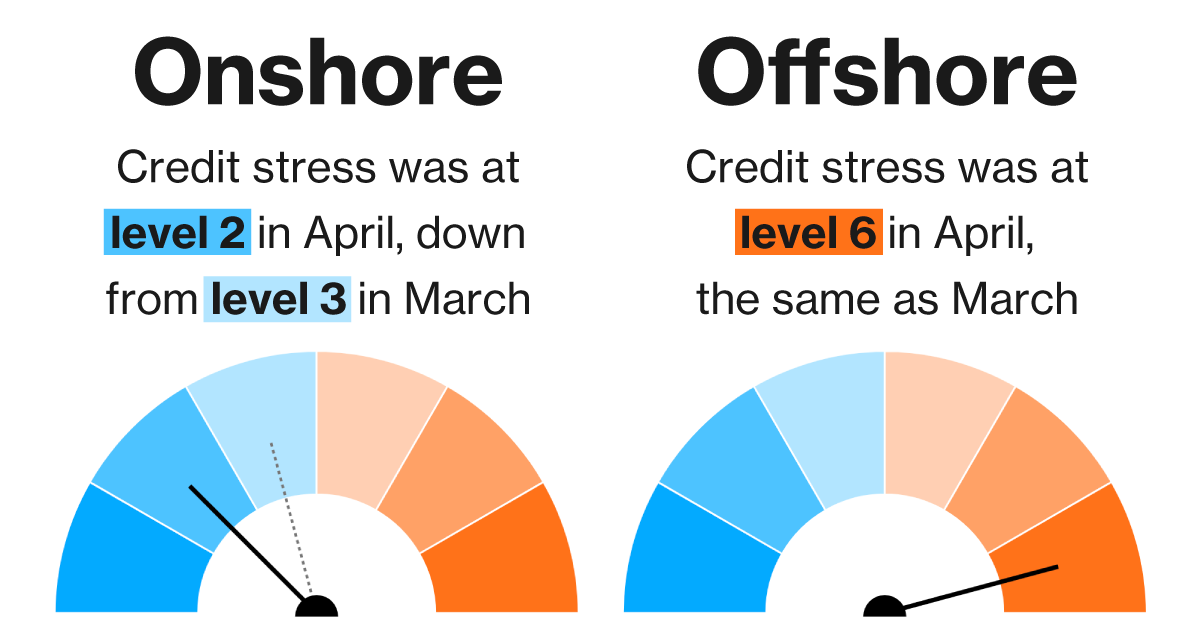

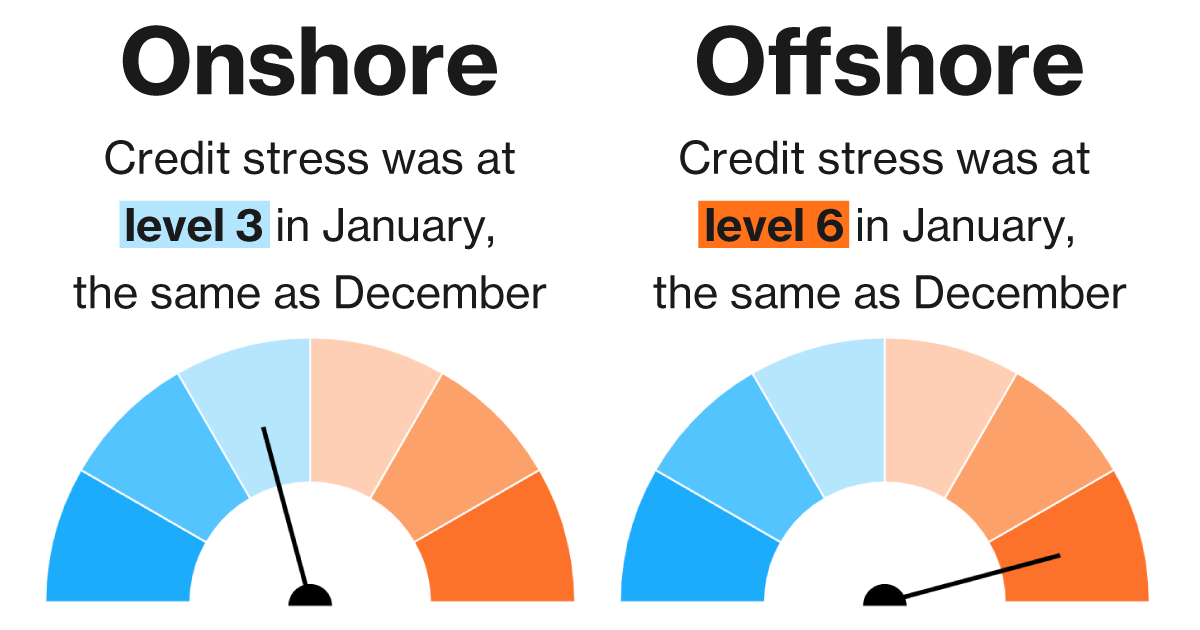

Xi’s Covid Zero Policy Prolongs Stress in China Real Estate Debt Market

Bloomberg

China's Evergrande baffled (and worried) after lenders claim $2 billion in cash

Hindustan TimesEvergrande says it is on track to restructuring after shares suspended and billions seized by banks

ABC)

Chinese property developer giant Evergrande stops trading on Hong Kong Stock Exchange

Firstpost

China Credit Investors Brace for More Surprises From Hidden Debt

Bloomberg

Evergrande’s debt crisis: International creditors threaten legal action over ‘opaque’ restructuring process

CNN

Evergrande default signals volatility but no crash, analysts say

Al JazeeraEvergrande downgraded to default, ASX closes down, IMF warns of Omicron pain

ABC)

Chinese real estate behemoth Evergrande, one other firm default on $1.6 billion in bonds

Firstpost

Evergrande has defaulted on its debt, Fitch Ratings says

CNN

Evergrande restructuring puts onus on Xi to limit fallout

Al Jazeera

Evergrande fails to make overdue coupon payments: sources

Al Jazeera

China tries to reassure on Evergrande as default fears rise

Associated Press

Evergrande debt crisis: Chairman has sold $1.1 billion worth of his personal assets to prop up the company, Chinese state media reports

CNN

Evergrande has reportedly made good on another payment, averting default once again

CNN

As Evergrande fears linger, Beijing says it’s time for companies to pay their offshore debts

CNN

Evergrande shares plunge as Chinese property developer faces another debt deadline

The Independent

China’s real estate crisis: Evergrande and these developers are already in trouble

CNN

China’s real estate crisis: Evergrande and these developers are already in trouble

CNN

Evergrande stock surges after report that it made an important bond payment

CNN

Evergrande conundrum

The HinduThe Evergrande crisis and how Xi is remaking China's economy | In Focus podcast

The Hindu

Chinese banks try to calm fears about developer’s debts

Associated Press

Evergrande Group meets crucial debt deadline but another looms

CNN

Evergrande stock surges as debt deadline passes. It’s not in the clear yet

CNN)

Global investors rattled as Evergrande struggles with debt: All you need to know about China's biggest builder’s troubles

Firstpost

EXPLAINED: The Evergrande Crisis And What It Means For Markets

News 18China's real estate house of cards could be brought down by Evergrande, the world's most indebted company

ABC

As Evergrande stock sinks, Chinese conglomerate puts on a brave face but will Beijing bail it out?

CNN

Evergrande shares plummet as Chinese property giant's debt issues deepen

India TV News

Chinese property developer’s debt struggle rattles investors

Associated Press

The Delta Covid variant is hitting China’s economy hard, and a property crunch is looming

CNN

What could an Evergrande debt default mean for China and beyond?

Al Jazeera

Evergrande, Chinese property giant, warns again that it could default on its enormous debts

CNN

Premarket stocks: There’s another big risk brewing in China

CNNDiscover Related

)