)

US authorities rush to contain Silicon Valley Bank fallout; President Joe Biden vows to fix 'this mess'

FirstpostIn a joint statement, financial agencies including the US Treasury said SVB depositors would have access to ‘all of their money’ starting Monday, 13 March, and that American taxpayers will not have to foot the bill Washington, United States: US authorities unveiled sweeping measures Sunday to rescue depositors’ money in full from failed Silicon Valley Bank and to promise other institutions’ help in meeting customers’ needs, as they announced a second tech-friendly bank had been closed by regulators. In a joint statement, financial agencies including the US Treasury said SVB depositors would have access to “all of their money” starting Monday, 13 March, and that American taxpayers will not have to foot the bill. The Fed, the Federal Deposit Insurance Corporation and Treasury said in their statement that depositors in Signature Bank, a New York-based regional-size lender with significant cryptocurrency exposure which was shuttered on Sunday after its stock price tanked, would also be “made whole.” And in a potentially major development, the Fed announced it would make extra funding available to banks to help them meet the needs of depositors, which would include withdrawals. Hours before Sunday’s joint statement, Treasury Secretary Janet Yellen said the government wants to avoid financial “contagion” from the SVB implosion, as it ruled out a bailout.

History of this topic

How to protect YOUR cash from banking Armageddon: Shark Tank star Kevin O'Leary warns THOUSANDS more 'radioactive' regional banks could fail like SVB - you'll be amazed how simple it is to be safe

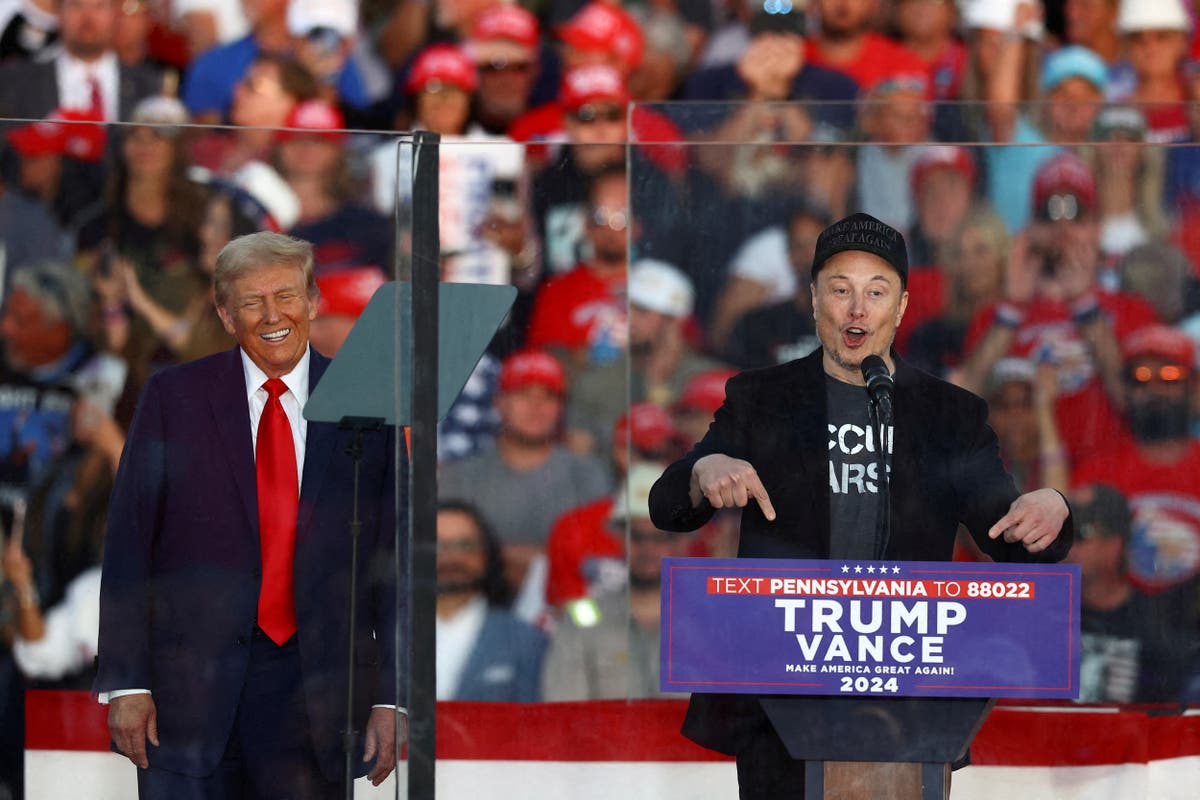

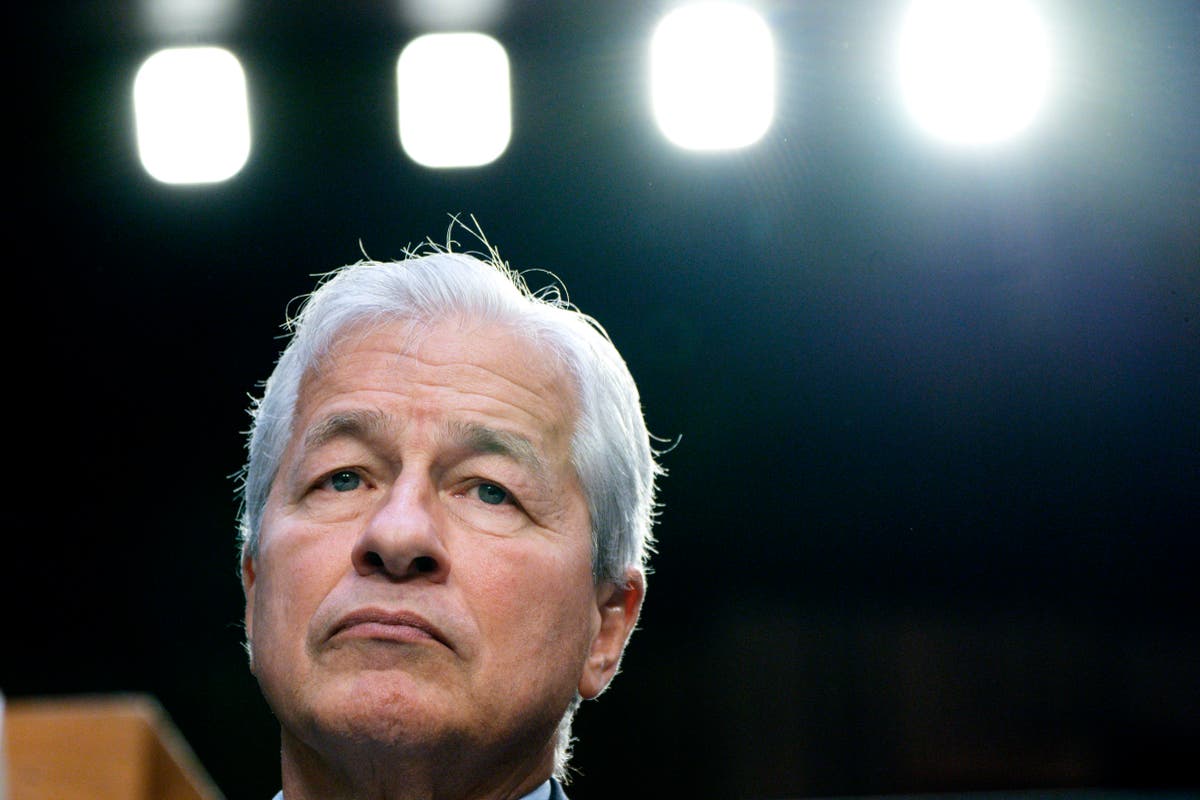

Daily MailCEOs of the nation’s biggest banks warn that new regulations could harm the economy

Associated Press

Big bank CEOs warn that new regulations may severely impact economy

The Independent

Bank execs blame panicked depositors for Silicon Valley, Signature failures, but senators blame them

Associated Press

Heads of failed banks refuse to accept blame, defend their pay and bonuses

LA Times

US authorities investigate Goldman Sachs over Silicon Valley Bank collapse

Live Mint

Biden says bank system ‘safe’ after JPMorgan buys First Republic

Al Jazeera

First Republic: Cheap, interest-only jumbo mortgages to Silicon Valley’s elite fueled the bank’s failure

LA Times

Fed faults Silicon Valley Bank execs, itself in bank failure

Associated PressSilicon Valley Bank: US Fed calls for tougher bank rules after SVB collapse

Live Mint

Fed Admits to Failures in Oversight of Silicon Valley Bank Collapse in New Report

News 18

Congress Helped Set Stage For Silicon Valley Bank’s Failure, Federal Reserve Says

Huff Post

US Federal Reserve admits faults and calls for stronger banking oversight after Silicon Valley Bank collapse

Hindustan Times

Regulators to Publish Postmortems on Silicon Valley Bank, Signature Failures

Live Mint

Column: Love it or hate it, the Silicon Valley Bank bailout won’t cost taxpayers a cent

LA Times)

How the failure of Silicon Valley Bank might have affected the entire financial system

Firstpost

Profits at big US banks show few signs of industry distress

The Independent

Biden calls to revive bank regulations that Trump weakened

Associated Press

White House skirts Congress to push new regional bank rules

Daily Mail

Biden urges US regulators to restore strict rules on midsize banks

Hindustan Times

Data | The Collapse of Silicon Valley Bank and Signature Bank Amid Rising Interest Rates and Asset Losses

The Hindu)

US regulators to consider SVB oversight failures in upcoming reports

Firstpost

Fed official: Bank rules under review in wake of SVB failure

Associated Press

When Is a Global Economic Meltdown Expected? Five Financial Experts Lay It Down

The Quint

Collapsed Silicon Valley Bank sold to US rival First Citizens

The Independent

First Citizens acquires bankrupt Silicon Valley Bank: 5 key things to know

Live Mint

Good News for SBV customers! First Citizens to acquire troubled Silicon Valley Bank

India TV News

Bank failures and rescue test Yellen’s decades of experience

Associated Press

Bank failures and rescue test Yellen's decades of experience

The Independent

Biden says U.S. banks are in good shape, turmoil will ease

LA Times

Yellen says US prepared to take more action to keep bank deposits safe

Live Mint

How safe is my money in a US bank, and what happened with SVB depositors?

Live Mint

Column: The Fed’s anti-inflation work is almost done, with an assist from the banking crisis

LA TimesSilicon Valley Bank's parent company cut off from bank's records

Firstpost

FDIC said to move toward breakup plan for Silicon Valley Bank

Live Mint

Silicon Valley and Credit Suisse weigh heavily as Bank of England considers interest rate rise

The Telegraph

Silicon Valley Bank’s demise animates early days of California’s 2024 U.S. Senate contest

LA Times

The global banking turmoil explained; what’s happening at SVB, Credit Suisse

Live Mint

What caused the collapse of Silicon Valley Bank, and is there a danger of ‘contagion’? | In Focus podcast

The Hindu

Explained | What’s next for Silicon Valley Bank?

The Hindu

Will Americans end up footing the bill for bank failures?

LA Times

Yellen declares bank system sound, as new rescues ordered

Associated Press

Treasury Secretary Yellen Tells Congress U.S. Banking System 'Remains Sound'

Huff Post

Wall Street giants rescue US bank First Republic in $30bn deal

The Telegraph

Silicon Valley Bank Was Not Your Bank

Slate

Massive job cuts in India due to Silicon Valley Bank collapse? Experts say…

Hindustan Times)

Silicon Valley Bank Collapse: How Washington ended up rescuing US banks

Firstpost

How Washington came to rescue US banks

Associated Press

Silicon Valley Bank collapse: 96 hours after biggest US bank failure in 15 years

Hindustan Times

From Moody’s downgraded outlook to oil prices, top 10 updates of SVB collapse

Live MintDiscover Related

)

)