Mutual funds: How long can you stay invested in a scheme?

Live MintWhile you shortlist an investment product, it is also very important to know the holding period or the ideal period to stay invested in the product. The Short Term Capital Gains tax is higher than the Long Term Capital Gains tax and so it would be wise to stay till the completion of the short term capital gains period. Up to 1 lakh long term capital gains waiver in a year Every financial year up to 1 lac of long term capital gains from equities or equity mutual funds is waived from being taxed. So to make use of this benefit investors can redeem equity mutual fund units with up to 1 lacs of long term capital gains every financial year. Exit from debt funds Short term capital gains from debt funds, which are gains generated in less than 3 years are taxed are the applicable marginal tax slab of investors.

History of this topic

Make your investments more tax-efficient with these debt-oriented funds

Live Mint

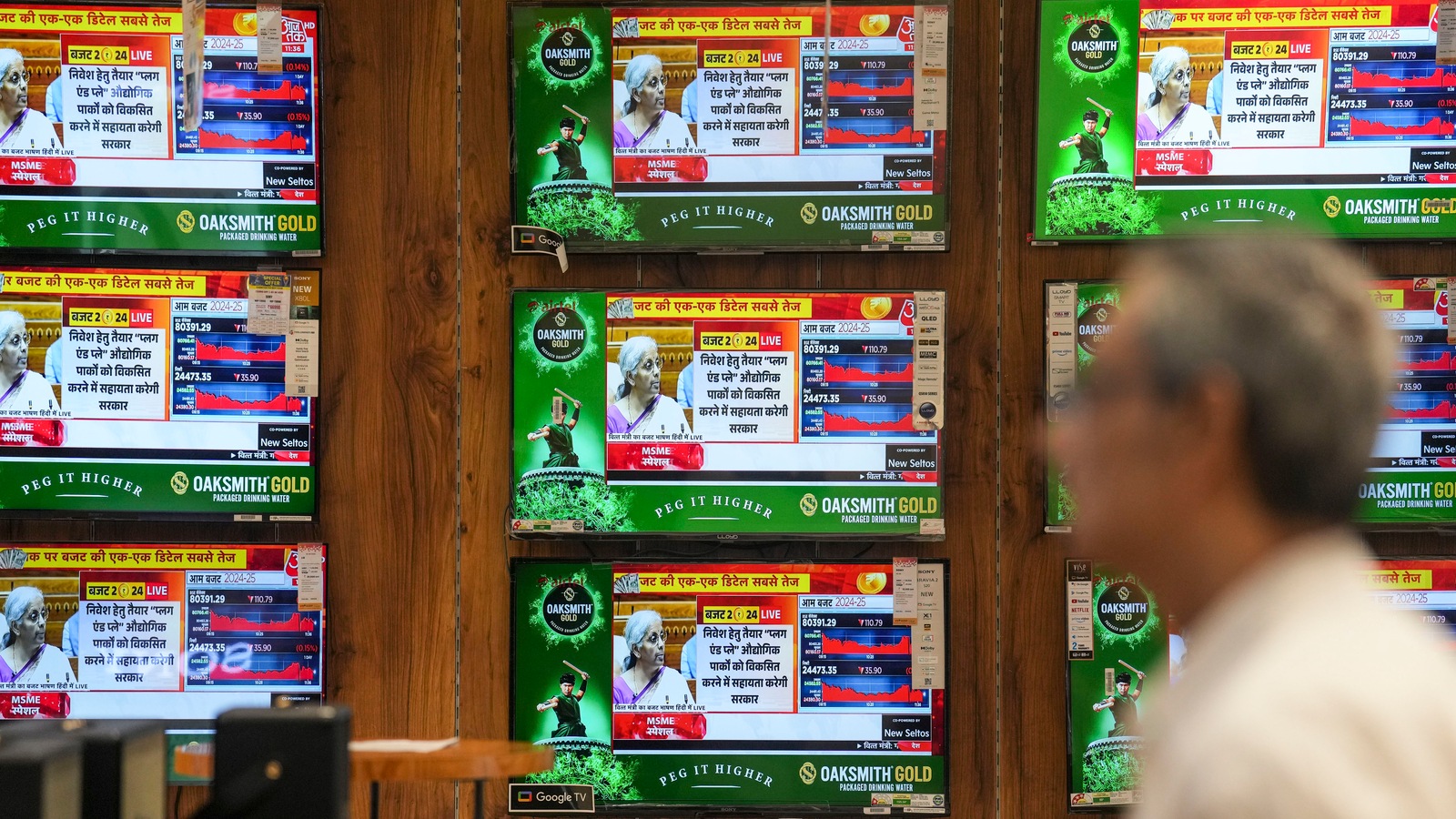

Mutual Fund SIP: How Will Budget 2024 Impact Tax Calculations on Capital Gains?

News 18

Enhancing Investor Returns: A Proposal to Revise Capital Gains Tax for Debt Mutual Funds

Deccan Chronicle

Budget expectations from individual taxpayers, investors

New Indian ExpressGovernment scraps long-term tax benefit for debt mutual funds investing less than 35% assets in equity

The HinduDiscover Related

)