Farmers who go green in Natural England scheme face inheritance tax

The TelegraphThe scheme is one of several being rolled out as part of the Government’s overhaul of its £2.4 billion agricultural subsidy regime to help meet its goals to reverse nature loss by 2030 and cut carbon emissions. Tax threat holding farmers back The tax threat is stopping Mr Ruggles-Brise from converting land to scrub or wetland, which Natural England said has significant ecosystem benefits for carbon sequestration, water quality and birdlife. And this is one of the things that is standing in the way.” Removing the inheritance tax burden could spare farmers a £120 million annual tax penalty, according to analysis from the Energy and Climate Intelligence Unit, a think tank, and Strutt & Parker, a rural property consultancy firm. “Our analysis shows that the cost to the Treasury of removing this barrier to progress on nature recovery and climate change is small compared to the benefits it could unlock, including new sources of revenue for tenant farmers,” said Tom Lancaster, land analyst at ECIU. “Without it, they risk effectively excluding the quarter of all farmland that is tenanted from contributing towards the most ambitious climate and nature goals, making already stretching targets significantly harder to reach.” ECIU found that without reforms, the country would likely miss out on around 309,000 tonnes of carbon emissions savings every year, the equivalent to driving around 793 million miles in a petrol car.

History of this topic

Farm tax changes under fire in Parliament as angry farmers protest outside

The Independent

Farmers should shut up and muck in – for the greater good

The Independent

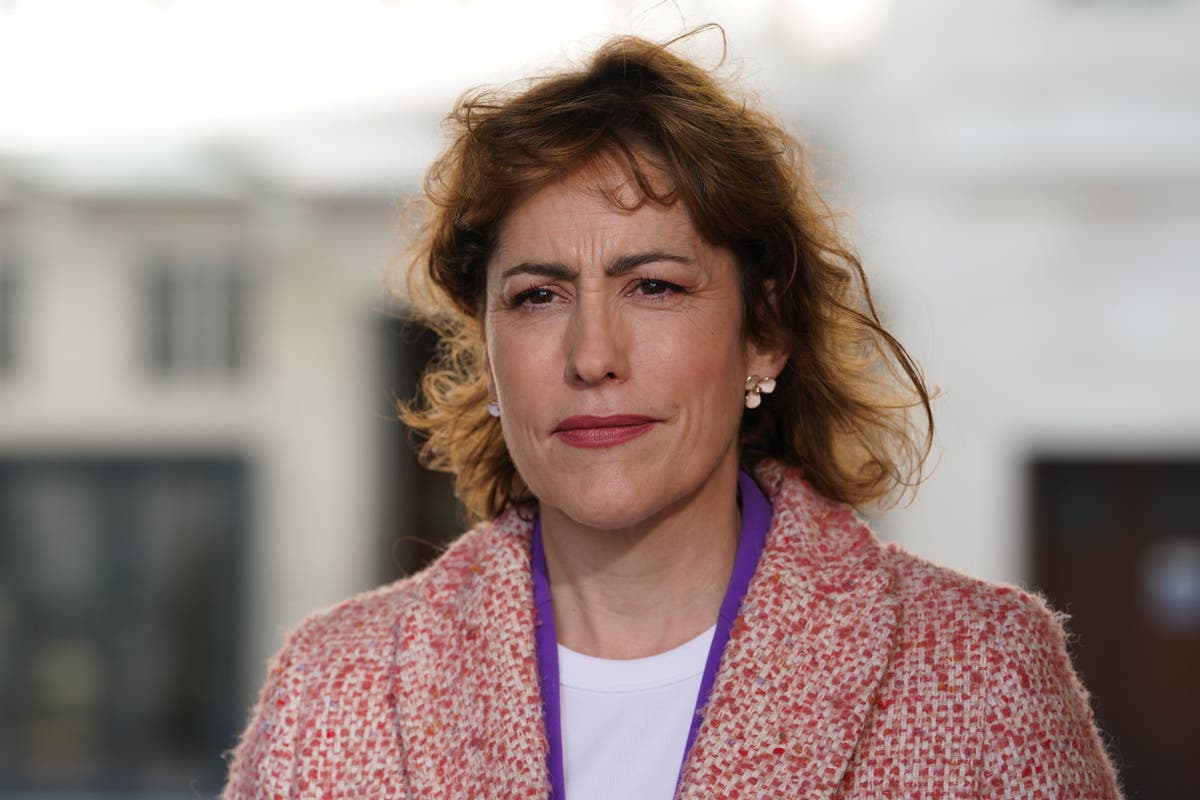

Ailbhe Rea: Farmers Descend on Westminster

Bloomberg

Farmers may never trust Labour again after inheritance tax change, say Tories

The Independent

Farmers exaggerating impact of inheritance tax raid on land, Environment Secretary suggests

The Telegraph

Labour's inheritance tax raid on family farms could turn them into 'net zero forests' used by foreign firms for carbon offsetting instead of food, landowners claim

Daily Mail

Rachel Reeves tells furious farmers it is 'fair' that they pay higher death taxes on their land amid rural anger led by Kirstie Allsopp and Jeremy Clarkson at Budget cash raid

Daily MailDiscover Related