Planning to sell securities? This is how you can calculate long-term capital gains tax on share sale

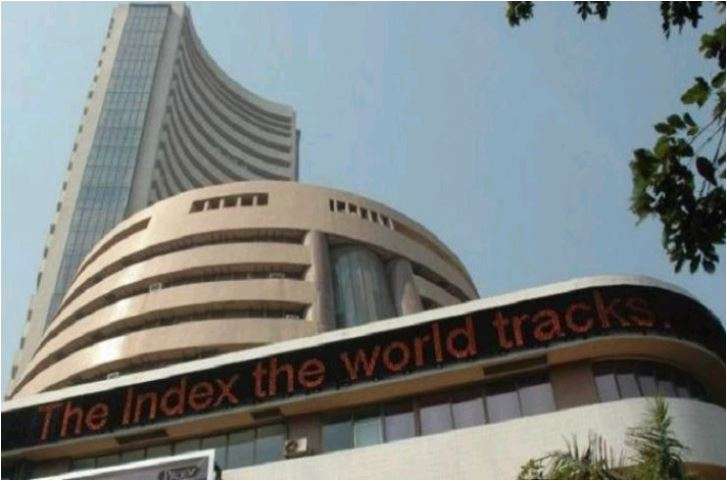

Live MintIf you regularly invest in financial assets and have recently redeemed some of your investments, it is noteworthy that the profits earned on these gains are subject to capital gains tax. Here, we give a lowdown on capital gains tax with regard to financial assets: Listed Securities Short-term gains: When you sell the shares of a listed company within one year of purchase, you are required to pay 20 per cent tax on capital gains. Long-term gains: When the securities of a listed company are sold more than one year after purchase, investors are expected to pay 12.5 per cent income tax. This means if a taxpayer is under the 20 per cent tax bracket, they will be liable to pay 20 per cent income tax. Category Gain Sold on Purchased on Tax rate Listed ₹ 1.5 lakh Jan 1, 2025 Aug 1, 2024 20 Listed ₹ 1 lakh Jan 1, 2025 Dec 1, 2022 0 Listed ₹ 1.5 lakh Jan 1, 2025 Dec 1, 2022 12.5 Unlisted ₹ 1 lakh Jan 1, 2025 June 30, 2023 20 In the above table, the first scenario attracts a 20 per cent tax because it is a short-term capital gain.

History of this topic

Rachel Reeves' plan to hike capital gains tax 'will bite into the profits of investors'

Daily Mail

Tax Issues Arising Out Of A Sale Of Indian Securities By A Non-Resident To A Resident

Live LawDiscover Related

)

)

)