Budget 2025: Simplified capital gains tax, enhanced benefits on investors’ budget wish list

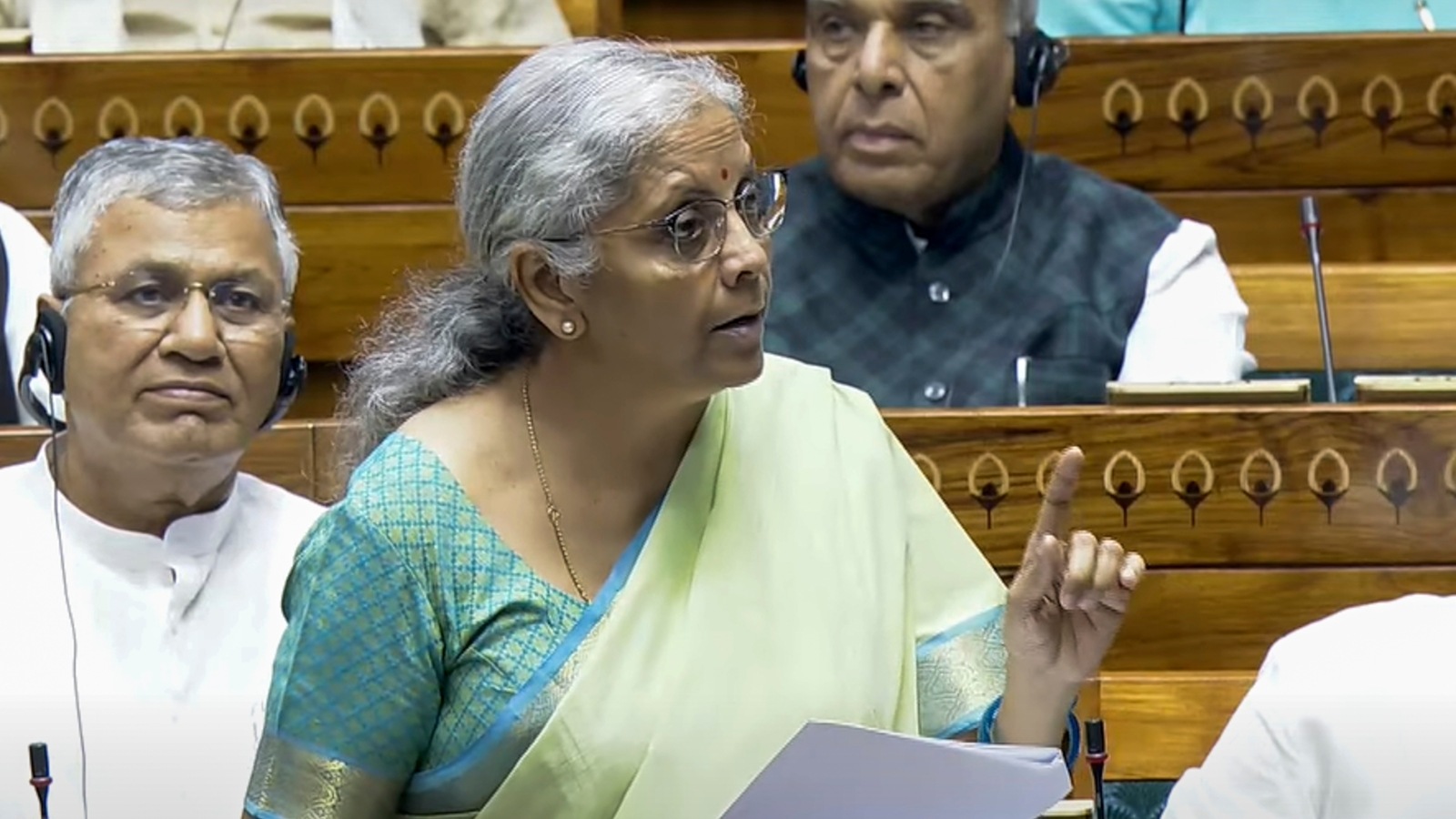

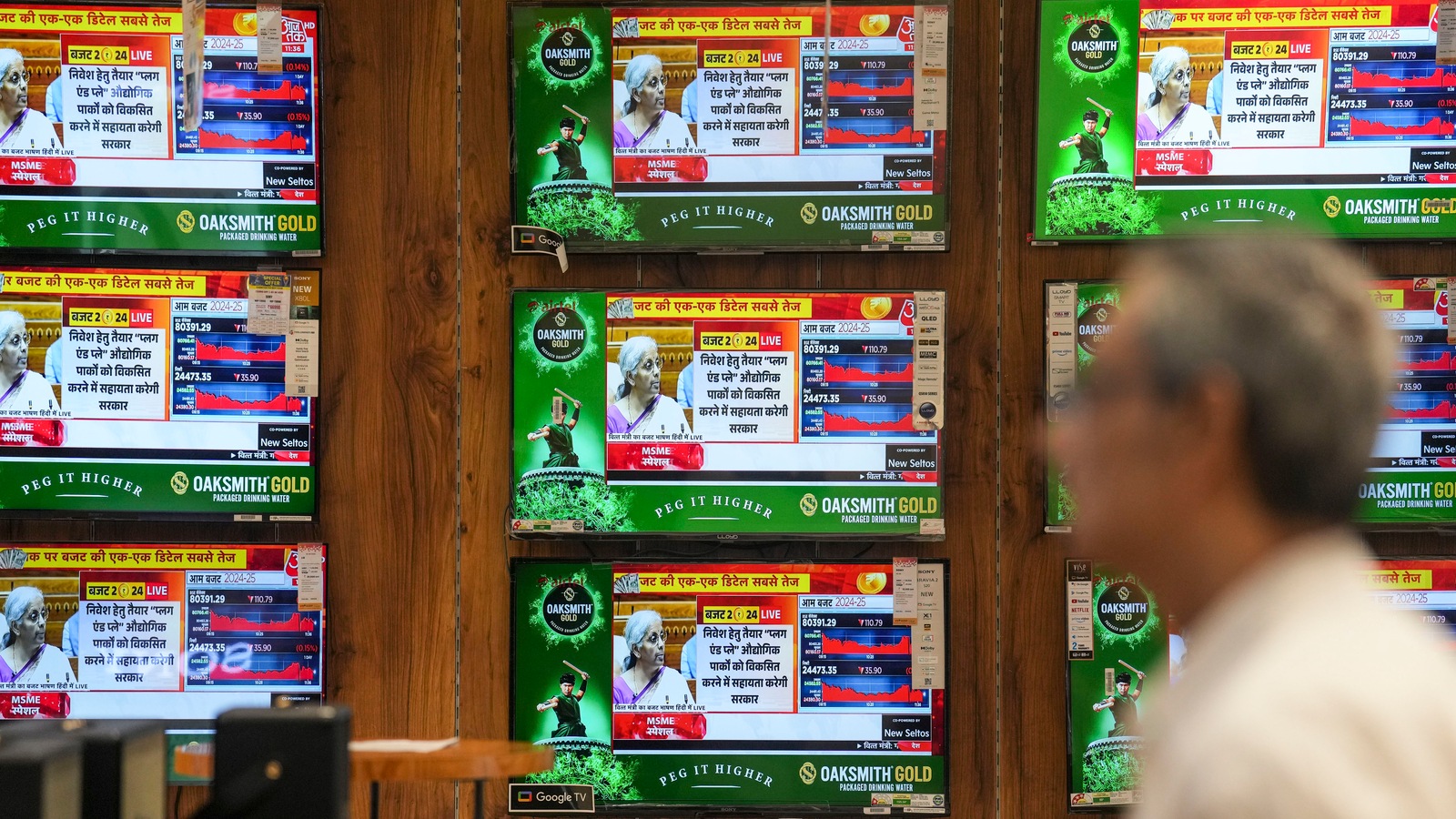

Live MintBudget 2024 eliminated indexation advantages and rationalized capital gains tax on several products. Union Budget 2025 wish list Streamlining the capital gains tax is still a major priority as the Union Budget 2025 draws near. “Some of the key demands for the rationalization of capital gains tax include lowering tax rates on long-term capital gains, revising the thresholds for LTCG tax, enhancing indexation benefits, increasing threshold limits of deductions like 54, 54F, etc., and other similar measures,” said Sofiya Syed, Direct Tax Division, Dewan P.N. While it's uncertain if FM Sitharaman will concede fully to the demands of capital gains tax rationalization, the market continues to expect some changes that could benefit long-term investors, added Sofiya Syed. For instance, to streamline the capital gains tax structure by aligning tax rates/ period of holding across various sub-asset classes, for instance, treating international equities the same as domestic equities, debt funds the same as gold funds, and gold funds the same as gold ETFs.The hike in short-term rates from 15% to 20% and in long-term rates from 10% to 12.5% has raised investor tax liabilities significantly.

History of this topic

Budget 2025: Don't expect these tax changes

India Today

Budget 2025: Higher exemption limit and lower tax rates? Check top expectations

India Today

Budget 2025: Easier ITR filing and tax dispute reduction expected, says report

India Today

Budget 2025: 5 reforms that could make new tax regime a better deal for you

India Today

Budget 2025: Will Nirmala Sitharaman address TDS-TCS challenges?

India Today)

Yearender: From NPS Vatsalya to higher standard deduction, 5 money rules that changed in 2024

Firstpost

Income tax rule: Ten key changes in 2024 that will impact your ITR filing in 2025

Live Mint

Budget 2025: When was the last major income tax relief given?

India Today

Can you expect major income tax changes in Budget 2025? Check details

India Today

FM Nirmala Sitharaman announces amendment to LTCG tax proposal, offers new options

Hindustan Times

India's FY25 Budget Simplifies Capital Gains Tax

Deccan Chronicle

Changes in long-term capital gain tax to benefit most real estate investors: Revenue Secy

Hindustan Times

Budget 2024: Taxation related to capital gains in equity market transactions will affect you— THIS is how

Live Mint

Budget 2024 | STT hike to curb excessive speculation in F&O market: Sunil Damania of MojoPMS

Live Mint

Budget 2024: How will capital gains tax tweaks impact taxpayers? Beneficial, says I-T department. Here's the math

Live Mint

Budget 2024 has laudable goals but misses a few tricks

Live Mint

2001: The year that divides property sellers under new Budget tax rules

Hindustan Times

Budget 2024: Stocks wobble on capital gain tax plan

The Hindu

Watch: Budget 2024 | What’s in it for markets and investors?

The Hindu

Budget 2024: A case for HNIs to revise investment portfolios

Live Mint

Budget 2024: Capital gains taxes hiked, indexation benefit discontinued for property sale

Hindustan Times

Budget: Centre proposes to increase STT, capital gains tax

Hindustan Times

Union Budget 2024 India: Sensex, Nifty Take Big Hit As Govt Hikes Capital Gains Tax

ABP News

Budget 2024 Capital Gains taxation: Corporate tax for foreign companies slashed to 35%, charities, cruise operations taxation revised

The Hindu

Budget 2024 announcements on new tax regime: Standard deduction increased, check new tax slabs

India TV News

Budget 2024: Selling old property to attract more tax. Here's why

India Today

Big change in capital gains tax, LTCG increased to 12.5%. Check details

India Today

Union Budget 2024: How will the stock market react to capital gains tax changes in the budget?

Hindustan Times

Jefferies' Chris Wood on Budget 2024: India should have no capital gains tax

Hindustan Times

Crypto Tax In India: The Current State & How Union Budget 2024 Can Help

ABP News

CII Budget Wishlist: Revised Tax Returns Deadline Extension, Urges Capital Gains Overhaul

News 18

Budget 2023: Will FM Sitharaman revise the long-term pending income tax exemptions limit?

India TV News

Budget 2023: Why investors wish for easing in long term capital gains?

Live Mint

ICYMI: The history of capital gains tax in India

Live Mint

Budget 2022: 8 key tax-related expectations

India Today

India Budget 2022: What analysts expect from FM Nirmala Sitharaman

Live Mint

Union Budget 2022-23: Why salaried class may not get big income tax relief

India Today)

Capital Gains to Increase in Spending Power, Here's What the Common Man Expects from Budget 2021

News 18

Budget 2021: Yes Securities expects income tax benefit u/s 80C at ₹2.5 lakh

Live Mint)

Budget 2020: Finance Minister Nirmala Sitharaman must consider announcement of implementation of proposed Direct Tax Code

Firstpost

Finance ministry looks to widen tax base in FY21 budget

Live Mint

Budget 2019: Tax on capital gains may continue this year, rise from 10% unlikely

India Today)

Budget 2019: Industry wants clarity in e-KYC norms, rationalisation in GST and increase in tax deduction limits

Firstpost

IPOs, FPOs, ESoPs exempt from STT for availing concessional LTCG tax

Live MintDiscover Related

)

)