)

Banks in India to See Capital Decline Over 2 Years Without Fresh Infusion: Moody's

News 18New Delhi: Moody's Investors Service on Monday said the bank capital will moderately fall in emerging Asia over the next two years, with India seeing larger capital decline without further infusion. In a report, Moody's said the uncertain trajectory of asset quality is one of the biggest threats for emerging market banks, as operating conditions remain challenging amid the current COVID pandemic. Capital will moderately fall in emerging Asia over the next two years, and banks in India and Sri Lanka will post larger capital declines without public or private injections," Moody's said. "Profit growth will be modest because of low-interest rate and subdued lending, but lower loan volumes should aid capital," Moody's Managing Director Celina Vansetti-Hutchins said in the 'Emerging Markets Financial Institutions Outlook' report.. Read all the Latest News, Breaking News and Coronavirus News here

History of this topic

India in economic sweet spot amid global headwinds: Moody’s

Live Mint

Indian banks well placed to ride on economic growth: Moody’s

The Hindu

India's Corporates Face High Capital Needs: Moody's

Deccan Chronicle

India’s credit worthiness stable compared to negative outlook for the world: Moody’s

Live Mint

Keep an eye on these economic indicators in 2023

Live MintFinancial markets at a turning point as inflation looms large

The Hindu)

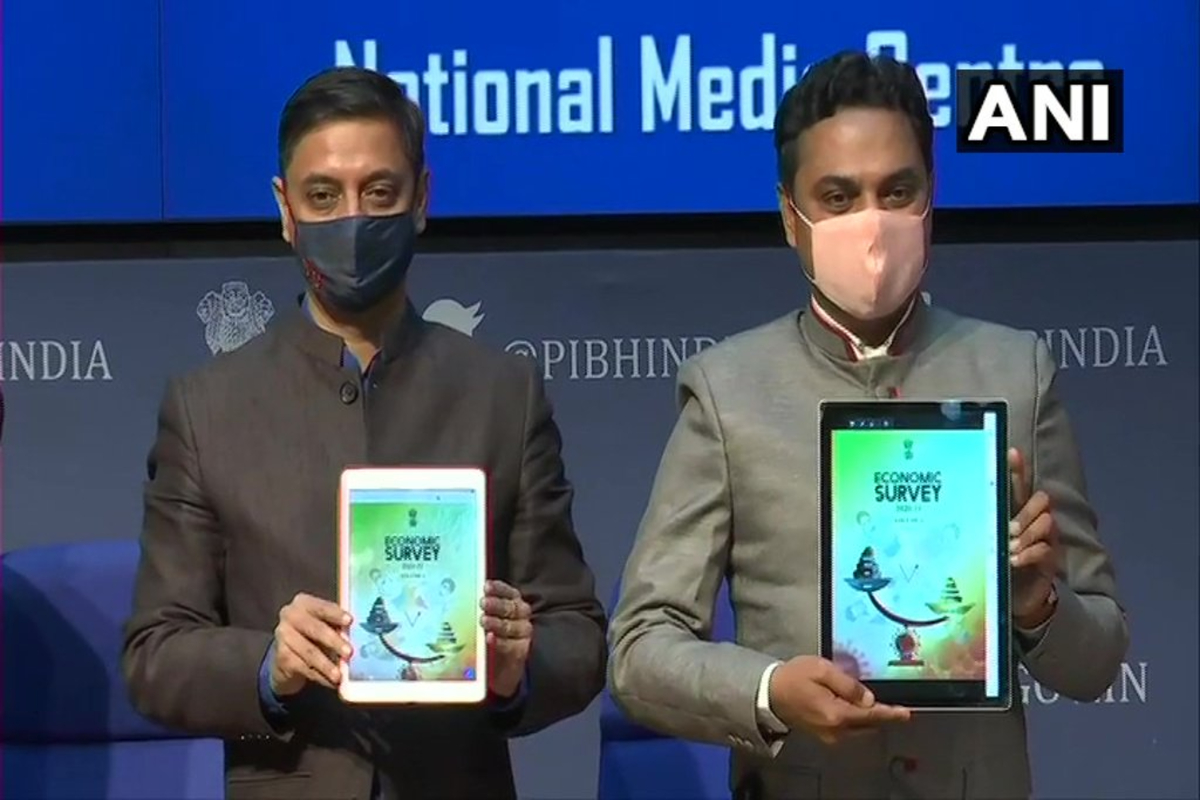

Economic Survey 2021: Under-Capitalisation of Banks Will Hamper Economic Growth in Long Run

News 18)

India's Public Sector Banks Will Need Rs 2.1 Trillion Over Next 2 Yrs to Plug Covid-19 Damages: Moody's

News 18Discover Related