Column: Oil firms and others face unprecedented pressure to come clean on climate change

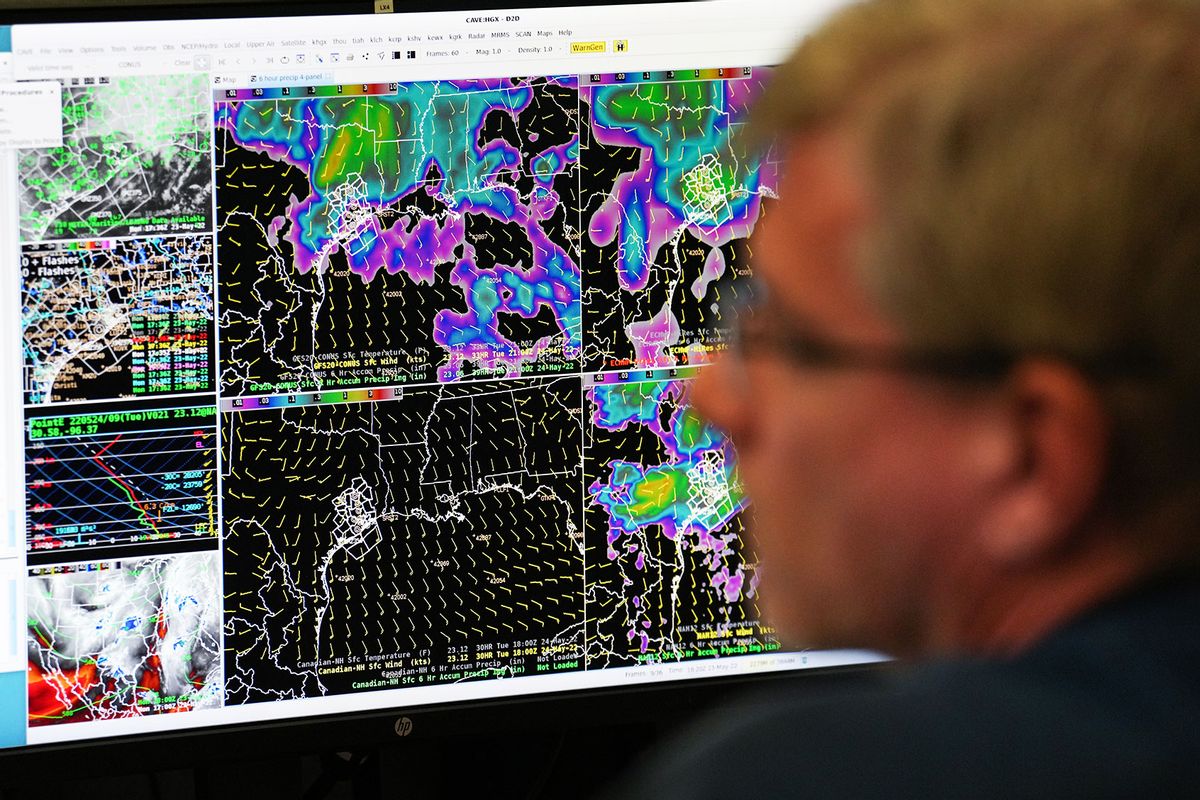

LA TimesChevron, one of the world’s leading oil companies, got a major wake-up call on climate change from its shareholders May 26. “Investors want to know how a company is preparing for a different world where there’s more regulatory change and more environmental change,” says Ann Lipton, a business law expert at Tulane University who has been tracking corporate responses to these inquiries. The guidelines observed that reportable risks could include “significant physical effects of climate change, such as effects on the severity of weather, sea levels, the arability of farmland, and water availability and quality.” The SEC’s concerns largely evaporated during the Trump administration, which was hostile to any official recognition of climate change as well as to new regulations on business. One reason investors are so interested in more information from managements is that the existing standards of corporate disclosure, based on “generally accepted accounting principles”, aren’t useful for assessing novel threats such as climate change. Clearly, the company’s shareholders remain unhappy with its direction on climate change.” Investors at Exxon Mobil took an even harder stance at that company’s annual meeting, held the same day as Chevron’s.

History of this topic

Maine Sues Major Oil Companies Over ‘Ongoing Deception’ About Climate Change

Huff Post

Column: Exxon Mobil is suing its shareholders to silence them about global warming

LA Times

Column: Bowing to business and the right wing, the SEC issues a pathetically watered-down climate disclosure rule

LA Times

Column: Voters, like investors, have had it with GOP extremism

LA TimesCalifornia lawsuit says oil giants deceived public on climate, seeks funds for storm damage

Associated Press

The laws that took down mobsters are now being turned against Big Oil

Raw Story

Greenwashing is the new climate misinformation battleground

Live Mint

New corporate climate change disclosures proposed by SEC

Associated Press

House panel plans to subpoena oil companies as executives are grilled on climate disinformation

LA Times

Democrats call oil giants to testify on climate campaign

Associated Press

Exxon Lobbyist Caught On Video Talking About Undermining Biden's Climate Push

NPR

Climate Activists Get Renewed Victory After Third Member Elected To Exxon’s Board

Huff Post

Activist investor ousts at least two Exxon directors in historic win for pro-climate campaign

CNN

Exxon uses Big Tobacco’s playbook to downplay the climate crisis, Harvard study finds

CNN

Oil company ads should carry a climate health warning, say activists

CNNDiscover Related

)

)

)

)