Under RBI’s ombudsman scheme, 7,813 complaints received against digital apps and recovery agents

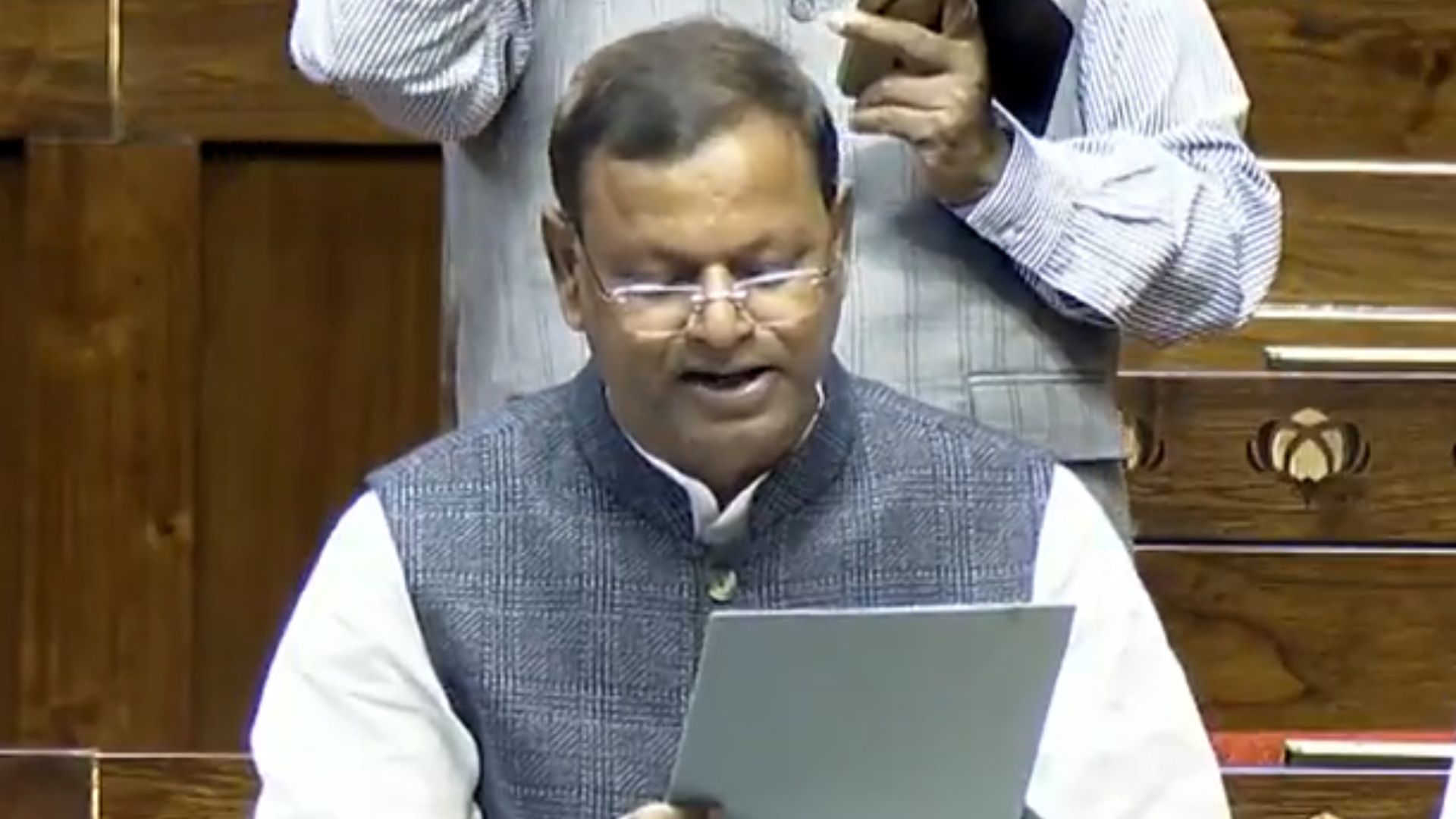

The HinduAs many as 7,813 complaints against banks and non-banking finance companies, pertaining to digital lending applications and recovery agents, were received under the Integrated Ombudsman Scheme of the Reserve Bank of India during the last financial year, according to the Central government. In a written reply to a question from Lok Sabha member Aparajita Sarangi, the Minister of State for Finance said the RBI had introduced the “The Reserve Bank - Integrated Ombudsman Scheme, 2021” wherein complaints against banks and NBFCs regarding digital lending could be lodged. Through a statement in December 2020, the RBI had cautioned the general public against falling prey to unscrupulous activities of unauthorised digital lending platforms/mobile apps and verify the antecedents of the entities offering such loans. It has also issued advisories to the State governments to keep a check on unauthorised digital lending platforms/mobile apps through their respective law enforcement agencies.

History of this topic

ED Files Complaint Against NBFCs and Fintech Firms in Loan Scam

Deccan Chronicle

Indian consumers still falling prey to unlawful loan applications: Report

India TV News

RBI ban on Bank of Baroda World app: Finance ministry's likely plan on frauds

Hindustan Times

The impact of technology on finance: Enhancing experiences and safety

Hindustan Times

In Chandigarh, RBI ombudsman bats for consumer empowerment

Hindustan Times

Google removed over 2200 fraudulent loan apps from Play Store

Deccan Chronicle

Harmonizing Horizons: Unravelling Digital Lending Regulations in a Global Context

Live Law)

Fraudulent loan apps proliferate in India. But how big of a problem are they?

Firstpost

RBI enhances UPI payment limits for healthcare and education

The HinduIndia ranks first in digital payments made globally: Report

Deccan Chronicle

Explained | What is RBI’s pilot programme for facilitating ‘frictionless’ and ‘timely’ credit?

The Hindu

RBI to start pilot on Public Tech Platform for frictionless credit

The Hindu

Home loan, other borrowers can switch to fixed-rate regime: RBI

Hindustan Times

7 reasons why it is essential to stay cautious of digital lending apps

Live Mint)

10 things to know about Reserve Bank of India's Integrated Ombudsman Scheme

Firstpost

Digital Loan Apps in India denied access to user location and call logs: Know Google’s latest guidelines

India TV NewsRBI asks banks, NBFCs to promote digital payments

The Hindu

Har Payment Digital: RBI launches mission to make every citizen a user of digital payment

India TV News

Fintech-Driven Digital Lending To Bridge Credit Gap In India, Says Report

News 18

Are You A Digital Lending App User? Know Your Rights, Complaint Process

News 18)

RazorpayX launches its own digital lending platform for NBFCs ahead of RBI's 30 Nov deadline

Firstpost

Andhra Pradesh: Probe into loan app cases finds links with servers operating from Pakistan, China

The Hindu

Why CCI matters for protecting customers from digital players

Live Mint

RBI to Prepare Whitelist of Legal Loan Apps as Nirmala Sitharaman Cracks Down on Illegal Apps

News 18

India preparing whitelist of legal loan and finance apps, will ban others soon

India Today

The fatal lure of instant loan apps

The Hindu

Entities in Other States Behind Online Loan Frauds, Police Taking Strict Action, Says Kerala Govt

News 18

ED raid on loan apps reveals strong Chinese presence in crypto crimes

The Hindu

Google Play got rid of 2K controversial personal loan apps- Know more

India TV News

India May Ban 300 Apps to Plug the 'Sleaze Route' of Predatory Lending - News18

News 18

Explained | Why has the RBI come out with a framework to regulate digital lending?

The HinduRBI issues guidelines to regulate digital lending

The Hindu

Digital lenders should stick to businesses they are licensed to do: RBI governor

Live Mint

RBI To Soon Come Out With Guidelines On Digital Lending, Says Shaktikanta Das

News 18

RBI unveils guidelines for digital banking units. Here’s 10 key points

Live Mint

RBI finds 600 illegal lending apps operating in India

India Today

Govt issues warning, says installing unknown lending apps may compromise data

Hindustan Times

Credit-starved India Cannot Achieve Double-digit Growth. It Needs Digital Banks for Lending

News 18

Beware! 600 fake money lending apps operating in India, says RBI report

India TV NewsRBI report finds 600 illegal loan apps operating in India

The Hindu

Experience Bank of Maharashtra’s hassle free Digital Lending platform

Hindustan Times

Digital lenders must help the vulnerable access productive credit

Live Mint

ED attaches assets worth Rs 76 Crore in Chinese loan app scam

India Today

Desist from sharing sensitive info online: SBI tells customers

India TV News

Government planning crackdown on apps offering cash loans online

Hindustan Times

RBI receives complaints against 1,509 digital lending apps

India TV News

RBI received complaints against 1,509 digital lending apps

Hindustan Times

RBI sees 387% rise in complaints against NBFCs, 58% rise against banks

Live Mint

NBFCs, fintech companies urge FM Nirmala Sitharaman to enhance lending facilities

Live MintDiscover Related

)

)