)

Govt Raises Provident Fund Threshold Limit to Rs 5 Lakh for Earning Tax-free Interest

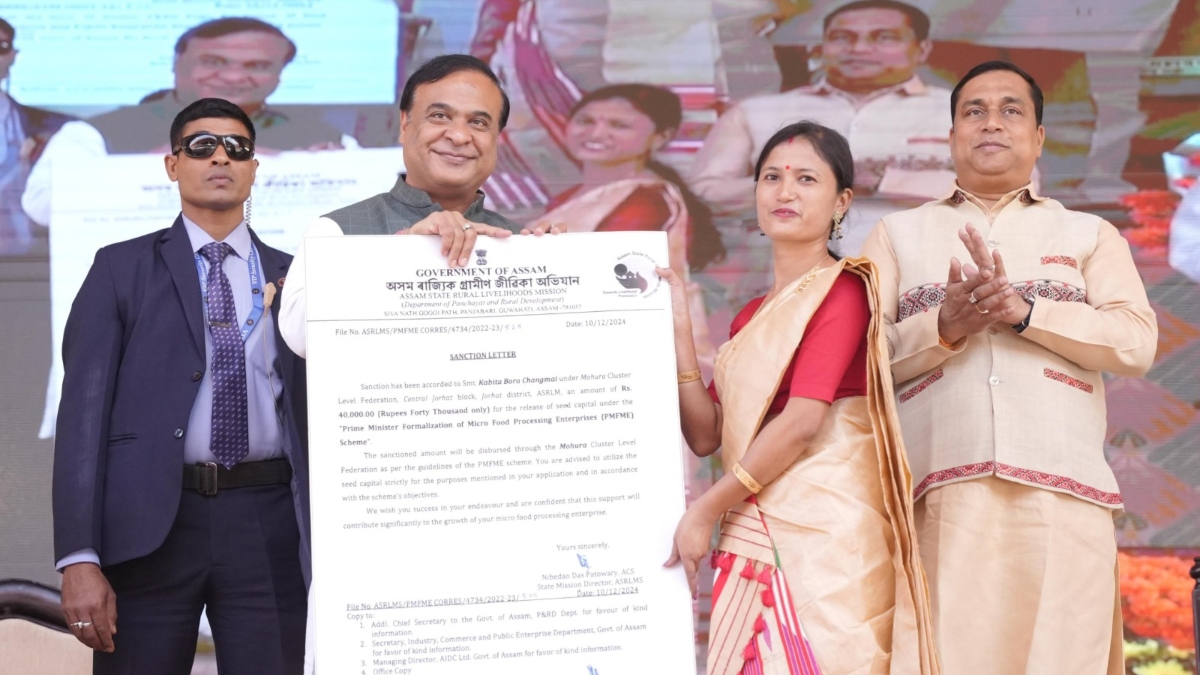

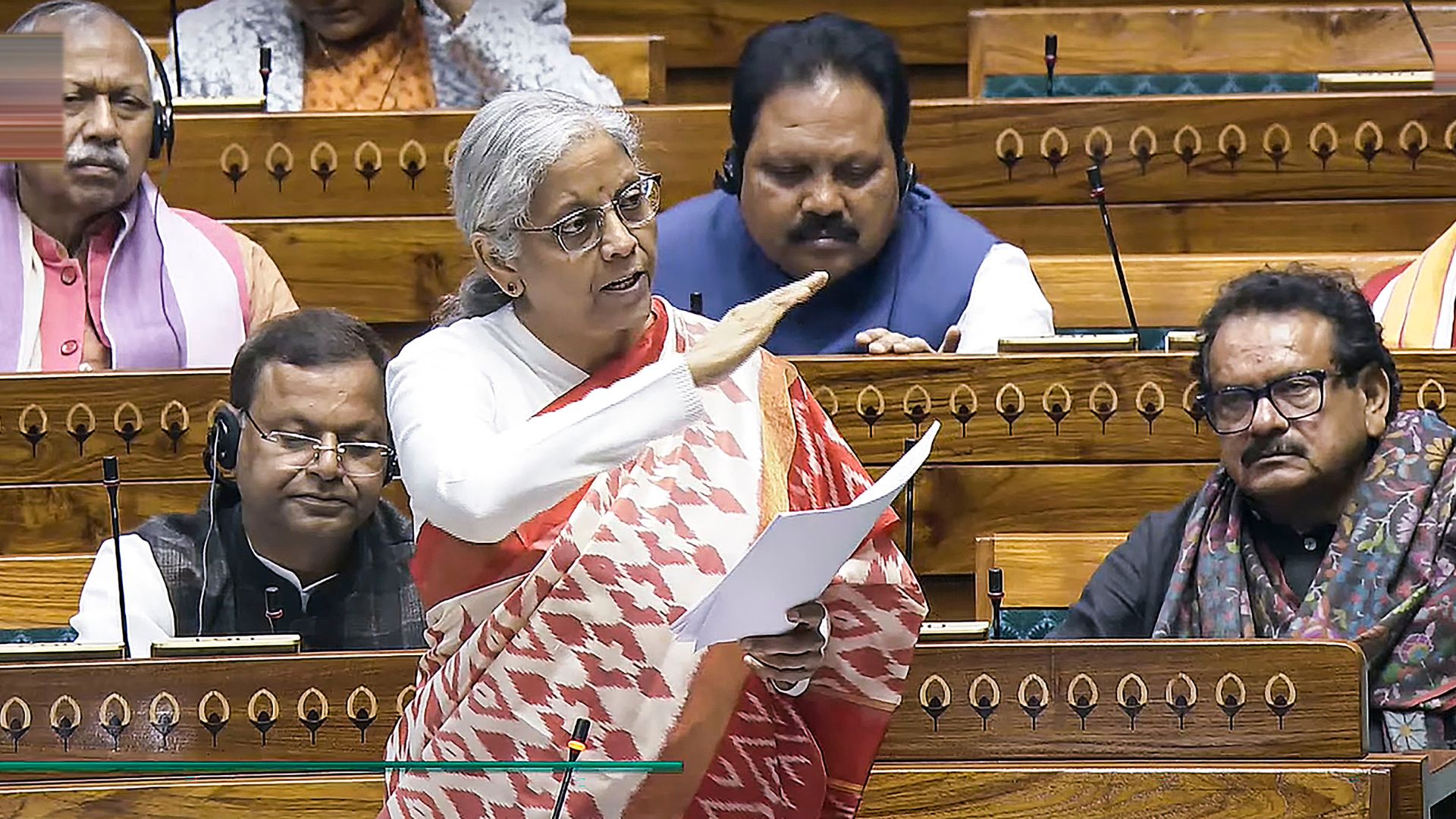

News 18The government on Tuesday raised the deposit threshold limit to Rs 5 lakh per annum in provident fund for which interest would continue to be tax exempt. In her Budget presented to Parliament on February 1, Finance Minister Nirmala Sitharaman had provided that interest on employee contributions to provident fund over Rs 2.5 lakh per annum would be taxed from April 1, 2021. Replying to the debate on the Finance Bill 2021 in the Lok Sabha, Sitharaman made the announcement regarding raising the limit to Rs 5 lakh in cases where employers do not make contributions to the provident fund. The minister also stressed that tax on interest on provident fund contribution affects only 1 per cent of the contributors, and the remaining are not impacted as their contribution is less than Rs 2.5 lakh per annum.

History of this topic

First NDA 3.0 Budget Gets On The 'Job' with Employment Push, Gives Key Allies Their 'Money's Worth'

News 18

Budget 2024: How the changes in new tax regime will benefit the salaried, explained

Hindustan Times

Watch: Budget 2024 | What’s in it for markets and investors?

The Hindu

Budget 2024 Highlights on income tax: FM Sitharaman revises personal income tax slabs; taxation rates remain unchanged

The Hindu

Budget 2024 Boost To New Tax Regime: Standard Deduction Raised To Rs 75k From Rs 50k

News 18

Budget 2024: Will common man and salaried class get income tax relief? | Here's what we know

India TV News

Budget 2024 announcements on new tax regime: Standard deduction increased, check new tax slabs

India TV News

Budget 2024: Will Nirmala Sitharaman bring cheer to middle-class with income tax changes?

Hindustan Times

Budget 2024: What income tax benefits can taxpayers expect on July 23?

India Today

Budget 2024: Finance minister Nirmala Sitharaman to increase income tax exemption limit?

Hindustan Times

Budget 2024: Exemption limit under new tax regime may be hiked to Rs 5 lakh, says report

India Today

New Tax regime rules to come into effect from today: Check deductions, rebates, changes in tax slab

India TV News

Maximise Your Savings: Top 7 Tax-Saving Tips As FY2023-24 Draws To A Close

ABP News

Budget 2024: 6 key changes taxpayers want from FM Sitharaman

India TodayIndia’s fiscal deficit may breach 5.9% of GDP target: India Ratings and Research

The Hindu

LS Gives Nod for Additional Cash Outgo of Rs 58,378 Crore

Deccan Chronicle

I-T Exemption Limit For Retirement Leave Encashment Raised To Rs 25 Lakh For Salaried Employees

ABP News

FM says new tax regime has been made \'very attractive\'

Deccan Chronicle

'...still India is fastest-growing major economy'- FM Nirmala Sitharaman's reply to Budget 2023 debate in LS

India TV News

Budget 2023: How Nirmala Sitharaman attempted to simplify tax experience

Live Mint

Deposit limit for Senior Citizen Savings Scheme increases to ₹30 lakh

Hindustan Times

New income tax regime overhaul, Rs 2.4 L cr for railways among 5 big announcements by FM Niramala Sitharaman

India Today)

Budget 2023-2024: From revised tax slabs to savings scheme for women, Nirmala Sitharaman’s biggest announcements

Firstpost

Budget 2023: Big hike in tax exemption on encashed leaves for non-govt staff

Hindustan Times

Union Budget 2023: Read Nirmala Sitharaman's full speech here

Hindustan Times

Budget 2023-24: Finance Minister Proposes To Increase Threshold Limit For Co-Operatives To Withdraw Cash Without TDS

Live Law

5 Major Announcements For Middle-Class: Budget 2023-24

Live Law

No income-tax upto Rs 7 lakh in new tax regime

Deccan Chronicle

Budget 2023 Key Highlights: Are You Under New Tax Regime? Nirmala Sitharaman Has Good News for You

News 18

Budget 2023: Govt increases income tax rebate to Rs 7 lakh per annum | 5 major announcements

India TV News

#Incometax trends on Twitter after Nirmala Sitharaman's Budget 2023 speech. Best memes

India Today

From Tax Exemption To Rural Push, Here Are Key Expectations From Budget 2023

News 18

Union Budget 2023: Govt likely to raise income tax exemption limit from Rs 2.5 lakh to 5 lakh

India TV News

The fineprint on the new tax on Employees’ Provident Fund income

The Hindu

New income tax rules for GPF from 1st April 2022 that you should know

Live Mint

PF Update: Provident Fund Contributions to Be Taxed Soon? Know What the Govt Says

News 18

Govt seeks Parliament nod for additional spending of ₹1.5 tn in FY22

Live Mint

Budget 2022: NPS exemption raised for state govt staff. An explainer

Live Mint

Budget 2022: No change in income tax slabs announced

India Today

Income tax rebate to PPF, top 5 budget 2022 announcements expected

Live Mint

Union Budget 2022-23: Why salaried class may not get big income tax relief

India Today

New Provident Fund Tax rules come into effect: Here's what will change now

India TV News

New PF tax rule from this month: How it will impact you

Live Mint

Tax-free Investment Limit In PF Raised Up To Rs 5 lakh If Employers Don't Contribute Know What It Means For Taxpayers

ABP NewsNirmala Sitharaman tweaks tax provisions for EPF contributions, says ready to discuss GST on fuel if States want it

The Hindu

Govt raises PF threshold limit to Rs 5 lakh for earning tax-free interest

India TV News)

Centre Planning to Provide 5-Year Tax Holiday to Pvt Development Finance Institutions

News 18

5 new income tax rules that will come into effect from 1 April

Live Mint‘Interest on PF contributions of over ₹2.5 lakh must in I-T filing’

The HinduDiscover Related