How the Fed's steep rate hikes stand to affect your finances

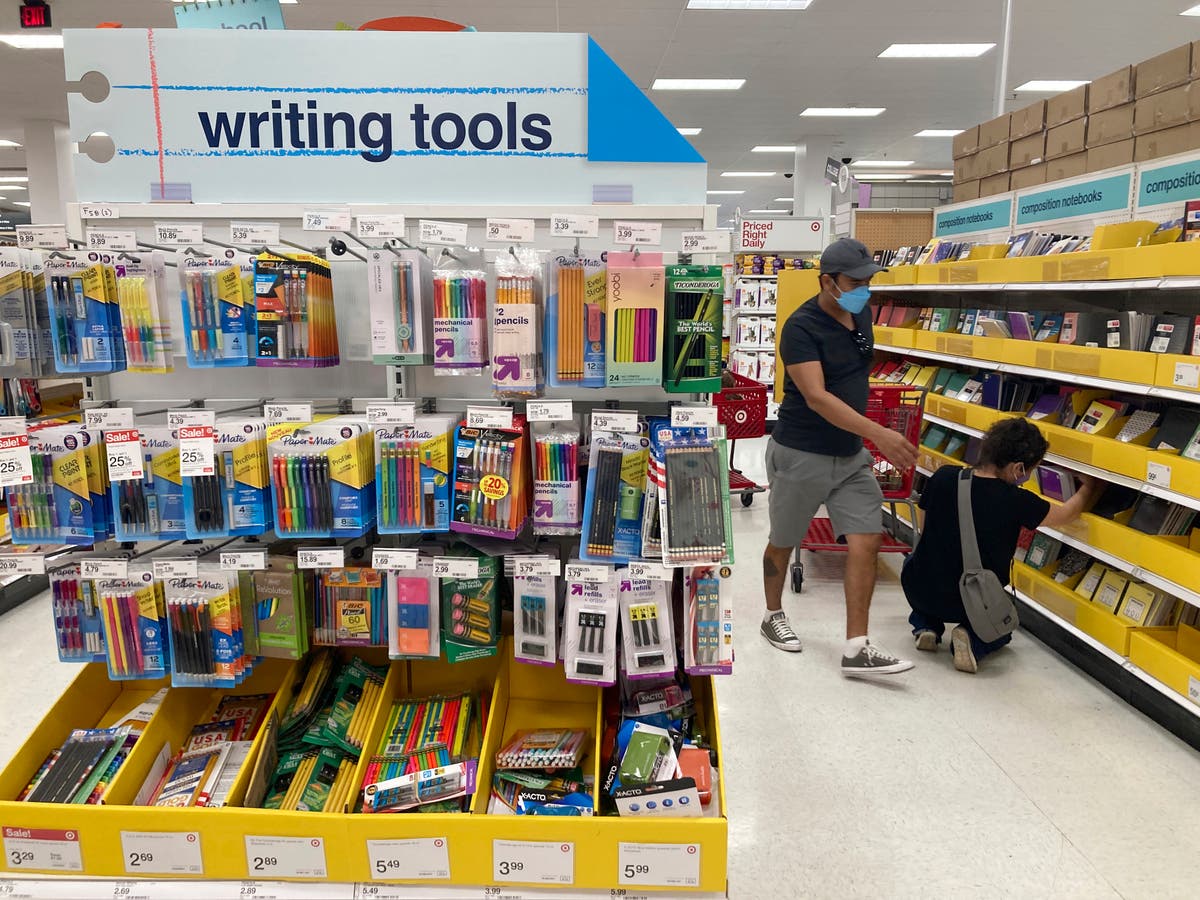

The IndependentFor free real time breaking news alerts sent straight to your inbox sign up to our breaking news emails Sign up to our free breaking news emails Sign up to our free breaking news emails SIGN UP I would like to be emailed about offers, events and updates from The Independent. Yet as the Federal Reserve has rapidly increased interest rates, many economists say they fear that a recession is inevitable in the coming months — and with it, job losses that could cause hardship for households already hurt worst by inflation. Even before the Fed's decision Wednesday, credit card borrowing rates have reached their highest level since 1996, according to Bankrate.com, and these will likely continue to rise. Rates on new auto loans are likely to go up by nearly as much as the Fed's rate increase. Fed Chair Jerome Powell warned last month that, “our responsibility to deliver price stability is unconditional” — a remark widely interpreted to mean the Fed will fight inflation with rate increases even if it requires deep job losses or a recession.

History of this topic

US Federal Reserve lowers interest rates, signals slower cuts for 2025

India TV News

US Federal Reserve lowers rates by a quarter point, signals two cuts for 2025

Hindustan TimesThe Fed expects to cut rates more slowly in 2025. What that could mean for mortgages, debt and more

Associated PressFederal Reserve is likely to slow its rate cuts with inflation pressures still elevated

Associated Press

As the Fed cuts, some long-term interest rates are rising

SalonWhy Trump and the Federal Reserve could clash in the coming years

Associated Press

December interest rate cut depends on inflation, Fed official says

Salon

US Fed rate cut: First inflation uptick in 7 months does little for Powell-led FOMC’s December plans; here’s why

Live Mint

Trump enters just as the Fed is shifting its focus

Live Mint

Federal Reserve cuts its key interest rate by a quarter-point

The Hindu

Federal Reserve cuts its key interest rate by a quarter-point after Trump's election win

Hindustan Times)

US Federal Reserve cuts rate by 0.25% after first post-election meeting, notes easing inflation

Firstpost

Fed cuts rates in boost for Trump

The Telegraph

The Fed cuts interest rates — but Trump's election could make things trickier

NPR

US Federal Reserve is finally lowering rates: Here's what consumers need to know

Hindustan Times

Ahead of elections, US Federal Reserve shifts interest rates dramatically to deal with worst inflation

India TV News

How the economy will respond to the Fed's rate cuts

Politico

The Federal Reserve starts cutting interest rates in a big moment for the economy

NPR

Will the Federal Reserve cut interest rates fast enough to deliver a ‘soft landing’?

LA Times

How to prepare for the Fed’s forthcoming interest rate cuts

LA Times

'The time has come' to lower interest rates: Fed Chair Jerome Powell

NPR

U.S. inflation slowed again in July, clearing the way for the Fed to begin cutting rates

LA TimesBuckle up: Wall Street’s shaky July could be a preview for more sharp swings

Associated PressFirst interest rate cut in 4 years likely as the Federal Reserve meets

Associated Press

US Fed paves the way for pre-election rate cut

The TelegraphFederal Reserve is edging closer to cutting rates. The question will soon be, how fast?

Associated PressEx-regional Fed president: Inflation headed lower, with interest rates likely to follow

Associated PressUS inflation cools again, Fed may cut interest rates soon

Associated PressFurther rate rises look increasingly possible, but would they fix inflation?

ABCFederal Reserve sees some progress on inflation but envisions just one rate cut this year

Associated Press

Inflation eases in May, but major relief on interest rates not coming soon

LA TimesAre US interest rates high enough to beat inflation? The Fed will take its time to find out

Associated PressAre US interest rates high enough to beat inflation? The Fed will take its time to find out

Associated Press

The Fed indicated rates will remain higher for longer. What does that mean for you?

LA TimesThe Fed indicated rates will remain higher for longer. What does that mean for you?

Associated Press

The Fed indicated rates will remain higher for longer. What does that mean for you?

The Independent

Fed officials vote to hold interest rates steady at 23-year-high - here's what it means for YOUR wallet

Daily Mail

Fed keeps interest rates at 23-year high

NPR

Wages, employment, inflation are up, causing headaches for the Fed

NPRFed’s Powell: Elevated inflation will likely delay rate cuts this year

Associated PressHigher gas and rents keep US inflation elevated, likely delaying Fed rate cuts

Associated PressWhen will Fed cut rates? As US economy flexes its muscles, maybe later or not at all

Associated PressPowell: Fed still sees rate cuts this year; election timing won’t affect decision

Associated Press

Fed rate outlook looks just right for banks

Live MintFederal Reserve foresees 3 rate cuts in 2024 despite bump in inflation

Associated Press

Federal Reserve holds interest rates steady, projects three rate cuts later this year

NPRFederal Reserve is likely to preach patience as consumers and markets look ahead to rate cuts

Associated Press

US inflation unexpectedly rises to 3.2%, dampening hopes of Fed's interest rate cuts in March

Hindustan TimesInflation is nearly back to 2%. So why isn’t the Federal Reserve ready to cut rates?

Associated PressWhy now is a crucial time to pay off credit card debt

Associated PressDiscover Related