Retail buyers dump LIC, Nykaa, others

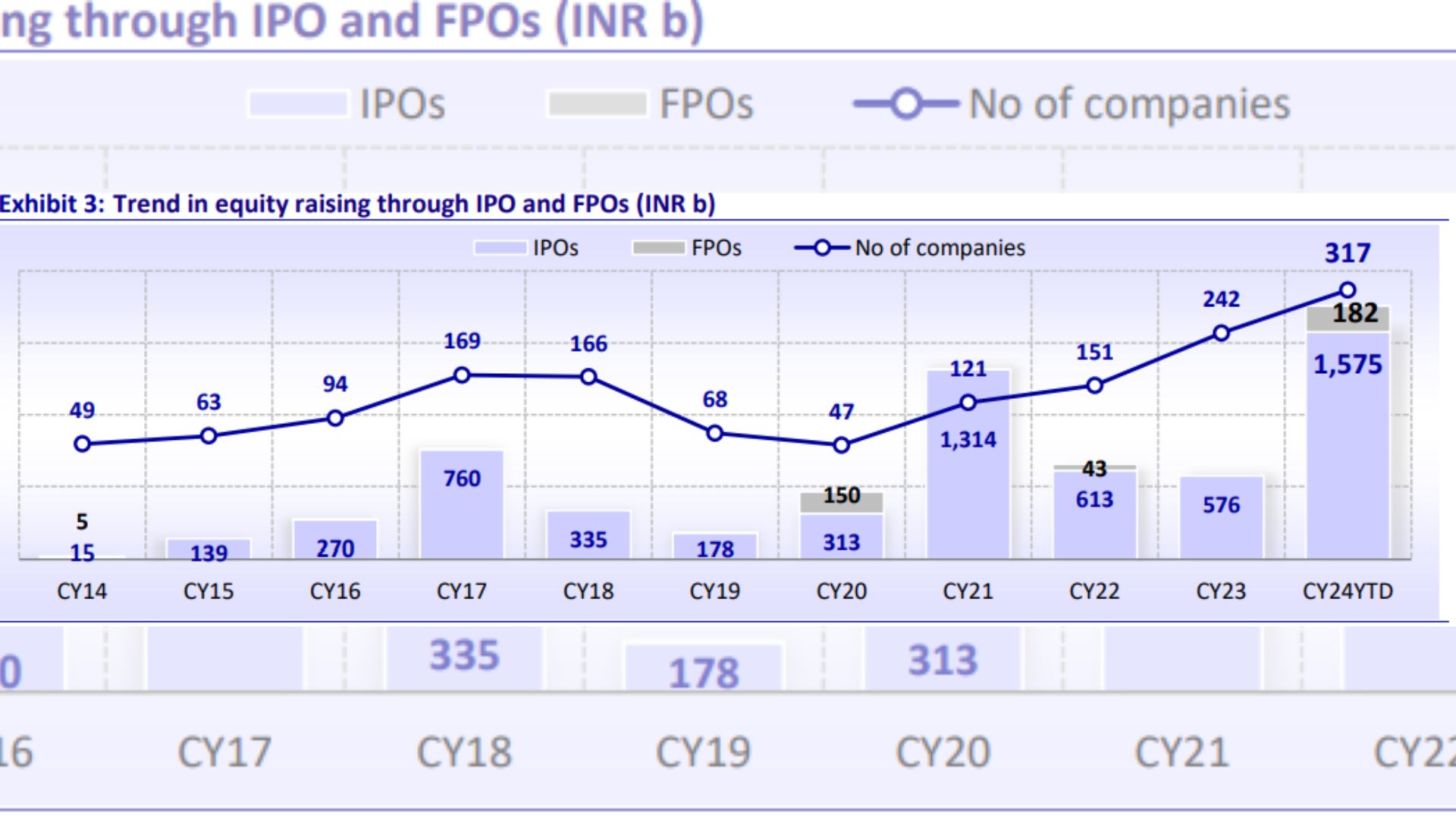

Live MintMUMBAI : A clutch of companies that eroded billions in shareholder wealth since their public listing has seen an exodus of retail shareholders, a Mint analysis of exchange data showed. At least 2.2 million retail shareholders, 73 large foreign institutional investors, and 22 mutual funds sold shares of 12 large companies, including Nykaa, Life Insurance Corporation of India and Paytm, since their initial public offerings. “While the erosion in investor wealth somewhat indicates unfair IPO pricing, with their money stuck in such large listings, millions of public investors, especially retail, are now desperately waiting to exit and put in money in fresh IPOs as primary markets seem to be reviving," said the head of equity capital markets in India at a large US-based banking and financial services firm. Out of the 441 firms, 316 companies—mostly small and mid-cap—together have made gains worth ₹5.11 trillion in market value since their IPOs; however, at least 125 companies, mostly large-caps, caused a loss of ₹5.81 trillion for their IPO investors so far, forcing hundreds of thousands of disgruntled public investors to either exit at steep losses or await indefinitely for their IPO investments to turn a profit. Companies that saw the largest erosion in investor wealth since IPO include Nykaa, LIC, Paytm, EaseMyTrip, Star Health and PolicyBazaar.

History of this topic

MobiKwik’s $67 million India IPO fully sold in first hour as retail investors rush in

Live Mint

Nykaa share price jumps over 5% after strong Q2 results. Should you buy, sell or hold the stock?

Live Mint

Stocks to watch: Vodafone Idea, Eicher Motors, GRSE, Swiggy, Nykaa

India Today

LIC shares may see 51% upside amid deepening market cap discount: Analysts

Live Mint

Nykaa underperforms Zomato, Paytm in last 1 year! Is it still a good buy?

Live Mint

Why Nykaa’s fashion biz is a blemish for growth

Live Mint

What’s adding sparkle to Nykaa shares

Live Mint

Vodafone Idea Shares Fall Over 5%, Nykaa Plunges 11%

ABP News

Nykaa IPO GMP, Subscription Status, Financials: Last Day to Invest, Should you Buy?

News 18

Nykaa IPO opens for subscription today | Price band, lot size, grey market premium, other details

India TV News)

Nykaa IPO Opens Today: Price, GMP, Strength, Valuation, Key Risks; Should you Invest?

News 18

Nykaa IPO GMP, Price, Financials, Key Details to Know Before Subscription Opens

News 18)

Nykaa IPO: Beauty Retailer Looks to List at $ 4.5 Billion Valuation, Reports Say

News 18Discover Related