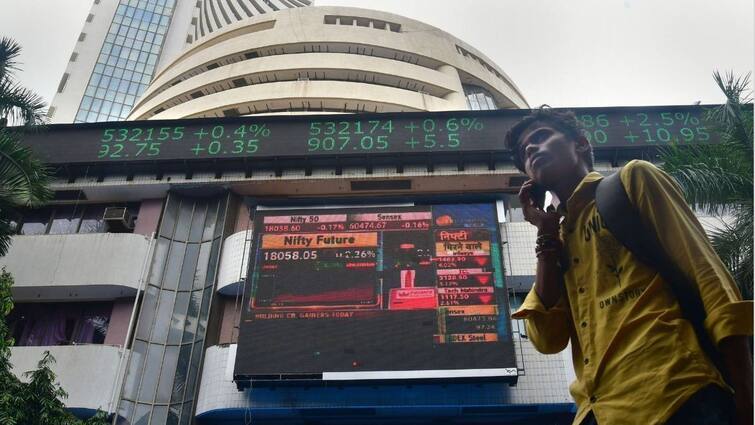

As foreign funds flee amid uncertainty, domestic investors seize the Nifty dip

Live MintAfter a year of stellar returns, the Nifty 50’s \momentum appears to be losing steam, with gains tapering off over the past week. On Monday, as the benchmark Nifty 50 fell nearly 2%, DIIs stepped in with net purchases of ₹2,936 crore, while foreign institutional investors sold ₹4,330 crore in Indian equities. In October, DIIs purchased ₹104,876 crore in Indian equities, marking their highest monthly inflow since 2017, while FIIs net sold ₹87,590.11 crore of Indian shares. Jiten Doshi, co-founder and chief investment officer at Enam AMC, said DIIs are, by default, heavy on Indian equities and are “long-term investors with near-predictable inflows visibility in the short term". While valuations have moved up, Indian equities continue to remain exciting due to their long-term growth prospects, said Hari Shyamsunder, vice president and institutional portfolio manager–emerging markets equity India, at Franklin Templeton.

History of this topic

Nifty at 26,000? Citigroup sees 10% upside for Indian stocks in 2025; here’s why

Live Mint

FPIs to remain cautious on India until clarity comes on Q3 FY25 earnings: Report

Live Mint

Nifty, Sensex continue to decline on Wednesday as market seeing continuous selling by FIIs

Live Mint

Indian equity benchmarks set to open little changed

Live Mint

Nifty, Sensex open higher in 2nd session of 2025, result season starts next week

Live Mint

Intraday stocks for today under ₹100: Experts recommend four shares to buy today — 2 January 2025

Live Mint

FPIs pump ₹1.65 lakh cr in Indian markets, equity inflows plunge 99% to ₹427 cr in 2024: What lies ahead in 2025?

Live Mint

Indian shares set for marginal gains to start the new year

Live Mint

Intraday stocks under ₹100: Experts pick five shares to buy today—January 1, 2025

Live Mint

Sensex and Nifty in 2025: Will Dalal Street's turbulent run continue?

India Today

Buy or sell: Ganesh Dongre of Anand Rathi recommends three stocks to buy on Monday - 30 December

Live Mint

Week Ahead: Auto sales, Q3 updates, FII flow, global cues among key market triggers for Nifty in new-year week

Live Mint

Indian shares set to open higher as investors await earnings season

Hindustan Times

Indian shares set to open higher

Live Mint

Buy or sell: Ganesh Dongre of Anand Rathi picks three stocks to buy on Monday - 23 December

Live MintMarkets decline in early trade amid unabated foreign fund outflows

The Hindu

Stock Market Today: Sensex Plummet 400 Points, Nifty Below 23,850

ABP News

Nifty 50, Sensex today: What to expect from Indian stock market on December 19 after US Fed predicts fewer cuts ahead

Live Mint

Market falls sharply as Fed indicates low interest rate cut in 2025

New Indian Express

Sensex, Nifty open lower as cautious investors weigh global trends

India Today

Sensex, Nifty down 1.3% as weak rupee spark FPI selling

Live Mint

Shares to buy: Riyank Arora of Mehta Equities suggests these four stocks to buy in short term

Live Mint

Technical Picks: Nagaraj Shetti of HDFC Securities suggests these two stocks to buy this week

Live Mint

Stocks to buy: Two stock recommendations from MarketSmith India for 16 December

Live Mint

Buy or sell: Ganesh Dongre recommends three stocks to buy on Monday — December 16

Live Mint

FPIs pump ₹22,766 crore in Indian equities; Will the inflows continue in December? Experts weigh in

Live Mint

Market sees sharpest swing in 6 months before closing in green

Live Mint

Sensex Nifty recovery: Strong comeback amid easing inflation, buying in telecom stocks

The Hindu

Stock market today: Nifty 50, Sensex jump 1% each; midcaps, smallcaps underperform

Live Mint

Will Nifty 50 breach 25,000 level in December? Technical experts unveil year-end target and trading strategy

Live Mint

Intraday stocks for today under ₹100: Experts pick seven shares to buy today — Dec 12

Live Mint

Sensex, Nifty swing between high, lows in volatile trade ahead of U.S. inflation data

The Hindu

Stock market today: Trade setup for Nifty 50 to global markets; 5 stocks to buy or sell on Wednesday — Dec 11

Live Mint

Buy or sell: Ganesh Dongre recommends three stocks to buy on Monday — December 9

Live Mint

Stock Market Today: Sensex Down About 100 Points, Nifty At 24,400 Ahead Of RBI MPC Announcements

ABP News

Breakout stocks to buy or sell: Sumeet Bagadia recommends five shares to buy today - Dec 5

Live Mint

Sensex, Nifty rebound sharply: 3 factors behind stock market rally

India Today

Shares to buy: Riyank Arora of Mehta Equities suggests these four stocks to buy in short term

Live Mint

Share Market Today: Sensex Gains 490 Points; Nifty Above 24,400. Adani Ports Jump 4%

ABP News

FPIs end 3-day buying run with ₹11,756 crore sell-off; Nov outflows hit ₹41,300 crore

Live Mint

Sensex, Nifty 50 rebound a day after stock market crash. Experts unveil this investment strategy amid volatility

Live Mint

Indian shares set to open higher after steepest decline in two months

Live Mint

Heavy FII selling, derivatives expiry torpedo relief rally

Live Mint

Share Market Today: Sensex Sheds 700 Points; Nifty Below 24,100. IT, Auto Drag

ABP News)

Sensex, Nifty jump over 1.3%, providing relief after weeks of foreign investor-led sell-off

Firstpost

₹1.5 lakh crore offloaded since Oct! Will FIIs return to Indian stock market anytime soon? Experts weigh in

Live Mint

Stock Market Today: Sensex, Nifty 50 rally 1% each on Maharashtra poll outcome; investors mint ₹7 lakh crore

Live Mint

Stock market outlook: Can Nifty 50 reclaim 25,000 this month amid ’Maha’ rally on D-Street?

Live Mint

Stock market today: Investors mint ₹5.65 lakh crore as Nifty 50, Sensex rebound. What happens next?

Live Mint

Indian shares set for a muted start

Live MintDiscover Related