Matter Which Is Not The Subject Matter Of Limited Scrutiny Cannot Be Raised In Revisionary Proceedings: ITAT

Live LawThe Chandigarh Bench of the Income Tax Appellate Tribunal has held that matters that were not subject to limited scrutiny cannot be raised in revisionary proceedings.The two-member bench of Diva Singh and Vikram Singh Yadav has observed that the matter relating to wages and labor expenses, which was not subject to limited scrutiny, cannot be raised. The Chandigarh Bench of the Income Tax Appellate Tribunal has held that matters that were not subject to limited scrutiny cannot be raised in revisionary proceedings. The two-member bench of Diva Singh and Vikram Singh Yadav has observed that the matter relating to wages and labor expenses, which was not subject to limited scrutiny, cannot be raised in revisionary proceedings under Section 263 of the Income Tax Act for the first time. The matter relating to wages and labor expenses was not subject to limited scrutiny, and it was raised in revisionary proceedings for the first time.

History of this topic

Assessee Can Confine Settlement Under Direct Tax Vivad Se Vishwas Act To Disputes Which Were Subject Matter Of Its Appeal: Delhi HC

Live Law

Recourse To Section 147 Of Income Tax Act Not Barred In Cases Where Assessing Officer Is Empowered To Proceed U/S 153C: Delhi High Court

Live Law

Mistake In Calculation Of Tax As Per Sec 115BBE Can Be Rectified U/s 154 And Not U/s 263: Ahmedabad ITAT Quashes Revision Made By PCIT

Live Law

Revisionary Power Can't Be Invoked On Allegation Of Improper Inquiry By AO: Delhi ITAT

Live Law

I-T Authority Fails To Consider Reason For Difference In Sale Consideration & Stamp Duty: Mumbai ITAT Deletes Penalty Levied U/s 270A For Under-Reporting Of Income

Live Law

Penalty Order On Ground Of Misreporting Of Income Not Justified When SCN And Assessment Order Alleged Under-Reporting: ITAT

Live Law

Assessment By AO Can't Be Termed As Prejudicial To Interest Of Revenue If It Doesn't Result In Any Loss To Revenue: Indore ITAT

Live Law

PCIT Cannot Enlarge Scope Of Limited Scrutiny By Invoking Sec 263: Chennai ITAT

Live Law

Ahmedabad ITAT Quashes Reopening In Absence Of Tangible Material With AO To Form Reason To Believe Escaped Assessment

Live Law

Discrepancies In Maintaining KYC Documentation Does Not Constitute Incriminating Material: ITAT Deletes Income Tax Addition

Live Law

Change Of Opinion Does Not Constitute Justification To Believe Income Chargeable To Tax Has Escaped Assessment: Bombay High Court

Live Law

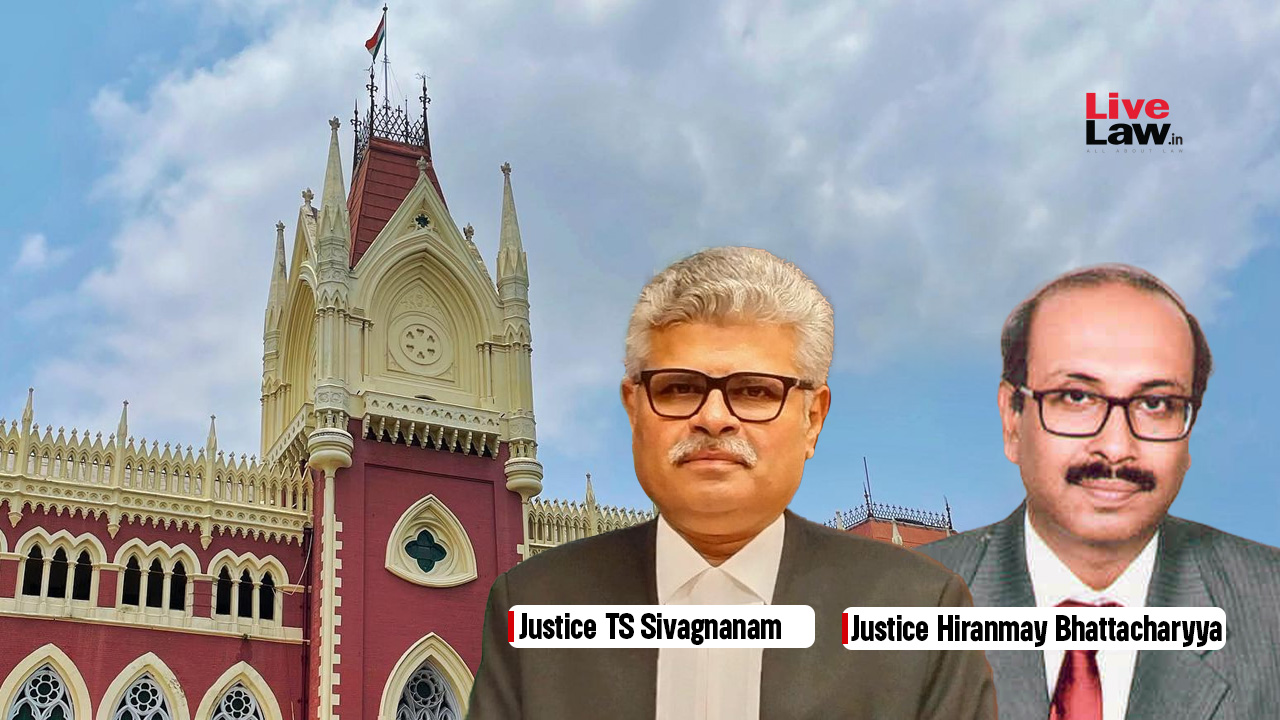

Dept.’s Personal Opinion Not Tangible Material For Reopening Assessment: Calcutta High Court Quashes Reassessment

Live Law

Initiation Of Revision Proceedings By Issuing Show Cause Notice And Passing Revision Order Without DIN Are Invalid: ITAT

Live Law

UPVAT | Exemption/Concession Form Not Produced During Assessment Due To Unavoidable Circumstances, Can Be Considered By Tribunal: Allahabad HC

Live Law

ITAT Quashes Income Tax Addition In Respect Of Immovable Property Warranting Revision By The PCIT

Live Law

Additions Can’t Be Made In Absence Of Incriminating Material: ITAT Deletes Income Tax Addition

Live Law

Department Can Bring Expenditure Incurred In Earlier Years To Be Taxed In Subsequent Years On Grounds Of Bogus Expenditure: ITAT

Live Law

Merely Making Unsustainable Claim Will Not Amount To Furnishing Of Inaccurate Particulars Of Income: ITAT

Live Law

When AO Has Taken One Of The Possible Views The PCIT Is Prohibited From Adopting Different View: ITAT

Live Law

Department Is Not Allowed To Travel Beyond The Issues Involved In Limited Scrutiny Cases: ITAT

Live Law

Reassessment Proceedings Can't Be Initiated On Same Set Of Facts Available: ITAT

Live Law

Other Income Tax Additions In Reassessment Proceedings Cannot Be Sustained If Addition on Primary Grounds Is Not Made: ITAT

Live Law

Setting Aside Of Assessment Orders By ITAT On Technical Grounds Will Not Lead To Automatic Quashing Of Criminal Complaint: Madras High Court

Live Law

ITAT Final Arbiter Of Facts, Its Order Can Be Interfered With Only If There Is Substantial Question Of Law, Manifest Illegality/ Perversity: Delhi HC

Live Law

Non Production Of Persons Despite Summons Leads To Inference Of Routing Own Money : ITAT Delhi

Live LawDiscover Related

![[Income Tax Act] Placing Funds In One Account Before Transferring It To Another Does Not Attract S. 69A: Allahabad High Court](https://www.livelaw.in/h-upload/2024/12/07/575113-allahabad-high-court.jpg)

![[Income Tax] No Substantial Question Of Law Arises If Perversity Cannot Be Shown In Order Passed By Tribunal: Allahabad High Court](https://www.livelaw.in/h-upload/2024/10/31/568956-allahabad-high-court-prayagraj.jpg)

![[Direct Tax Vivaad Se Vishwas Act] Review Plea Against SLP Constitutes "Disputed Tax" U/S 2(i)(j): Delhi High Court](https://www.livelaw.in/h-upload/2024/09/11/560539-justice-yashwant-varma-justice-ravinder-dudeja-delhi-high-court.jpg)

![[Direct Tax Vivaad Se Vishwas Act] Review Plea Against SLP Constitutes "Disputed Tax" U/S 2(i)(j): Delhi High Court](https://www.livelaw.in/h-upload/2024/09/11/560539-justice-yashwant-varma-justice-ravinder-dudeja-delhi-high-court.jpg)