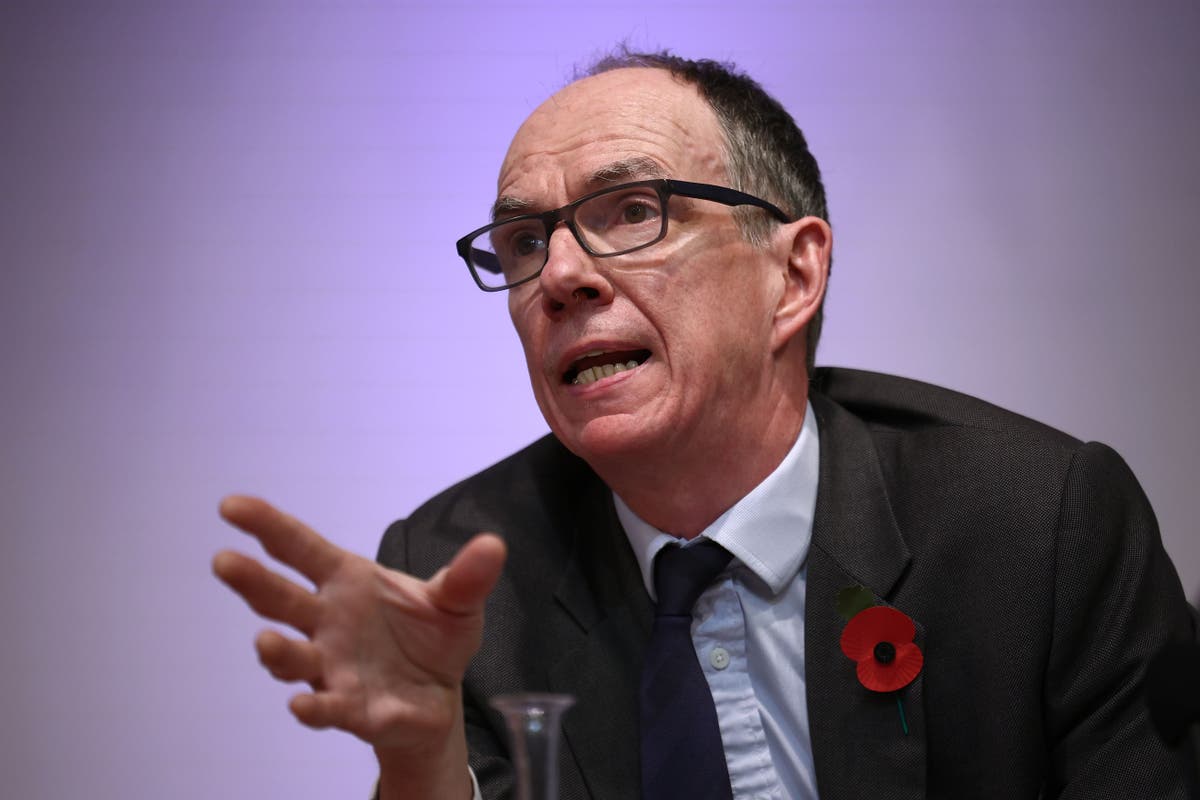

Government borrowing binge undermining faith in OBR forecasts, says IFS

The TelegraphToo much government borrowing is undermining faith in official economic forecasts, the Institute for Fiscal Studies has warned. The think tank said a raft of unexpected and expensive policies rolled out by recent Chancellors had led to a surge in the size of the state and fuelled Britain’s deficit, while also making forecasts less accurate. The result is a “ratchet” of higher borrowing and a larger state, the economists said, as they predicted a further hike in the deficit beyond recent forecast from the Office for Budget Responsibility. The IFS said: “Government borrowing in 2027–28 should be 1.4pc of GDP higher than under the OBR’s central forecast.” If Chancellors had responded equally to good and bad news on finances, debt at the start of the pandemic could have been as much as 11pc lower than it is now, the IFS said.

History of this topic

Interest on national debt tops £100bn a year as a result of Labour's Budget borrowing binge

Daily Mail

Government borrowing costs rise further after Budget

The Independent

UK economic growth upgraded this year amid ‘temporary boost’ from spending

The Independent

Britain’s choice: spiralling debt, £40bn in spending cuts or tax rises every 10 years

The Telegraph

Worst debt burden since 1950s makes huge tax raid inevitable, warns IFS

The Telegraph

Rise in debt costs could dash Budget tax cut hope

Daily Mail

New UK leader to face highest government debt in 60 years

Associated Press

Rees-Mogg suggests Chancellor could ignore OBR forecasts

The Independent

Interest bill for UK's £2.4tn debt mountain more than DOUBLES to record £19.4bn in June

Daily Mail

Interest on government borrowing jumps to December record amid soaring inflation

The Independent

Borrowing cheer to prove short-lived for Chancellor, warns think tank

The Independent

Government borrows more than a billion pounds PER DAY during coronavirus crisis

Daily Mail)

British Public Debt Tops 2 Trillion Pounds for First Time Due to Covid-19

News 18Discover Related

)