![Delhi HC reads down Section 28(11) of Customs Act [Read Judgment]](https://www.livelaw.in/cms/wp-content/uploads/2015/10/Delhi-High-Court-min.jpg)

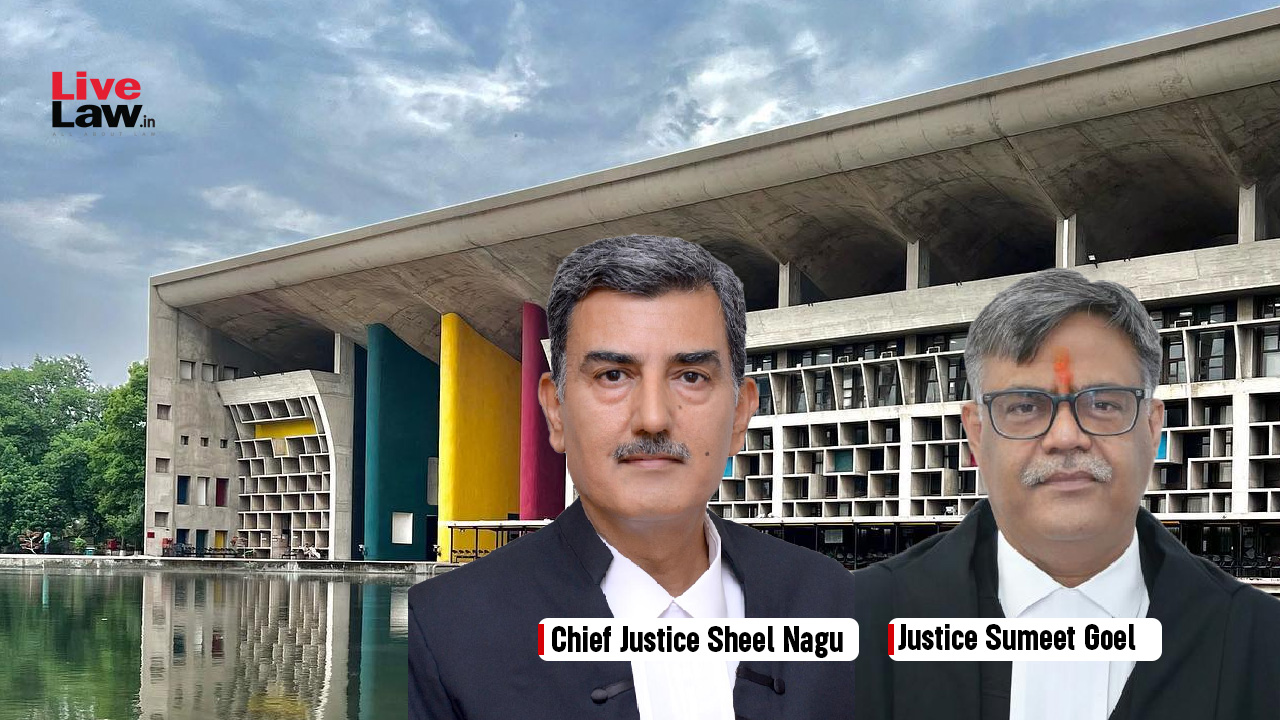

Delhi HC reads down Section 28(11) of Customs Act [Read Judgment]

Live LawThe Delhi High Court has read down Section 28 of the Customs Act holding that the Customs Department cannot seek to rely upon Section 28 of the Act as authorising the officers of the Customs, DRI, the DGCEI etc. to exercise powers in relation to non-levy, short-levy or erroneous refund for a period prior to 8th April 2011 if, in fact, there was no proper assigning of the functions of reassessment or assessment in favour of such officers who issued such SCNs since they were not “proper officers‟ for the purposes of Section 2 of the Act. In terms of Section 28 of the Act, all persons appointed as Customs Officers under Section 4 of the Act prior to 6th July 2011 “shall be deemed to have and always had the power of assessment under Section 17 and shall be deemed to have been and always had been the proper officers.” The Court made following observation on Validity of Section 28 of Customs Act. INTERPRETATION TO AVOID VICE OF UNCONSTITUTIONALITY The Department cannot seek to rely upon Section 28 of the Act as authorising the officers of the Customs, DRI, the DGCEI etc. to exercise powers in relation to non-levy, short-levy or erroneous refund for a period prior to 8th April 2011 if, in fact, there was no proper assigning of the functions of reassessment or assessment in favour of such officers who issued such SCNs since they were not “proper officers‟ for the purposes of Section 2 of the Act and further because Explanation 2 to Section 28 as presently enacted makes it explicit that such non-levy, short-levy or erroneous refund prior to 8th April 2011 would continue to be governed only by Section 28 as it stood prior to that date and not the newly re-cast Section 28 of the Act.

History of this topic

Delhi High Court Allows Indigo Airlines' Plea, Holds Levy Of Additional IGST On Repaired & Re-Imported Aircraft Parts To Be Unconstitutional

Live Law

Penalties Like Seizure, Detention Of Goods In Transit U/S 129 CGST Act Shouldn't Be Imposed To Penalise Minor Breaches: Delhi High Court

Live Law

S.28 Customs Act | Keeping Matter In Call Book, Taking It Up After Several Years Is Not Permissible: Delhi HC Quashes SCN

Live Law

Pendency Of Revenue's Appeal Regarding Classification Of Imported Goods No Ground To Insist On Provisional Assessment U/S 18 Customs Act: Delhi HC

Live Law

Power Of DRI Officers To Issue Show-Cause Notices Under Customs Act And A 'Flux' In The Legal Position: Delhi HC Discusses

Live Law

Proper Officer Must Provide 'Reason To Doubt' Value Of Goods Declared By Importer Before Initiating Reassessment U/S 17 Customs Act: Delhi HC

Live Law

Customs Act | Importer Accepting Enhanced Valuation Of Goods For Expeditious Clearance Not 'Waiver' Of Right To Contest Re-Assessment: Delhi HC

Live Law

Incorrect Classification Is Not By Itself Collusion/ Wilful Misstatement U/S 28AAA Customs Act; Prior Determination By DGFT Must: Delhi HC

Live Law

Incorrect Classification Is Not By Itself Collusion/ Wilful Misstatement U/S 28AAA Customs Act; Prior Determination By DGFT Must: Delhi HC

Live Law

DRI Officers Can Issue Show-Cause Notices Under Customs Act : Supreme Court Allows Review Against 'Canon India' Judgment

Live Law

Customs Deputy Commissioner's Order Contrary To AAR's Ruling, Bombay High Court Quashes

Live Law

Delhi High Court Quashes Suspension Of License, Issued To Customs House Agent, Finding Order Illegal

Live Law

Legal Impact Of 2014 Specific Judgment on Section 6A(1) of Delhi Police Special Establishment Act

Live Law

Customs Broker Licence Can’t Be Revoked On Mere Charge Of Mis–Declaration And Undervaluation Of The Illegal Imports: CESTAT

Live Law

Knowledge Is A Necessary Element For Committing Abetment : Delhi High Court Quashes Penalty Against Customs Broker

Live Law

Writ Court Can’t Classify Products Under Customs Tariff Act, Technical Analysis Is Required: Calcutta High Court

Live Law

Prosecution For Customs Duty Evasion Can't Be Initiated As The Valuation Of The Goods Is Less Than Rs.1 Crore: Delhi High Court

Live Law

Chapter XXIA CrPC | Provisions Of Plea Bargaining Applicable To Offences U/S 132 & 135 Of Customs Act: Delhi High Court

Live Law![Prosecution Under Customs Act Not Barred In Regard To Antiquities Or Art Treasures: SC [Read Judgment]](https://www.livelaw.in/h-upload/2019/01/22/ashok-bhushan-km-joseph.jpg)

Prosecution Under Customs Act Not Barred In Regard To Antiquities Or Art Treasures: SC [Read Judgment]

Live Law

SC To Examine Validity Of Delhi Laws (Special Provisions) Act, 2006 That Gave Relief To Illegal Constructions

Live Law

Delegation Of Powers: Delhi HC Issues Notice To Consumer Affairs Dept, ASCI

Live Law![Delhi HC slams Customs Department for disobeying Court orders, imposes 10,000 as costs [Read Order]](https://www.livelaw.in/cms/wp-content/uploads/2015/10/Delhi-High-Court-min1.jpg)

Delhi HC slams Customs Department for disobeying Court orders, imposes 10,000 as costs [Read Order]

Live Law![Delhi HC slams Customs Department for disobeying Court orders, imposes 10,000 as costs [Read Order]](https://www.livelaw.in/cms/wp-content/uploads/2015/10/Delhi-High-Court-min1.jpg)

Delhi HC slams Customs Department for disobeying Court orders, imposes 10,000 as costs [Read Order]

Live LawDiscover Related

![Delhi High Court Monthly Digest: February 2025 [Citations 119- 251]](https://www.livelaw.in/h-upload/2022/02/01/408685-delhi-high-court-monthly-digest.jpg)

![Madras High Court Monthly Digest - February 2025 [Citations 39-80]](https://www.livelaw.in/h-upload/2022/02/01/408688-madras-high-court-monthly-digest.jpg)