Inevitable increase: The Hindu Editorial on RBI’s interest rate hike

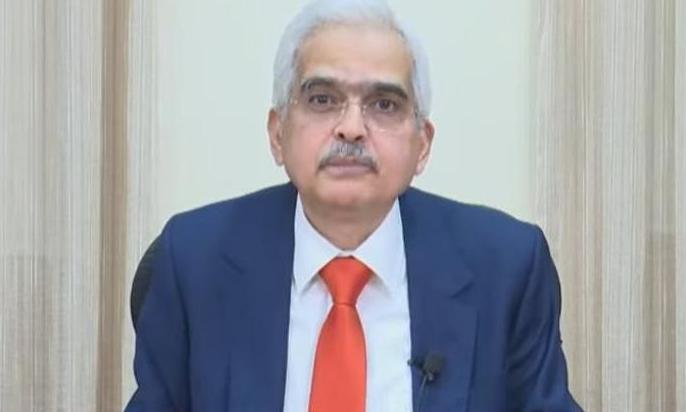

The HinduThe penny has dropped. After stubbornly holding off from acting to tame inflation, which has steadily eroded consumers’ purchasing power and derailed broader economic momentum, the RBI’s rate setting panel on Wednesday announced an ‘off-cycle’ increase in benchmark interest rates. RBI Governor Shaktikanta Das rationalised that letting inflation remain elevated at current levels for too long risked ‘de-anchoring inflation expectations’ and consequently hurting growth and financial stability. The IMF last month posited that the war in Ukraine was poised to not only slow global growth in 2022 but would also cause inflation to accelerate by 2.6 percentage points to 5.7% in advanced economies this year, and spur a more appreciable quickening of 2.8 percentage points in the case of emerging market and developing economies. With central banks in advanced economies led by the U.S. Federal Reserve pursuing a path of policy normalisation, the prospects of volatility in capital flows adding pressure on the exchange rate and consequently heightening the risks of imported inflation have also surely queered the pitch for the RBI.

History of this topic

RBI’s monetary policy panel divided over timing of rate action

Live Mint

Vivek Kaul: RBI’s new governor will have to confront a tricky old trilemma

Live Mint

RBI May Begin Shallow Rate Cut Cycle From Feb Amid Global Turmoil

Deccan Chronicle

Growth slowdown: Why lay a deeper economic malaise at RBI’s door?

Live Mint

Why RBI is central to the country’s economy

New Indian Express

Mint Quick Edit: Lower inflation raises the likelihood of an RBI rate cut

Live Mint

DC Edit | FM, new RBI chief signal cut

Deccan Chronicle

Retail inflation slows slightly at 5.48%

Hindustan Times

Retail inflation eases to 5.48% in November from above 6% in October

India Today

Inflation likely eased to 5.5% in November: Mint poll

Live Mint

DC Edit | Will RBI tweak inflation focus?

Deccan Chronicle

Shaktikanta Das's term ends amid rising inflation, GDP slowdown

Live Mint

Staying the course: On the RBI and inflation

The Hindu

Stalled demand, sluggish growth

Hindustan Times

RBI monetary policy decision: Is an RBI rate cut coming after Union Budget 2025? What experts suggest

Live Mint

RBI cuts GDP growth projection to 6.6%, repo rate unchanged at 6.5%

Deccan Chronicle

RBI monetary policy: MPC projects FY25 inflation at 4.8%

Live Mint)

RBI monetary policy: Repo rate to remain unchanged at 6.5%, says Shaktikanta Das

Firstpost

Amid high inflation, RBI keeps repo rate unchanged at 6.5%

The Hindu

RBI to Announce Interest Rate Decision Amid High Inflation

Deccan Chronicle

RBI monetary policy meeting: Will governor Shaktikanta Das announce a rate cut? What to expect?

Hindustan Times

RBI MPC verdict today: Repo rate to GDP, inflation forecasts— here are 5 key indicators to watch

Live Mint

RBI keeps interest rate unchanged at 6.5%, lowers GDP projection to 6.6%, cuts CRR to 4%

New Indian Express

RBI MPC announcement: Will RBI Governor Shaktikanta Das cut key lending rates?

India Today

RBI keeps repo rate unchanged for 11th time in a row at 6.5 per cent

India TV News

RBI must restore balance between inflation, growth

New Indian Express

RBI keeps key lending rate unchanged at 6.5%, focus remains on tackling inflation

India Today

RBI cuts growth forecast to 6.6 per cent, revises inflation estimate to 4.8 per cent for FY25

India TV News

RBI must restore balance between inflation, growth

New Indian Express

RBI MPC Meeting: What happens if the central bank cuts interest rates tomorrow? D-Street experts weigh in

Live Mint

RBI MPC meet: Growth needs a boost, but will inflation hold back rate cut?

India Today

Monetary policy review: RBI should stick to its price stability mandate

Live Mint

RBI MPC: FX, not inflation, curbing degrees of policy freedom

Live Mint

Is MPC doing enough on inflation? Consumers are divided

Live Mint

India rates market signals easing, likely via liquidity, after weak growth data

Live Mint

From RBI policy to pre-budget rally - experts highlight 3 near-term key triggers for Indian stock market

Live Mint

Will RBI cut key interest rates on December 6? 3 things to know

India Today

RBI to keep repo rate unchanged at meeting next week, chances of rate cut in Feb increased: Report

Live Mint

RBI Likely To Hold Interest Rates Amid Inflation Surge; Economists Push Rate Cut Forecast To February

ABP News

Stable Inflation Is Bedrock for Sustained Growth Says RBI Gov

Deccan Chronicle

Why Nirmala Sitharaman, Piyush Goyal would like RBI to slash interest rates

India Today

Nirmala Sitharaman calls for 'affordable' interest rates after Piyush Goyal

India Today

Inflation behaving more like a magician who tricks you again and again

New Indian Express

Piyush Goyal wants RBI to cut interest rates. Shaktikanta Das responds

India Today

DC Edit | RBI may have to defer rate cut

Deccan Chronicle

‘Absolutely flawed…’: RBI should boost growth with rate cut, says Union Minister Piyush Goyal; Governor Das responds

Live Mint

India trade minister says central bank should cut rates, look through food prices

Live Mint

October inflation wipes off rate cut hopes in Dec policy

Deccan Chronicle

Rising inflation clouds stock market sentiment, delays rate cut hopes; Earnings growth in focus, say analysts

Live Mint

Mint Quick Edit | Inflation above 6%: There goes a December rate cut

Live MintDiscover Related

)