Crypto’s hot streak cools down as harsh ‘winter’ descends

The HinduThe wealth-generating hot streak for Bitcoin and other cryptocurrencies has turned brutally cold. As prices plunge, companies collapse, and skepticism soars, fortunes and jobs are disappearing overnight, and investors’ feverish speculation has been replaced by icy calculation, in what industry leaders are referring to as a “crypto winter.” It’s a dizzying turn of events for investments and companies that at the start of 2022 seemed to be at their financial and cultural apex. “They did similar things leading up to the 2008 crisis: aggressively market these products, promise returns that were unreasonable, ignore the risks, and would dismiss any critics as folk who just didn’t get it.” Hays and others are also drawing comparisons to the 2008 housing-market meltdown, because the collapse in Bitcoin and other digital coins has coincided with crypto industry versions of bank runs and a lack of regulatory oversight that is stirring fears about just how bad the damage could get. In the world of crypto, bouts of heavy selling prompt references to the HBO series “Game of Thrones,” which popularized the ominous warning: “winter is coming.” Last week, the CEO and co-founder of Coinbase, one of the largest crypto exchanges, announced that the company would be laying off roughly 18% of its employees, and he said a wider recession could make the industry’s troubles even worse. Jake Greenbaum, a 31-year-old known as Crypto King on Twitter, said he has recently lost at least $1 million on his crypto investments — “a nice chunk of my portfolio.” While he believes things could get worse before they get better, he is not throwing in the towel.

History of this topic

Crypto enforcement seen slowing as Trump shifts priorities

Hindustan Times

Crypto's New World Order: Who's Rising to the Top in 2024?

Deccan Chronicle

Is this the end of crypto?

Hindustan TimesUK to curb crypto advertising with 'cooling off' periods, risk warnings

The Hindu)

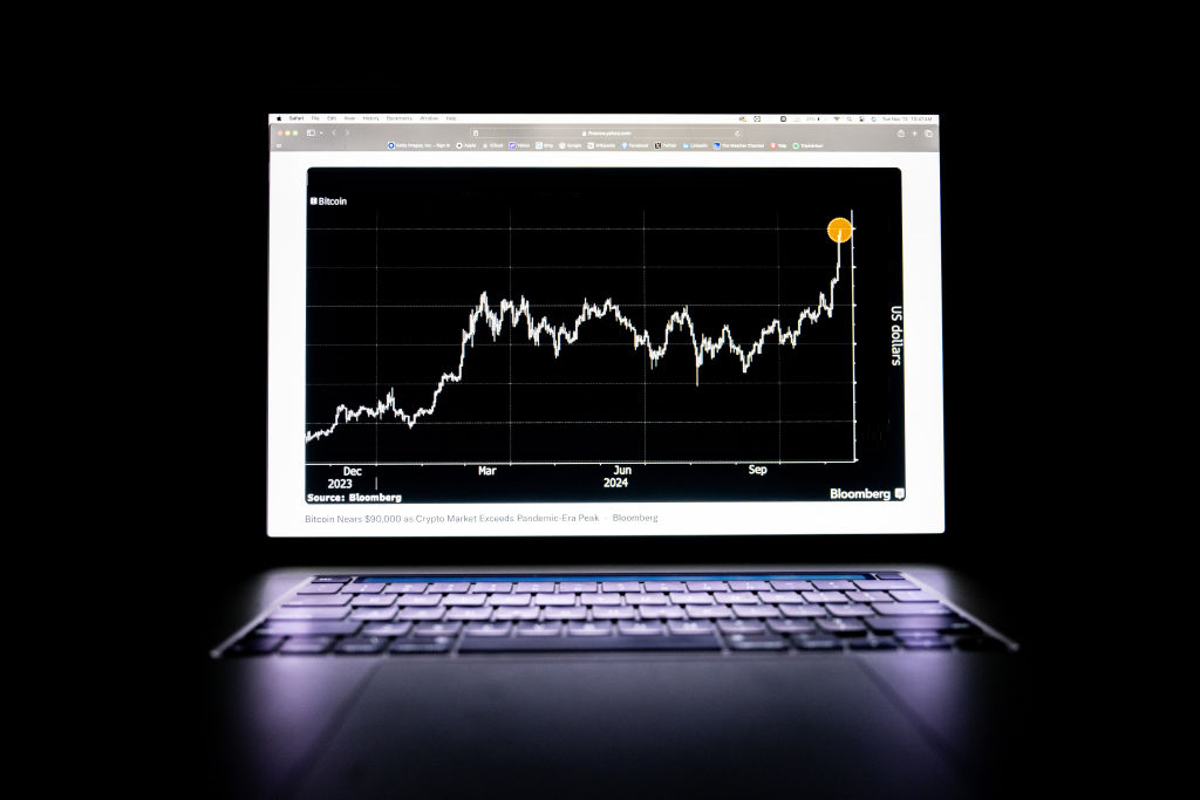

End Of Crypto-Winter? Bitcoin to rally up, touch $100,000 by 2024, says Standard Chartered

Firstpost

Is crypto about to go extinct?

Al Jazeera

How a Series of Crypto Meltdowns Is Reshaping the Industry

Bloomberg

Why Is Crypto Market On A Downward Trend In 2022? Here's What Investors Should Keep In Mind

ABP News

Weekly Crypto Roundup: seeking attention, slashed jobs, and sideways momentum

The HinduU.S. state regulator says it believes crypto lender Celsius is “deeply insolvent”

The Hindu

Weekly Crypto Roundup: disharmony, downfall, and discounts

The Hindu

Crypto investors’ hot streak ends as harsh ‘winter’ descends

Associated Press

Crypto markets down nearly 70% from peaks: Will the carnage continue?

Business Standard

Crypto investors’ hot streak ends as harsh ‘winter’ descends

LA Times

Crypto winter what is it when will it be over game of thrones advantages disadvantages investors advice

ABP News

Weekly Crypto Roundup: firings, freezing, and falls

The Hindu

Sure, Crypto Is Crashing, but Everything Is Perfectly Fine

Wired

After Layoffs, Crypto Startups Face a ‘Crucible Moment’

Wired

Crash of the Crypto: Why are cryptocurrency investors fleeing?

India Today

No let up in crypto slide, Bitcoin at 18-month low

Al Jazeera

A crypto winter or a meltdown? Recession fears and layoffs hit crypto currencies

NPR

Crypto meltdown is wake-up call for many, including Congress

Associated Press

Is Crypto entering another winter?

The HinduDiscover Related

)

)

)

)