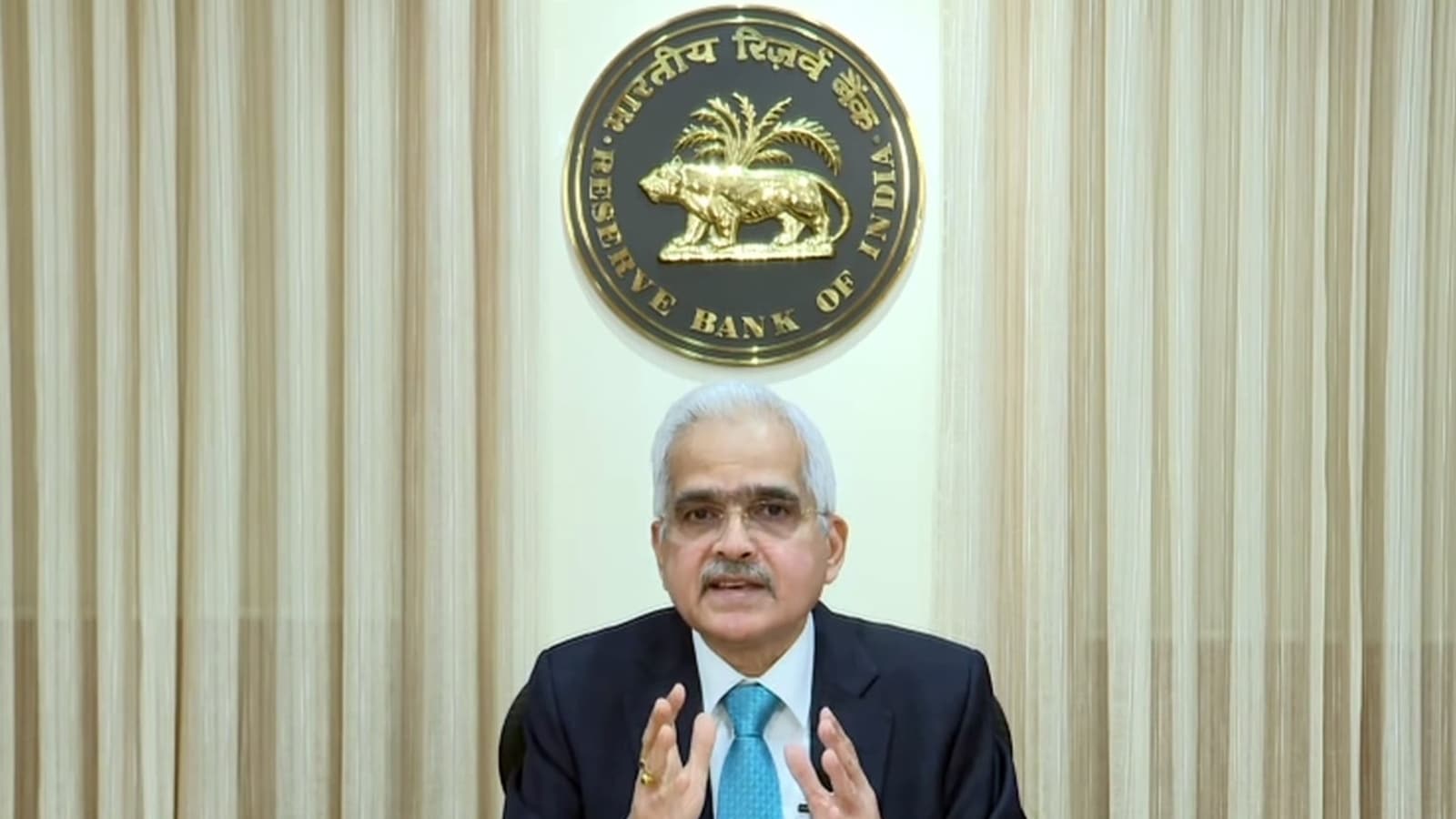

Online automatic transactions will not fail from April 1, RBI extends deadline by 6 months

India TodayThe Reserve Bank of India has now extended the timeline for implementation of new guidelines for automatic payment system by six months. Previous reports had noted that the RBI had refused to grant an extension to banks following which banks started notifying customers about failure in automatic recurring payments from April 1. For transactions above Rs 5000, banks will also be required to send one time passwords to customers HDFC Bank, ICICI Bank, SBI as well as card scheme operators like American Express and Mastercard notified network partners about their inability to process standard instructions recurring mandate-based payments, as per reports. “All the ecosystem players, be it banks and payment gateways are guilty of not taking RBI directive seriously from 2019 and not being able to come on a single platform, which we should have done at least a couple of months back so that there could have been a smooth transition to the new way of doing recurring transactions,” Payments Council Of India chairman Vishwas Patel told news agency PTI. Earlier this month, the RBI directed payment gateways, card-issuing banks, and other payment service providers to stop storing card details permanently citing data leaks.

History of this topic

RBI proposes regulation for safer digital payments

The Hindu

RBI issues draft guidelines on payment aggregators | Check details

India TV News

RBI issues new guidelines for issuance of credit cards, allow customers to choose from multiple card networks

India TV News

NPCI to examine Paytm's third-party app request for UPI: RBI

Hindustan Times

Paytm Payments Bank crisis: RBI issues 30 FAQs after crackdown

Hindustan Times

RBI Releases FAQs on Paytm Payments Bank Operations After March 15

Deccan ChronicleRBI gives 15 more days till March 15 to Paytm Payments Bank to stop transactions

The Hindu)

‘Pay… Paid’: How India plans to put paid to frauds adding delay to first-time digital payments of over Rs 2,000

Firstpost

RBI’s nod to payment aggregators signals start of light-touch regulation

Live Mint

RBI unlikely to extend 30 September deadline for credit, debit cards

Live Mint

RBI Extends Deadline for Complying with Card Tokenisation Norms by 3 Months: What It Means

News 18

Credit Card: RBI Extends Deadline to Implement New Rules to October 1; Know the Changes

News 18

Debit Card, Credit Card Online Payment Rule Changes from Next Month: Know Details

News 18

RBI unveils Payments Vision 2025 with intent to increase e-payments

India TV News

Debit, Credit Card Rule Changes Today: No OTP Needed for Recurring Payments Up To Rs 15,000

News 18

RBI Policy: Now, no OTP needed for auto-debit recurring payments upto Rs 15,000

India TV News

Debit, credit card: No OTP needed for recurring payments up to ₹15,000

Live Mint

Key takeaways from RBI circular on credit cards

Live Mint

New Online Card Payment Rules Delayed To July 2022: Details

News 18

RBI defers tokenisation deadline by six months

The HinduRBI's push for card security to hit merchants, lenders

The Hindu

RBI to soon float paper on reasonableness of charges on transactions via digital payments

India TV News

New RBI Rule: Confusion Over Auto Debit Payment System Adding To Customers' Woes

ABP NewsWill your standing instructions with payments provider continue unhindered?

The Hindu

In Focus: Will your recurring payments fail from today?

Business Standard

Debit Card, Credit Card Auto Payment to Fail from Today If you Don't Follow New Rule

News 18

Automated bill/card payments stop from today

Deccan Chronicle

Credit card

Live Mint

Credit card, debit card payment: New rule on auto-debit transactions from next month

Live Mint

RBI relaxes current account norms, extends deadline to implement new rules. Check details

India TV News)

RBI Bars Mastercard from Acquiring New Customers in India from July 22

News 18)

Debit Card, Credit Card Rule: Can't Use New Card for Online Transactions? Know How to Activate it

News 18

RBI defers rules on auto debit transactions till Oct

Live Mint

RBI extends timeline for processing of recurring online transactions till Sept 30

India TV News)

RBI Extends Deadline for New Guidelines on Auto-Payment of Bills, Subscriptions to Sep 30

News 18)

Auto-Payment Of Bills, Subscriptions May Face Issues From April 1 Due to RBI Direction

News 18

Debit, credit card automatic payment rule to change from April 1: All you need to know

India Today

Automatic recurring payment to comply with RBI direction from April 1

The Hindu

Debit Card, Credit Card new rules come into force from October 1. All you need to know

India TV NewsDiscover Related

)