Calcutta High Court Weekly Round-Up 20th May To 26th May, 2024

Live LawNOMINAL INDEXCommissioner Of Income Tax, Central-Iii, Kolkata Versus M/S. 2024 LiveLaw 136 ORDERS/JUDGEMENTS Share Application Money Or Repayment Doesn't Attract Penalty Section 269SS And 269T: Calcutta High Court Citation: 2024 LiveLaw 127 Case Title: Commissioner Of Income Tax, Central-Iii, Kolkata Versus M/S. Filing Information In Sealed Covers For Enforcement Of Arbitral Award Is Contrary To Natural Justice: Calcutta High Court Citation: 2024 LiveLaw 131 Case Title: Uphealth Holdings Inc VS Glocal Healthcare Systems Pvt Ltd And Ors The Calcutta High Court bench of Justice Ravi Krishan Kapur held that the procedure of filing information in sealed covers for enforcement of arbitral award is contrary to the basic process of justice. In these commercial matters, there is no place for confidentiality nor privacy nor sealed covers.” Time Spent From Award Correction And Delivery Of Signed Copy Of Order Should Be Excluded From The Period Of Limitation: Calcutta High Court Citation: 2024 LiveLaw 132 Case Title: Saltee Productions Private Limited Vs. Indus Towers Limited The Calcutta High Court bench of Justice Hiranmay Bhattacharyya held that the starting point of limitation for setting aside an award in a case where a request under Section 33 of the Arbitration Act is made is the date of disposal of such request. In these commercial matters, there is no place for confidentiality nor privacy nor sealed covers.” Letter By Joint Secretary Can't Override Plain And Unambiguous Provision Of Income Tax Act, 1961 And Finance Act: Calcutta High Court Citation: 2024 LiveLaw 134 Case Title: The Royal Bank Of Scotland N.V. @ Abn Amro Bank N.V. Vs Director Of Income Tax, International Taxation 2, Kolkata The Calcutta High Court has held that the letter by the joint secretary cannot override the plain and unambiguous provisions of the Income Tax Act, 1961, and the Finance Act.

History of this topic

![Calcutta High Court Annual Digest: Part-II [Citations: 100-199]](https://www.livelaw.in/h-upload/2024/12/23/578091-calcutta-high-court-annual-digest-2024.jpg)

Calcutta High Court Annual Digest: Part-II [Citations: 100-199]

Live Law

Jharkhand High Court Annual Digest 2024- Part I

Live Law

Supreme Court Weekly Round-up: December 30, 2024 To January 05, 2025

Live Law

Madras High Court Quarterly Digest: October to December 2024

Live Law![Calcutta High Court Annual Digest: Part-I [Citations: 1-99]](https://www.livelaw.in/h-upload/2024/12/23/578091-calcutta-high-court-annual-digest-2024.jpg)

Calcutta High Court Annual Digest: Part-I [Citations: 1-99]

Live Law

Madhya Pradesh High Court Monthly Digest: December 2024

Live Law

Supreme Court Monthly Round-up: December 2024

Live Law

Supreme Court Monthly Round-up: December 2024

Live Law

Punjab & Haryana High Court Monthly Digest: December 2024

Live Law

Madras High Court Monthly Digest - December 2024

Live Law

Jharkhand High Court Weekly Round-Up: December 23 - December 29, 2024

Live Law![Kerala High Court Quarterly Digest: October - December, 2024 [Citations: 608 – 828]](https://www.livelaw.in/h-upload/2024/04/01/531475-kerala-high-court-quarterly-digest-2024.jpg)

Kerala High Court Quarterly Digest: October - December, 2024 [Citations: 608 – 828]

Live Law

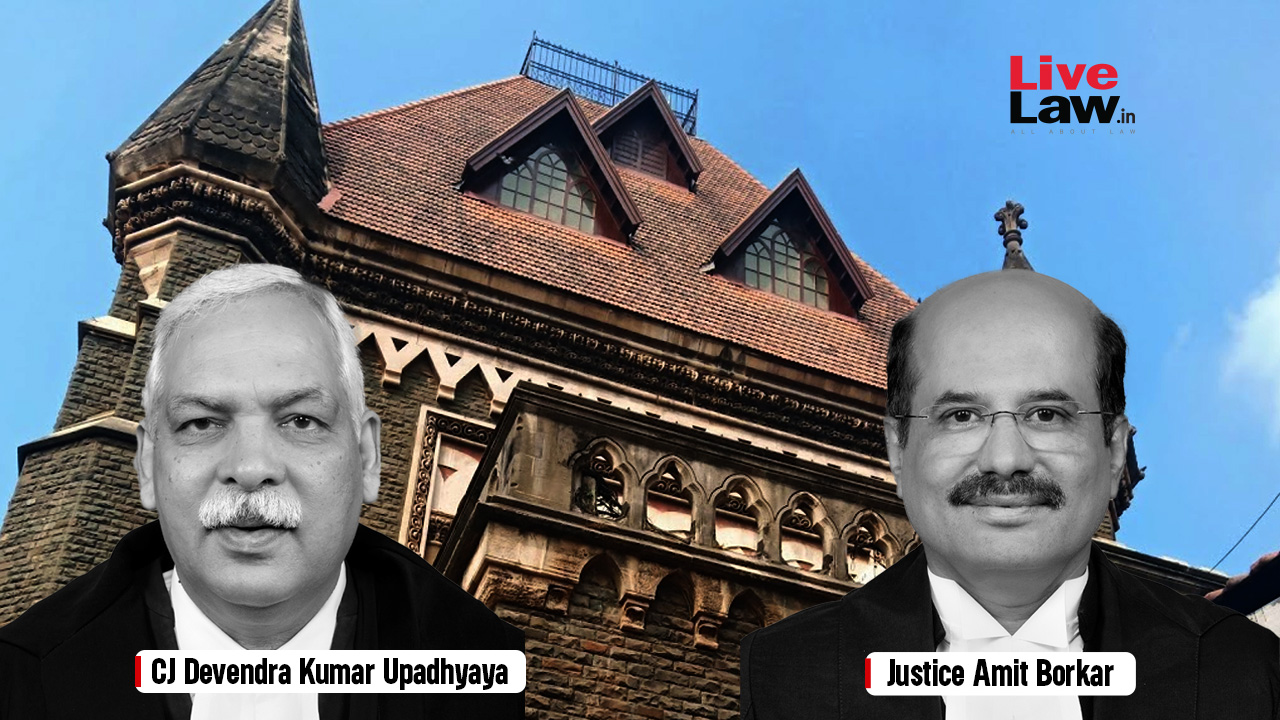

Bombay High Court Monthly Digest: December 2024

Live Law![Delhi High Court Monthly Digest: December 2024 [Citations 1305 - 1394]](https://www.livelaw.in/h-upload/2022/02/01/408682-delhi-high-court-monthly-digest.jpg)

Delhi High Court Monthly Digest: December 2024 [Citations 1305 - 1394]

Live Law![Kerala High Court Annual Digest 2024 [Part I]](https://www.livelaw.in/h-upload/2024/12/19/577406-kerala-high-court-annual-digest-2024.jpg)

Kerala High Court Annual Digest 2024 [Part I]

Live Law

Supreme Court Weekly Round-up: December 16, 2024 To December 22, 2024

Live Law

Bombay High Court Weekly Round-Up: December 16 - December 22, 2024

Live Law

Punjab & Haryana High Court Monthly Digest: November 2024

Live Law![Delhi High Court Monthly Digest: November 2024 [Citations 1193 - 1304]](https://www.livelaw.in/h-upload/2022/02/01/408682-delhi-high-court-monthly-digest.jpg)

Delhi High Court Monthly Digest: November 2024 [Citations 1193 - 1304]

Live Law

Tax Weekly Round-Up: December 09 - December 15, 2024

Live Law

Supreme Court Weekly Round-up: December 9, 2024 To December 15, 2024

Live Law

Rajasthan High Court Monthly Digest: November 2024

Live Law

Calcutta High Court Monthly Digest: November 2024

Live Law

Supreme Court Weekly Round-up: December 02, 2024 To December 08, 2024

Live Law

Bombay High Court Monthly Digest: November 2024

Live Law

Madras High Court Monthly Digest - November 2024

Live Law

Madhya Pradesh High Court Monthly Digest: November 2024

Live Law

Supreme Court Weekly Round-up: November 25, 2024 To December 01, 2024

Live Law

Calcutta High Court Weekly Round-Up: 25th November To 1st December, 2024

Live Law

Kerala High Court Weekly Round-Up: November 25 - December 01, 2024

Live Law

Bombay High Court Weekly Round-Up: November 25 - December 01, 2024

Live Law

Kerala High Court Weekly Round-Up: November 18 – November 24, 2024

Live Law

Delhi High Court Weekly Round-Up: November 18 To November 24, 2024

Live Law

Bombay High Court Weekly Round-Up: November 18 - November 24, 2024

Live Law

Delhi High Court Weekly Round-Up: November 11 To November 17, 2024

Live Law

Calcutta High Court Weekly Round-Up: 11th November To 17th November, 2024

Live Law

Kerala High Court Weekly Round-Up: November 11-November 17, 2024

Live Law

Madhya Pradesh High Court Monthly Digest: October 2024

Live Law

Supreme Court Weekly Round-up: November 4, 2024 To November 10, 2024

Live Law

Supreme Court Weekly Round-up: November 4, 2024 To November 10, 2024

Live Law

Calcutta High Court Weekly Round-Up: November 4th To November, 10th, 2024

Live Law

Himachal Pradesh High Court Weekly Round-Up November 4 - November 10 2024

Live Law

Madras High Court Weekly Round-Up: November 4 to November 10, 2024

Live Law

Jammu & Kashmir And Ladakh High Court Monthly Digest: October 2024

Live Law

Bombay High Court Monthly Digest: October 2024

Live Law

Indirect Tax Weekly Round-Up: 21 To 27 July 2024

Live Law

Kerala High Court Weekly Round-Up: July 16 – July 21, 2024

Live Law

Calcutta High Court Weekly Round-Up: 1st July To 7th July, 2024

Live Law![Allahabad High Court Monthly Digest: June 2024 [Citations 367-415]](https://www.livelaw.in/h-upload/2022/02/01/408722-allahabad-high-court-monthly-digest.jpg)

Allahabad High Court Monthly Digest: June 2024 [Citations 367-415]

Live Law

Kerala High Court Weekly Round-Up: June 24 - June 30, 2024

Live LawDiscover Related

![Kerala High Court Annual Digest 2024: Part II [Citations: 276-550]](https://www.livelaw.in/h-upload/2024/12/19/577406-kerala-high-court-annual-digest-2024.jpg)

![Delhi High Court Annual Digest 2024: Part III [Citations 801 - 1200]](https://www.livelaw.in/h-upload/2024/12/19/577393-delhi-high-court-annual-digest-2024.jpg)

![Jammu & Kashmir And Ladakh High Court Annual Digest: Part II Citation [ 175 - 356]](https://www.livelaw.in/h-upload/2024/12/29/578797-1500x900577411-jammu-and-kashmir-high-court-annual-digest-2024.jpg)

![Karnataka High Court Monthly Digest: December 2024 [Citations: 490 - 532]](https://www.livelaw.in/h-upload/2023/03/01/461349-408717-karnataka-high-court-monthly-digest.jpg)

![Allahabad High Court Annual Digest 2024 [Part II]](https://www.livelaw.in/h-upload/2024/12/23/578086-allahabad-hc-annual-digest-2024.jpg)

![Delhi High Court Quarterly Digest: October To December, 2024 [Citations 1081 - 1394]](https://www.livelaw.in/h-upload/2024/10/07/564729-delhi-high-court-quarterly-digest-2024.jpg)

![Delhi High Court Annual Digest 2024: Part II [Citations 401 - 800]](https://www.livelaw.in/h-upload/2024/12/19/577393-delhi-high-court-annual-digest-2024.jpg)

![Delhi High Court Half Yearly Digest: July To December 2024 [Citations 734 - 1394]](https://www.livelaw.in/h-upload/2024/07/01/547073-delhi-high-court-half-yearly-digest-2024.jpg)

![Punjab & Haryana High Court Annual Digest 2024 [Part- I]](https://www.livelaw.in/h-upload/2024/12/19/577409-punjab-haryana-high-court-annual-digest-2024.jpg)

![Kerala High Court Monthly Digest: December 2024 [Citations: 766 - 828]](https://www.livelaw.in/h-upload/2024/09/03/559124-750x450519604-750x450456553-408710-kerala-high-court-monthly-digest.jpg)