Big Banks Are 'Fueling Climate Chaos' By Pouring Trillions Into Oil, Gas And Coal

Huff PostLOADING ERROR LOADING The world’s largest banks have funneled $3.8 trillion into the fossil fuel industry over the last five years, according to new figures published Wednesday. “Major banks around the world, led by U.S. banks in particular, are fueling climate chaos by dumping trillions of dollars into the fossil fuels that are causing the crisis.” JPMorgan Chase provided $51.3 billion of fossil fuel financing in 2020, according to the report — 20% less than 2019 but enough to keep its position as the world’s biggest fossil fuel financer. French bank BNP Paribas, which has pledged to be a leader in climate strategy, provided $40.8 billion in fossil fuel financing in 2020, an increase of 41% from the previous year. However, BNP Paribas supported the oil and gas sector to a lower extent than other sectors of activity.” The spokesperson pointed to the bank’s policies restricting financing from going to the most environmentally damaging fossil fuels and “the significant decrease of our coal exposure in 2020, which directly results from these policies.” A striking finding for 2020 as a whole, said Jason Disterhoft, senior campaigner at Rainforest Action Network and one of the co-authors of the report, was the increase in financing for the 100 biggest companies that are expanding fossil fuels — including those involved in controversial pipeline projects. “Banks are very comfortable with financing the fossil fuel industry as a whole,” said Disterhoft, “but especially the worst clients that are doing the most to cook the climate.” The report examined financing by sector and found a mixed picture.

History of this topic

Big banks urged to step up on sustainable finance in 2025

The IndependentMultilateral banks are key to financing the fight against global warming. Here is how they work

Associated Press

COP28 Ten Top Development Banks World Bank Pledge To Step Up Climate Efforts But Do Not Mention Fossil Fuel Phaseout

ABP News

Canadian bank named world’s largest fossil fuel financier

Al Jazeera

Group of ING business clients ask bank to stop financing fossil fuel firms

NL Times

HSBC updates climate policy to stop funding new oil and gas

Associated Press

Cop26: Is your bank easing or exacerbating the climate crisis?

The Independent

Banks must stop funding new fossil fuel projects as fast as possible

The Independent

How UK banks are fuelling the climate crisis in numbers

The Independent)

World Bank Revises Climate Change Policy But Stops Short of Halting Fossil Fuel Funding

News 18

Banks And Investors Are Still Pouring Billions Into Coal Companies

Huff Post

Why your banking habits matter for the climate

BBC)

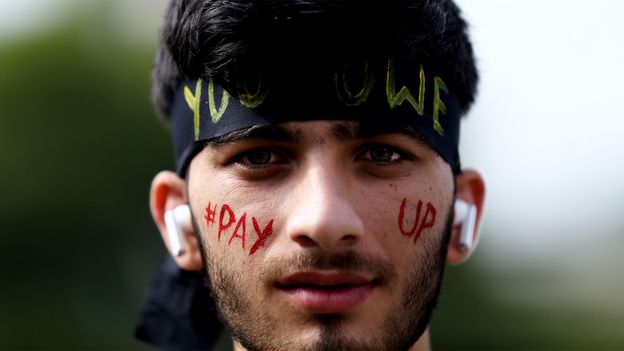

Amid Climate Crisis, Activists Ask Banks to Stop Giving Loans to Industries Harming Wildlife, Forests

News 18Discover Related

)

)

)