RBI likely to keep interest rate unchanged as inflation still high: Experts

India TV NewsThe Reserve Bank is likely to maintain status quo on policy rates for the fourth time in a row at its bi-monthly monetary policy review meeting early next month, as retail inflation continues to remain high and the US Federal Reserve has decided to keep a hawkish stance for some more time, according to experts. The Reserve Bank had raised the benchmark repo rate to 6.5 per cent on February 8, 2023 and since then it has retained the rates at the same level in view of the stubbornly high retail inflation and certain global factors including elevated crude oil prices in the international market. The Reserve Bank has projected CPI inflation at 5.4 per cent for 2023-24, with Q2 at 6.2 per cent, Q3 at 5.7 per cent and Q4 at 5.2 per cent, with risks evenly balanced. On his expectations from the next bi-monthly monetary policy, Sanjay Bhutani, Director, Medical Technology Association of India said the RBI has gone along with the market sentiment of retaining the benchmark interest rate at 6.5 per cent for quite some time now.

History of this topic

Vivek Kaul: RBI’s new governor will have to confront a tricky old trilemma

Live Mint

Why RBI is central to the country’s economy

New Indian Express

DC Edit | FM, new RBI chief signal cut

Deccan Chronicle

Retail inflation eases to 5.48% in November from above 6% in October

India Today

Inflation likely eased to 5.5% in November: Mint poll

Live Mint

Sanjay Malhotra takes charge as RBI Governor

Deccan Chronicle

Sanjay Malhotra to assume office as 26th RBI Governor amid inflation concerns today

India TV News

DC Edit | Will RBI tweak inflation focus?

Deccan Chronicle

What challenges await Sanjay Malhotra as he takes charge as RBI Governor?

India Today

New Challenges for New RBI Governor

Deccan Chronicle

New RBI guv must keep macro picture in sight

Hindustan Times

Five of MPC's six members may soon be new

Live Mint

Sanjay Malhotra's focus as RBI Governor: 3 key areas to watch out for

India Today

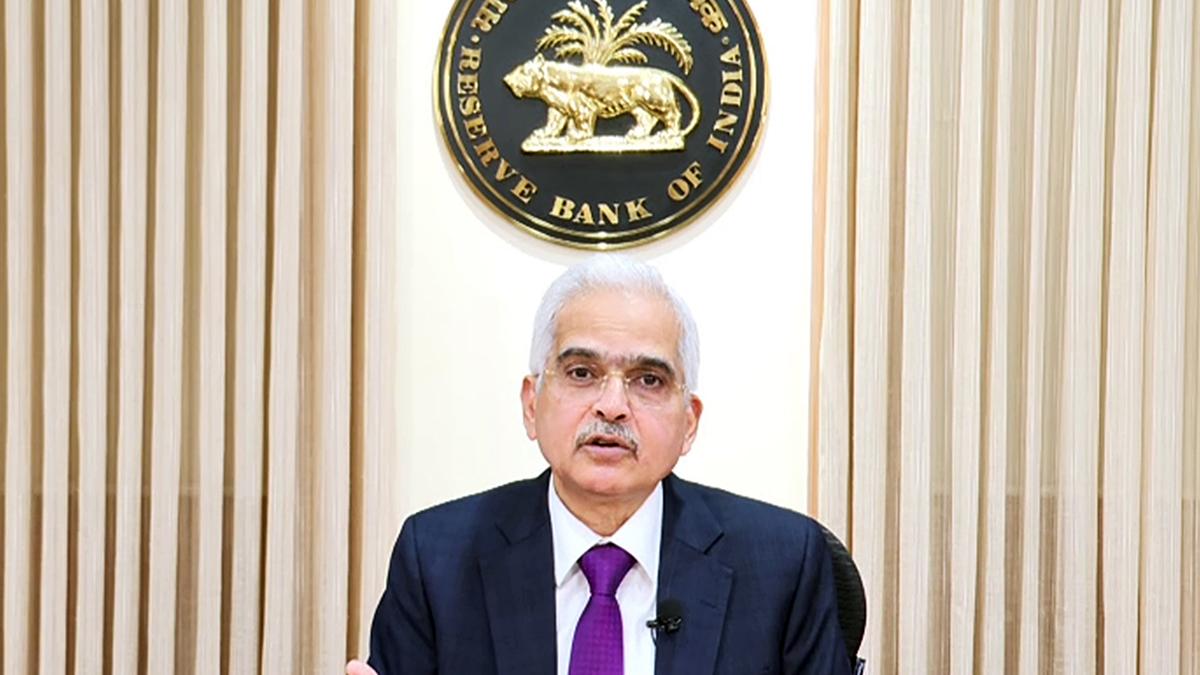

Immensely grateful: Shaktikanta Das thanks PM Modi on last day as RBI Governor

India Today

Sanjay Malhotra to command last leg of RBI’s war on inflation

Live Mint

Staying the course: On the RBI and inflation

The Hindu

DC Edit | RBI still cautious, but cuts CRR

Deccan Chronicle

RBI MPC meeting: Repo rate unchanged. What are other key takeaways? 10 points

Hindustan Times

RBI monetary policy: MPC projects FY25 inflation at 4.8%

Live Mint)

RBI monetary policy: Repo rate to remain unchanged at 6.5%, says Shaktikanta Das

Firstpost

Amid high inflation, RBI keeps repo rate unchanged at 6.5%

The Hindu

RBI to Announce Interest Rate Decision Amid High Inflation

Deccan Chronicle

RBI monetary policy meeting: Will governor Shaktikanta Das announce a rate cut? What to expect?

Hindustan Times

RBI keeps repo rate unchanged for 11th time in a row at 6.5 per cent

India TV News

RBI keeps key lending rate unchanged at 6.5%, focus remains on tackling inflation

India Today

RBI cuts growth forecast to 6.6 per cent, revises inflation estimate to 4.8 per cent for FY25

India TV News

RBI MPC Meeting: What happens if the central bank cuts interest rates tomorrow? D-Street experts weigh in

Live Mint

RBI MPC Meeting: When and where to watch Governor Shaktikanta Das’ policy announcement

Live Mint

RBI MPC meet: Growth needs a boost, but will inflation hold back rate cut?

India Today

Monetary policy review: RBI should stick to its price stability mandate

Live Mint

RBI MPC to start today: Will there be a rate cut? 3 things to know

India Today

RBI MPC Dec Meet: When And Where To Watch The Committee's Final Decision On Key Interest Rates?

ABP News

RBI MPC: FX, not inflation, curbing degrees of policy freedom

Live Mint

Is MPC doing enough on inflation? Consumers are divided

Live Mint

MPC to keep rates unchanged amid slowing growth, rising inflation

Live Mint

Will RBI cut key interest rates on December 6? 3 things to know

India Today

Nirmala Sitharaman calls for 'affordable' interest rates after Piyush Goyal

India Today

October inflation wipes off rate cut hopes in Dec policy

Deccan Chronicle

Mint Quick Edit | Inflation above 6%: There goes a December rate cut

Live Mint

Can October CPI inflation numbers alter RBI’s monetary policy path?

Live Mint

RBI invites applications for deputy governor’s post with Michael Patra set to step down in January

Live Mint

Govt invites applications for RBI DG post as Michael Patra’s term ends in January

New Indian Express

RBI Maintains Status Quo on Benchmark Rates, Emphasizes Price Stability

Live Mint

RBI maintains calm against global noise

Live Mint

RBI MPC 2024: RBI can’t ignore food inflation while framing monetary policy: RBI Governor Shaktikanta Das

The Hindu

Top Events of the Day: RBI’s monetary policy panel meeting; Tata Power, NCC, PFC results, FirstCry IPO, and more

Live Mint

RBI Governor warns against hasty rate cut

Deccan Chronicle

Markets hold on to early gains after RBI monetary policy decision

The Hindu

RBI keeps repo rate unchanged at 6.5%: Top announcements by Shaktikanta Das

Hindustan Times

RBI MPC Meeting: Repo rate unchanged at 6.5% for 8th time in a row

The HinduDiscover Related

)

)

)