)

Indian cos raised Rs 6 lakh crore from equity, debt markets in 2018; volatile market conditions brought down kitty by 30%

FirstpostData shows the debt market remains the most preferred route for raising funds to support business needs of the corporate world. New Delhi: Indian companies have raised nearly Rs 6 lakh crore from equity and debt instruments in 2018, but volatile market conditions brought down the kitty by 30 percent and political uncertainties ahead of the 2019 general elections may again cast a shadow on fund-raising activities in first half of the new year. Out of the cumulative Rs 5.9 lakh crore garnered so far this year from capital markets, a large chunk or Rs 5.1 lakh crore has been mopped up from the debt market and the remaining amount of about Rs 78,500 came from equity markets, figures compiled by data analytics major Prime Database showed. The final figures may go up to end the year at around Rs 6 lakh crore for debt and equities, experts said. Despite getting regulator SEBI’s go-ahead to float initial share-sales worth over Rs 60,000 crore in 2018, the year saw a total of 24 IPOs raising only Rs 30,959 crore.

History of this topic

Over 90 companies have filed draft papers for IPO to raise ₹1 lakh crore in 2025, says BSE CEO

Live Mint

Upcoming IPOs: Dr. Agarwal’s and Regreen Excel get SEBI nod to raise funds via public issue

Live Mint

Indo Farm Equipment shares list at ₹256 on NSE, up 19% from IPO price

Live Mint

Upcoming IPOs: 7 new public issues, 6 listings scheduled for next week; check full list

Live Mint

Star-studded IPO: From Amitabh Bachchan, Shah Rukh, to Tiger Shroff. How many celebs have invested in this realty IPO?

Live Mint

Indian Stock Market Faces Volatility in 2024, But Ends Strong

Deccan Chronicle

Indian Stock Market Lags Behind Global Indices in 2024

Deccan Chronicle

FPI inflows into Indian equities drop sharply in 2024; rebound anticipated in 2025

Live Mint

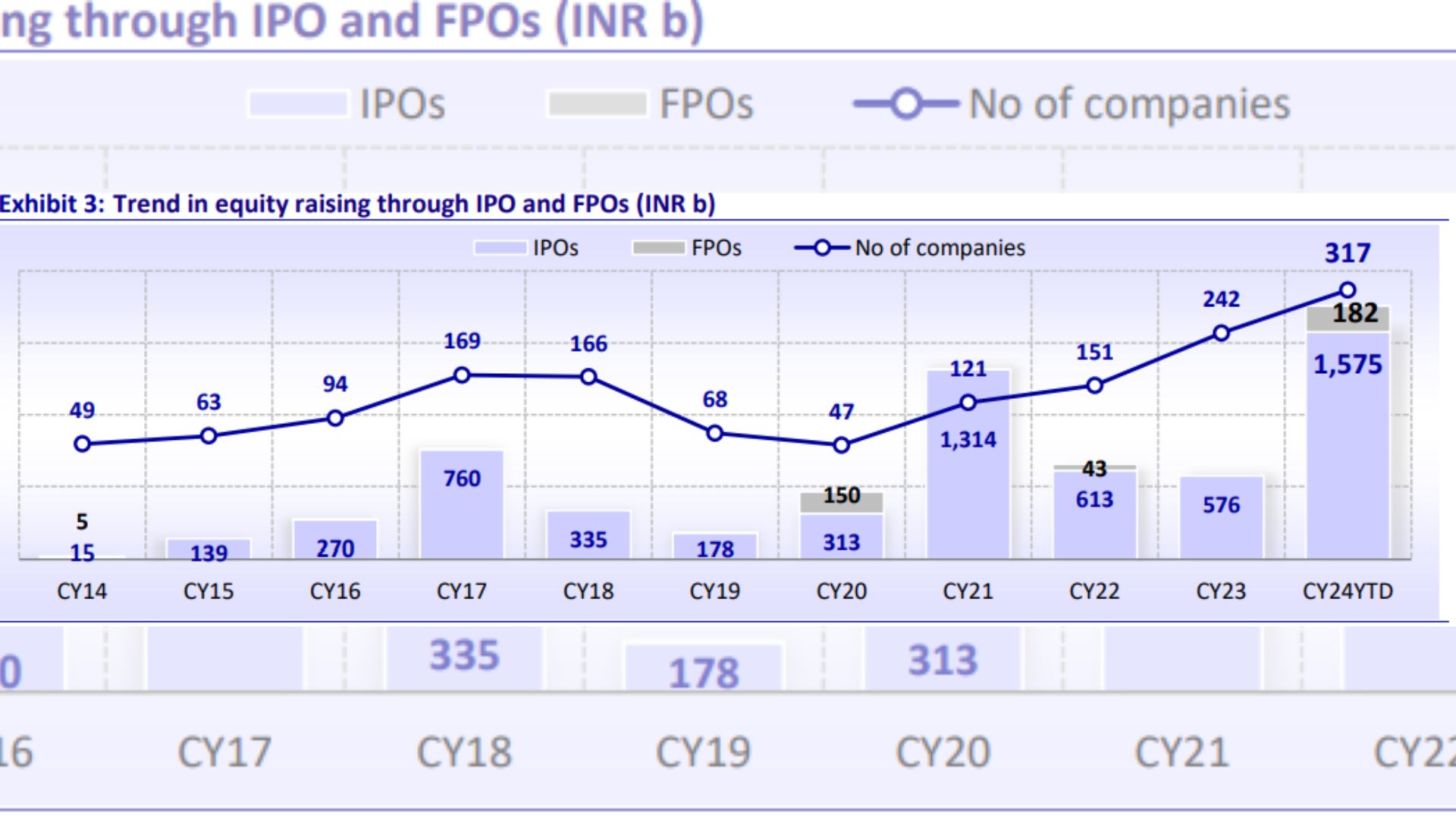

2024 Review: Indian IPO market shatters records as 317 issues raise ₹1.8 trillion

Live Mint

2024 IPOs: Ones that flew over the market's best

Hindustan Times

IPO in India hits landmark as investments soar, record Rs 1.6 lakh crore raised in 2024

India TV News

2024 Sees Record IPO Fundraising of Rs 1.8 Lakh Crore

Deccan Chronicle

Gurugram-based MSME lender Aye Finance Limited files DRHP with SEBI for ₹1,450 crore IPO

Live Mint

Upcoming IPO: Innovision files fresh DRHP with SEBI, reduces issue size to ₹255 crore. Check details

Live Mint

India IPO share sales rise to record in 2024, growing about 3-fold from last year on upbeat investor appetite

Live Mint

IPOs Ahead: Equity Markets To See Rush Of 11 Maiden Offers Including Mobikwik, Vishal Mega Mart

ABP News

Market Cap of top 6 listed companies jumps ₹2 lakh crore; TCS, HDFC Bank lead the rally

Live Mint

India’s IPO fundraising set for landmark year 2024: S&P Global Market Intelligence

Live Mint

IPOs to get larger after average size more than doubles to ₹2,000 crore this year: Kotak’s S Ramesh

Live Mint

Stock market this week: 6 new IPOs coming up along with 4 listings

Hindustan Times

IPO pipeline to remain strong; 10 companies aim to raise ₹20,000 cr in Dec

Live Mint

Upcoming IPO: BR Goyal Infrastructure gets BSE nod for SME IPO launch

Live Mint

IPO Update: Kolkata-based Crizac refiles IPO papers with SEBI

Live Mint

SME IPO Frenzy: Opportunity or bubble? 2024 sees record ₹8,200 crore raised by SME firms

Live Mint

Top 10 companies see valuation slump ₹1.55 crore, Reliance Industries biggest laggard & TCS biggest gainer

Live Mint

India accounted for 25% of global IPOs in first half of 2024

Hindustan Times

Shapoorji firm Afcons gets SEBI nod for ₹7000 crore IPO

The Hindu

IPO: Western Carriers India Sees Muted Response From Investors, Check GMP, Price Band And Other Details

ABP News

Upcoming IPO: Hexaware Tech Submits Draft Papers For Issue Worth Rs 9,950 Crore

ABP News

12 IPOs coming up next week including 8 SME IPOs to raise over $1 billion

Hindustan Times

IPO Frenzy: India’s Primary Market Soars In Aug, 10 Listings Raise Rs 17,047 Crore, Says Report

ABP News

Upcoming IPO: Shree Tirupati Balajee Offer Open For Bidding From Sep 5, Check Price Band And Details

ABP News

Indian Debt Market Remains A Favourite For FPIs As Inflow Crosses Rs 1 Lakh Crore In 2024

ABP News

Upcoming IPO: Rekha Jhunjhunwala-Backed Bazaar Style Retail Submits Papers For Maiden Offer, Check Details

ABP News

Foreign portfolio investors invest ₹26,565 crore in Indian equities in June

The Hindu

Market Capitalisation of nine of top-10 most valued firms jumps ₹2.89 lakh crore; Reliance biggest winner

The Hindu

Market capitalization of three of top-10 most valued firms rises by ₹1.06 lakh crore; HDFC Bank and ICICI Bank lead

Live Mint

Nine IPOs coming next week, 24 in total over next few months

Hindustan Times

Bajaj Housing Finance files for Rs.7000 crore IPO following RBI mandate

Hindustan Times

TCS, Infosys, SBI, ITC, HUL, ICICI Bank biggest losers, suffer ₹1.4 lakh crore loss in market capitalisation

Hindustan Times

Top 10 firms saw market value erode by ₹1.97 lakh cr; TCS, Infosys bear brunt

Hindustan Times

Jio Financial Services hits ₹2 lakh crore market cap, a 1st: What's happening

Hindustan Times

Top multibagger IPOs of 2023: These 5 IPOs gave up to 240% return this year

Live Mint

Market capitalisation of top 10 companies decreases: TCS, Infosys erode most

Live Mint

FPIs Withdraw Rs 20,300 Cr From Equities In Oct; Invests Rs 6,080 Cr In Debt

News 18

IPO fundraising slumps by 26% in H1 FY24 to ₹26,300 crore, shows data

Live Mint

Eight of top 10 firms lose Rs 2.28 lakh crore in mcap, HDFC Bank, Reliance biggest laggards

India TV News

IPO frenzy helps firms raise almost ₹12,000 cr. in September

The Hindu

Foreign Portfolio Investors Infuse Rs 45,365 Crore In Indian Markets In July

ABP News

Driven By SME IPOs, India Leads Global IPO Chart With 80 Listings Till June 2023: Report

ABP NewsDiscover Related