Multinational corporations dispute billions in tax bills as ATO profit shifting crackdown ramps up

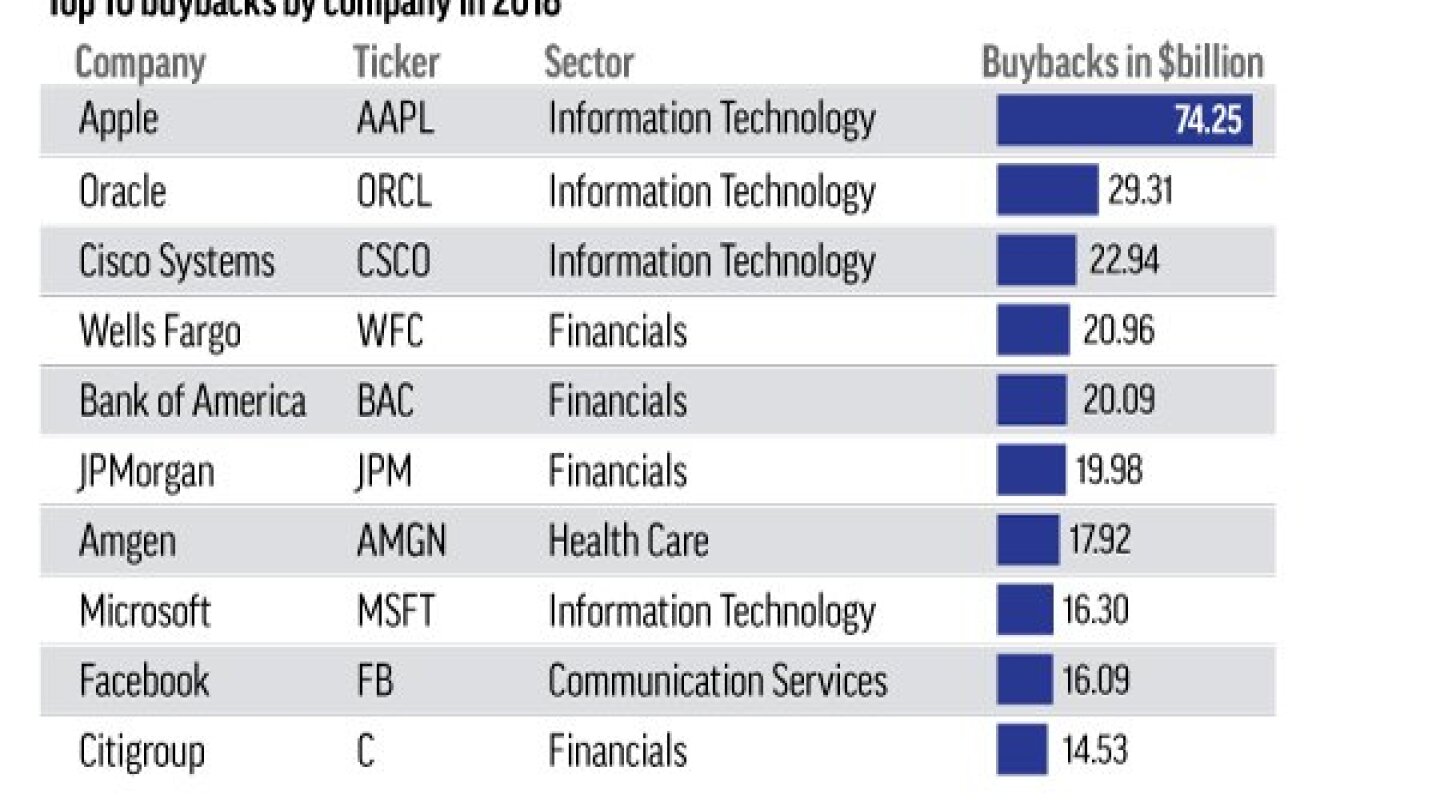

ABCAlmost 200 companies have been hit with $2.5 billion in tax bills over the past financial year alone, after using tactics including mispricing loans and channelling income into low-tax jurisdictions such as Singapore. Key points: The ATO is hitting more companies with tax bills after witnessing continued use of aggressive tax structures A key issue is companies failing to account for value created in Australia, such as intellectual property The tax disputes come as more companies opt to lock in secret deals with the ATO on future tax payments The Australian Taxation Office has been using its suite of powers to fight multinational profit shifting, worried that more large companies are imitating aggressive tax structures used by American tech giants. How companies play tricks to avoid paying tax Ms Saint said another key focus over the past financial year, and this financial year, was how multinationals treat intangibles and intellectual property. Asked whether the ATO would be settling the current tax disputes underway, Ms Saint said: "It's difficult to know at this point".

History of this topic

Hundreds of companies pay no tax, says ATO as it releases latest corporate tax transparency data

ABCATO's debt book grows to more than $53 billion as boss Chris Jordan faces Senate Estimates

ABCOne-third of large Australian companies paid no tax, ATO data show

ABCDiscover Related