Government extends relief to startups, simplifies the process of angel tax assessment

Op IndiaIn a major relief to startups, the Narendra Modi government has decided to simplify the angel-tax assessment process under which any action against startups will be taken only after approval of a supervisory officer. In such cases where scrutiny assessments of startup entities are pending, the CBDT has decided that the contention of the assessee will be summarily accepted whose cases are under ‘limited scrutiny’ for those entities recognised by DPIIT. 2 and whose cases have been selected under scrutiny to examine multiple issues including the issue of section 56, this issue will not be pursued during the assessment proceedings and inquiry on other issues will be carried out by the Assessing Officer only after obtaining approval of the supervisory authority,” an official statement said. The Finance Minister had proposed a series of incentives, including a special arrangement for resolution of pending assessments of income tax cases, with a view to encouraging startups.` “To resolve the so-called ‘angel tax’ issue, the startups and their investors who file requisite declarations and provide information in their returns will not be subjected to any kind of scrutiny in respect of valuations of share premiums,” she had said.

History of this topic

Centre scraps angel tax on foreign investments

The Hindu

Tax Benefits For Startups, Sovereign Wealth & Pension Funds Extended to March 2025

News 18

DPPIT Recognized Start-Ups Not to Face Verification On Account Of Angel Taxation: CBDT

Live Law

Opinion | The decline of tax demons and the ascent of angels

Live Mint

Cheer for the startup sector as FM relaxes angel tax rules

Live Mint)

CBDT's procedure for pending angel tax assessment cases to provide safeguard to start-ups, say experts

Firstpost

CBDT extends angel tax relief to startups facing tax demands

Live Mint)

Relief for startups: CBDT lays out procedure for pending angel tax assessment cases

Firstpost

CBDT tells tax officers to accept tax break claims by registered startups

Live Mint

Forget about taxman, focus on business: CBDT to startups

Live Mint

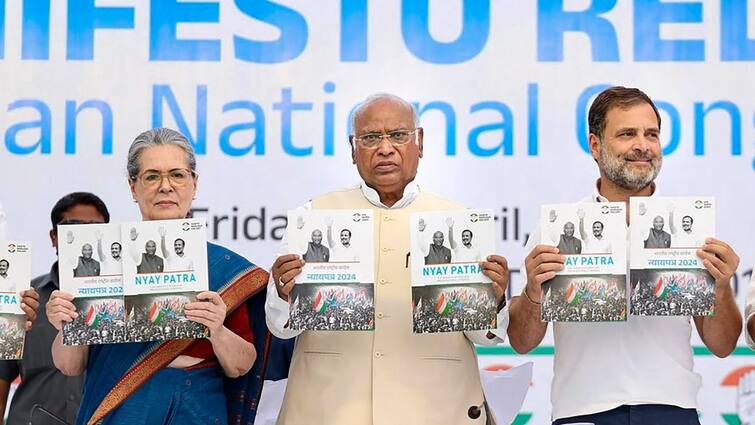

Budget 2019: Startups and investors can do away with ‘Angel Tax’ by filing requisite declarations

Op India

Budget may keep Status quo on angel tax for startups

The Quint)

DPIIT proposes relaxation in income tax law to help startups raise funds; tax incentives for budding entrepreneurs on the cards

Firstpost

CBDT notifies relaxed norms for start-ups

Live Mint)

Govt may exempt DPIIT-certified startups from angel tax; likely to raise investment limit to Rs 25-40 crore

Firstpost)

I-T Department to soon decide on startups to be exempted from angel tax; multilayer checking system in place to find eligible firms

Firstpost

Govt to form working group to resolve angel tax issue of startups

Live Mint

Angel tax issue: DIPP to hold discussions with start-ups on 4 Feb

Live Mint)

Angel tax exemption for startups: DIPP invites views from stakeholders for better implementation of procedure

FirstpostDiscover Related

![Catalyst: Startup Law And Policy Summit By CNLU Patna [12th August]](https://www.livelaw.in/h-upload/2024/07/26/551704-untitled-design-10.jpg)