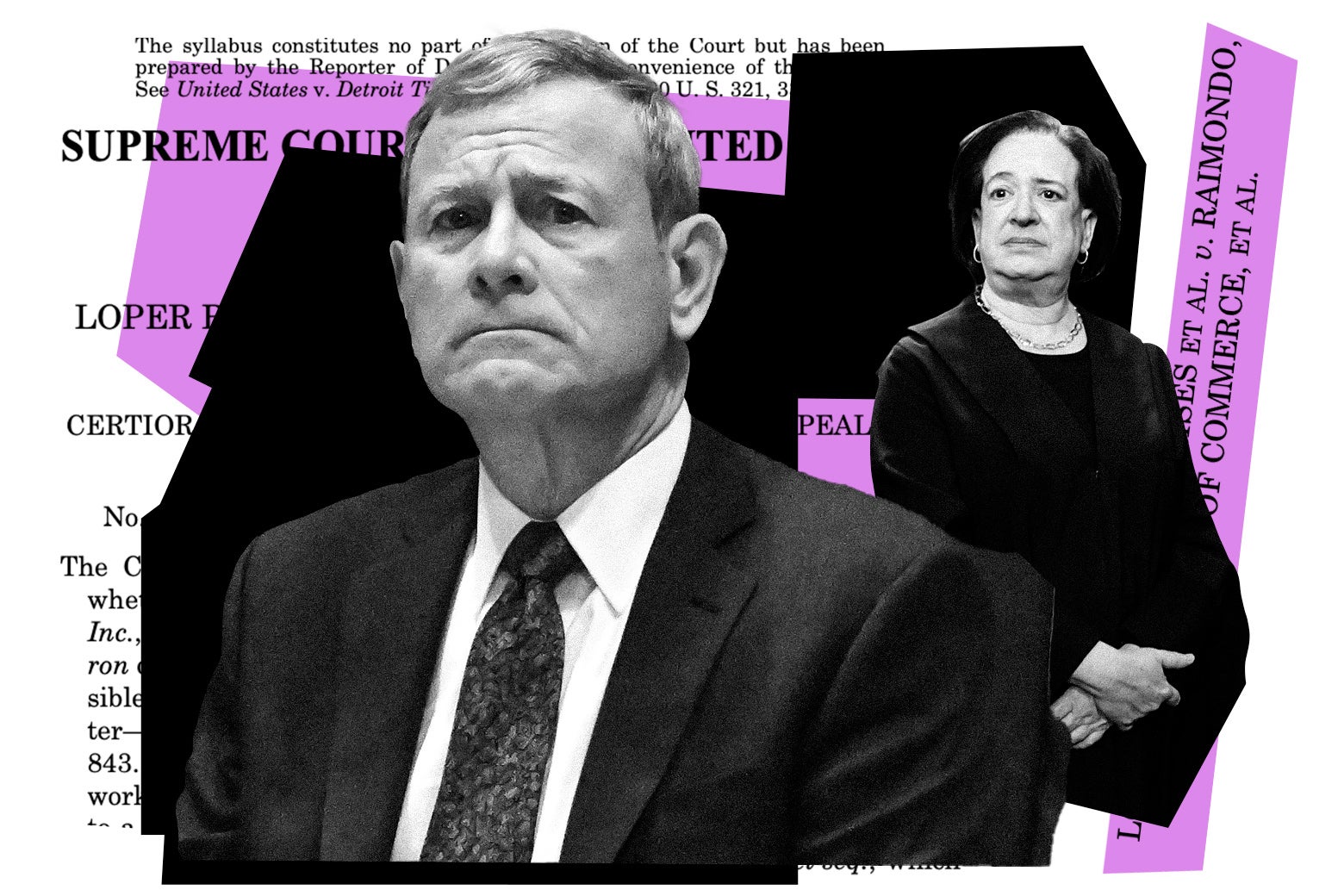

Supreme Court upholds a tax on corporate wealth held overseas

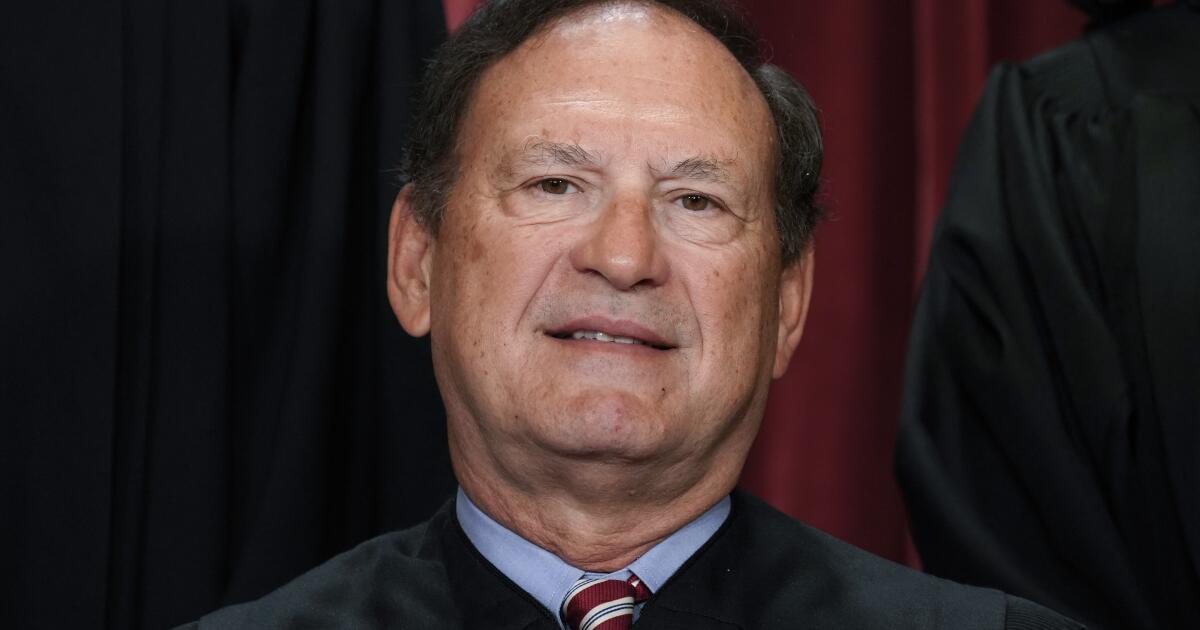

LA TimesSome had called for Justice Samuel A. Alito Jr. to recuse himself after a lawyer involved in the corporate wealth case interviewed him for articles published in the Wall Street Journal. In a 7-2 decision, the justices said Congress has the power to tax corporate shareholders based on the company’s “undistributed income.” “This court has long upheld taxes of that kind, and we do the same today,” said Justice Brett M. Kavanaugh for the court. The case came to the court as a test of whether the conservative majority would put constitutional limits on “wealth taxes.” Instead, the justices upheld an income tax that is not based on annual dividends. “Today’s decision will allow Congress to continue to exercise its power to tax income to fund the government and to make sure that all taxpayers — including multinational corporations and wealthy taxpayers — pay their fair share,” said Chye-Ching Huang, executive director of the Tax Law Center at NYU Law. “The court makes clear it is not opening the door to a wealth tax, which would still face constitutional problems as a tax on property,” said Joe Bishop-Henchman of the National Taxpayers Union.

History of this topic

Sam Alito and Brett Kavanaugh left door open to tax super rich in latest ruling: expert

Raw Story

Supreme Court Rejects Attack On Wealth Tax

Huff Post

Column: How the Supreme Court could kill a wealth tax before it’s been tried

LA Times

The Supreme Court’s Next Big Tax Case Demands Clarence Thomas’ Recusal

Slate

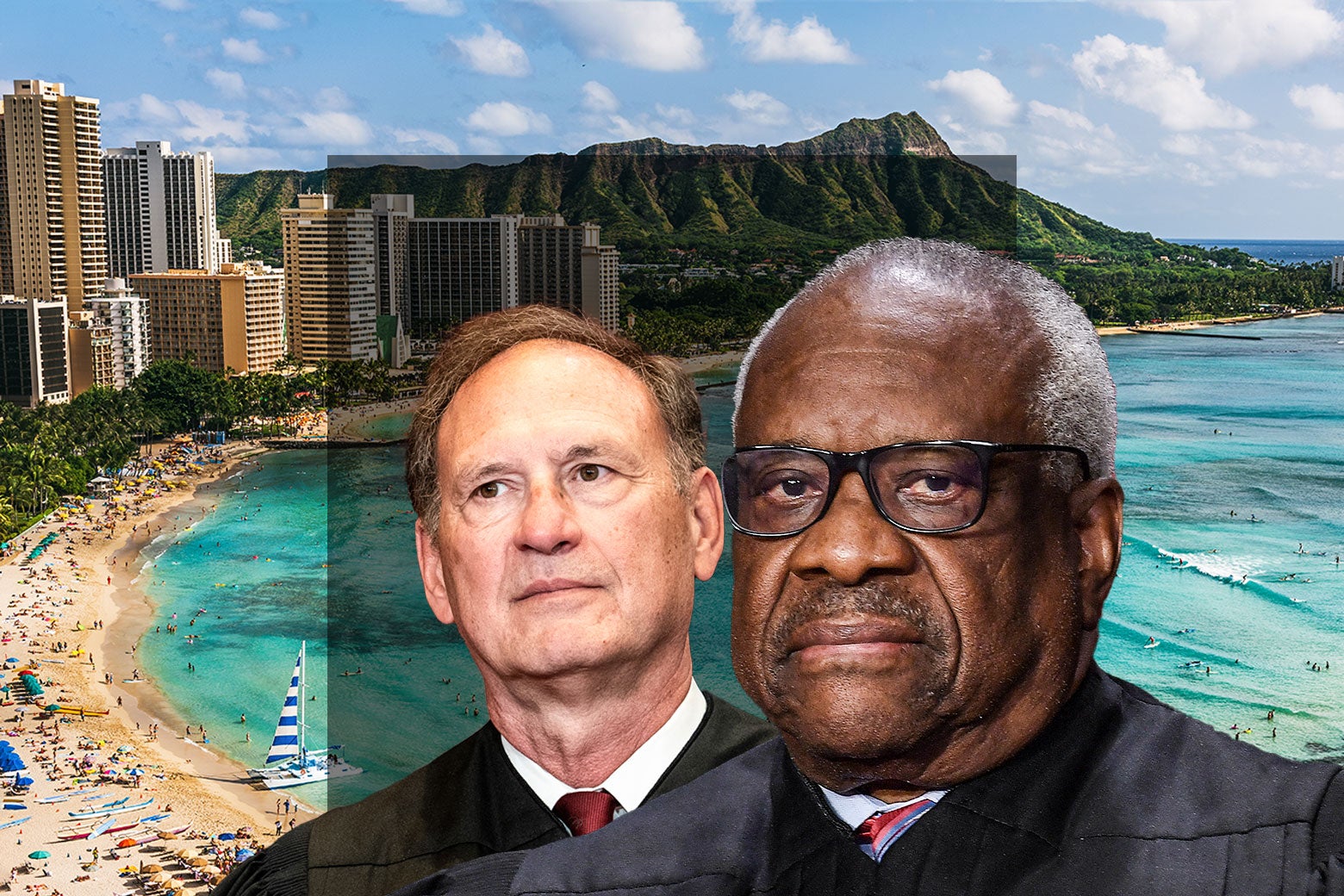

Alito urged to recuse from case that could preemptively ban federal wealth tax

Raw Story

US top judge temporarily halts push to obtain Trump’s tax records

Al JazeeraDiscover Related