What is ‘toddler tax’ that could see some parents paying VAT on nursery fees?

The IndependentThe best of Voices delivered to your inbox every week - from controversial columns to expert analysis Sign up for our free weekly Voices newsletter for expert opinion and columns Sign up to our free weekly Voices newsletter SIGN UP I would like to be emailed about offers, events and updates from The Independent. In what has been branded the “toddler tax”, HMRC confirmed earlier this month that a whole nursery class provided by a private school will be subject to 20 per cent VAT if children of compulsory school age attend. Referring to nursery classes provided by private schools, it stated: “Nursery classes made up wholly of children below compulsory school age remain exempt from VAT. Independent school leaders fear it is children with special educational needs and disabilities who might be affected by a “toddler tax”, as well as children who attend small nurseries or nurseries attached to schools that intentionally mix ages – causing “a wide range of harms”. Applying VAT to the fees of everyone in a class just because one child has reached school age appears very unfair and could have a detrimental effect on children who simply need more time before starting school to get the best start in life.” The charity said data suggests an estimate of more than 320 children wish to defer their school start date every year and so could be impacted by the policy.

History of this topic

The VAT ‘raid’ on private schools has finally made me proud to have voted Labour

The Independent

Private schools ‘to raise fees by more than Starmer predicted’ as controversial VAT policy imposed

The Independent

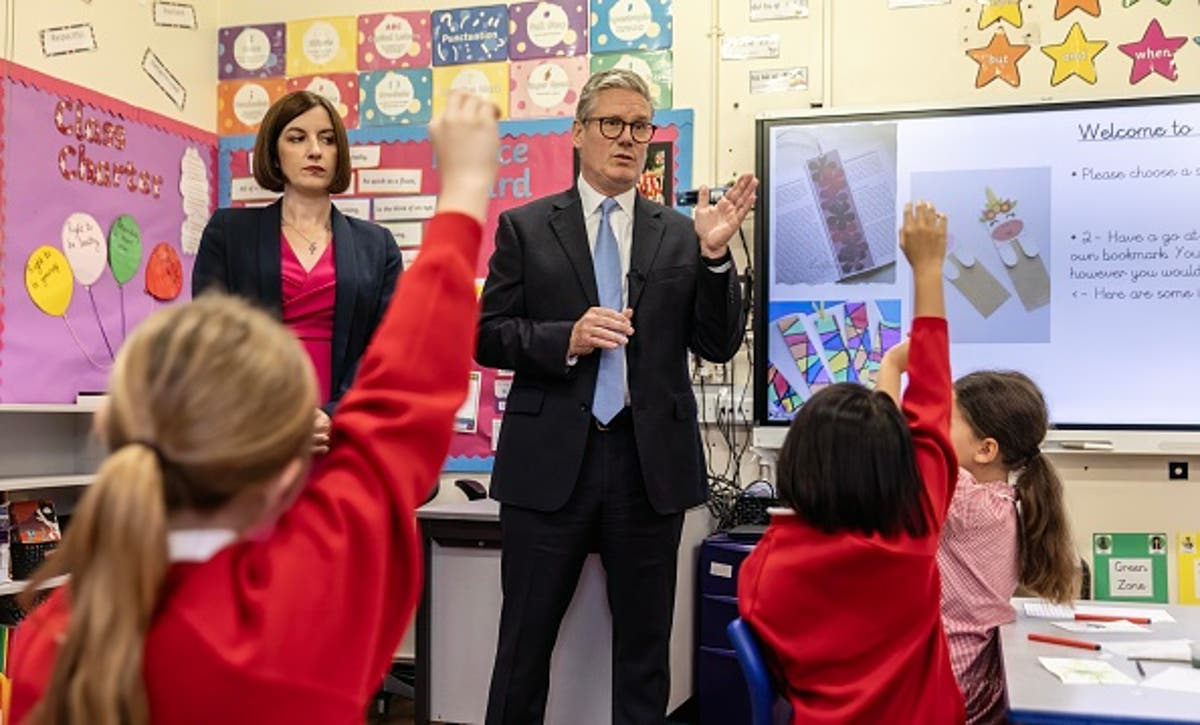

Starmer defends controversial private schools VAT policy by arguing it will benefit middles classes

The Independent

Private school tax breaks ‘a luxury we cannot afford’, says education secretary

The Independent

School chiefs turn on Rachel Reeves after 'shameful' claim that VAT raid will give all children the 'best start'

Daily Mail

Labour preparing for private school closures after VAT raid on fees, suggest reports

The Independent

Families launch legal action over government’s private school fees VAT raid

The Independent

Labour's tax raid on private tuition fees is left in CHAOS - as school heads have been unable to register for VAT on HMRC site

Daily Mail

Foreign Office asks private schools to offer discounted fees for diplomats' children following Labour's VAT raid

Daily Mail

Private school group to launch legal action over Government’s VAT plan on fees

The Independent

What is Labour’s controversial private school VAT raid policy?

The Independent

Parents already turning down private school places as Labour’s VAT policy looms

The Independent

France and Germany slam Labour's VAT plan for private schools - and warn it could force hundreds of pupils out of international schools

Daily Mail

Military families set to be exempt from Labour’s controversial VAT on private school fees

The Independent

Special needs children not protected from private school VAT raid, says Bridget Phillipson

The Telegraph

School VAT tax raid to go ahead in win for Bridget Phillipson

The Independent

Parents appalled after council asks those trying to move their children to state education from private schools to prove how poor they are

Daily Mail

Thousands of armed forces families depend on help into private schools. Labour's VAT raid plan threatens to hit their children hard, writes LORD KEMPSELL

Daily Mail

Eton 'to impose Labour's 20 per cent VAT rise in January's fees' with costs of attending 584-year-old school set to rise to £63,000 per year

Daily Mail

Government’s private schools VAT raid ‘could cost taxpayer £1.8bn’

The Telegraph

Eton College tells parents fees likely to rise by 20% over Labour’s VAT plan

The Independent

Eton College to raise fees by 20% following Labour’s VAT on private schools

The Independent

Eton to raise fees by 20pc amid Labour VAT raid

The Telegraph

Biggest private girls’ school chain raises fees by 12pc over VAT raid

The Telegraph

Private schools at risk of closure over VAT hike already face big budget shortfalls, says Phillipson

The Independent

Fury as Education Secretary Bridget Phillipson says parents were given 'ample warning' about Labour's VAT raid on private school fees

Daily Mail

Labour private school VAT tax plan could come soon – what parents need to know

The Independent

Phillipson blames private schools for ‘pricing out’ middle classes in row over VAT on fees

The Independent

Labour to shut loophole in VAT raid on private school fees

The Telegraph

Budget rules mean private schools VAT raid won’t start before Sept 2025, Labour insiders claim

The Telegraph

Labour VAT raid on private schools could harm vulnerable children, warns former Ofsted chief

The Telegraph

Labour’s VAT raid: ‘I already work two jobs and cannot fathom a third’

The Telegraph

The real losers from Labour’s VAT raid on private schools? The children

The Independent

Labour’s VAT raid will lead to ‘McDonaldsisation’ of education

The Telegraph

Military families will be priced out of private schools under Labour

The Telegraph

Labour’s private schools tax plans ‘blamed for fall in entries’

The Independent

State schools unprepared for flood of pupils sparked by Labour’s VAT raid

The Telegraph

Labour's planned tax raid on private schools would 'cost more than it saves' for the education system, report warns

Daily Mail

Labour’s private school tax raid ‘could cost taxpayer £1.6bn a year’

The Telegraph

Almost half of voters do not think private schools should be exempt from VAT

The Telegraph

Labour VAT raid on private schools ‘will displace vulnerable pupils’

The Telegraph

Private school VAT raid will hurt the less wealthy, parents tell Keir Starmer

The Telegraph

Labour will close potential ‘VAT loophole’ for private school fees

The Telegraph

Private schools offer 'pay now' option in attempt to dodge Labour VAT raid

The Telegraph

Education unions warn Labour's planned private school tax raid could cost teachers' jobs

Daily Mail

Letters: Voters see through Labour’s spin on its punitive plan for private schools

The Telegraph

Labour to add VAT to private school fees immediately if it wins power

The Independent

Labour’s private schools tax raid ‘will make education more elitist’

The Telegraph

Labour private school tax raid could cost taxpayers £300m – and force 40,000 pupils into the state system

The TelegraphDiscover Related