India’s Markets Are Turning Into an Inexorable Force

BloombergAnyone wondering whether the India juggernaut is sustainable will find the answer in bonds, which have a penchant for discerning the way of the world and telling every other market what to do. At least $1 trillion of government securities traded multiple times annually in the most populous nation and biggest democracy are poised to become the darling of international investors when India this year joins the benchmark for emerging-market debt compiled by JPMorgan Chase & Co. India's entry following Russia’s exclusion after Vladimir Putin's 2022 invasion of Ukraine and when China's sovereign debt is losing its luster, will make Asia's third-largest economy a beneficiary of as much as $40 billion of inflows during the next 18 months, according to Goldman Sachs Group Inc. How big a deal is that? Consider that foreigners, who are currently prohibited from owning more than 6% of India's sovereign debt, held as little as 0.4% last March, paltry by any measure of major developing countries.

History of this topic

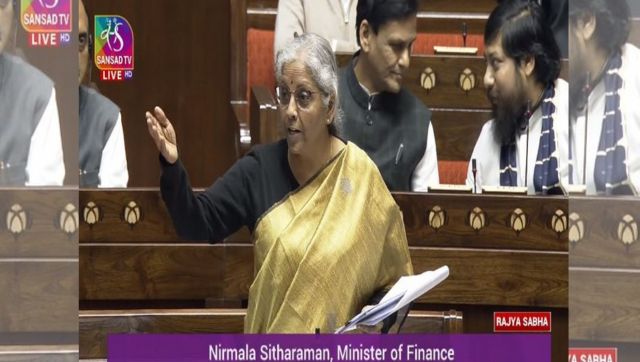

‘Inflation, geopolitics key global economic hurdles’: Nirmala Sitharaman

Hindustan Times

India’s Forex Reserves rebound after 8 weeks of decline amid global uncertainty

Live Mint

Foreign investors buy $1 billion of Indian bonds on bets of policy easing after GDP data

Live Mint

India’s foreign exchange reserves decline for eighth consecutive week

Live Mint

India’s GDP growth estimated to decelerate to 6.3% in 2025, says Goldman Sachs; sees shallow RBI rate cut from Q1CY25

Live Mint

India rupee to lean on central bank help; bonds to track US peers

Live Mint

Indian Economy to Grow 7.2 Percent in 2024, Moody’s Forecasts

Deccan Chronicle

Foreign investors sell nearly $1 billion of JPM index-linked Indian government bonds in Nov

Live Mint

Only a weaker dollar will bring foreign investors back to India: Ruchir Sharma

India Today

Will India triumph or be Trumped?

Live Mint

India Emerges as a Safe Haven for Global Investors Amid Market Uncertainty

Live Mint

Arvind Panagariya: Chinese investments give India leverage, tariff boost FDI

Live Mint

Goldman Sachs cuts India’s 2024 and 2025 GDP growth forecasts

Hindustan Times

India’s ‘sweet spot’ lures bond funds amid global market turmoil

Hindustan Times

India aims to expand scope of ESG debt after surpassing 2021 issuance record

Hindustan Times

India 'not rethinking' on issue of allowing Chinese investment as suggested by Economic survey: Piyush Goyal

India TV News

India’s Booming Forex Reserves: Hidden Risks and Economic Concerns

The Hindu)

Bonds, Indian bonds: Are they outshining those in other emerging markets?

Firstpost

Indian government bonds included in JPMorgan emerging market index: What happens next?

Hindustan Times

Foreign investors find it hard to invest in Indian government bonds due to heavy paperwork: Report

Hindustan Times

IMF says India's GDP growth to moderate to 7% in 2024 and 6.5% in 2025

Times of India

FDI inflows into India down to $28 billion in 2023: UN

Deccan Chronicle

Foreign investors buy $10 billion of Indian govt bonds since JPM inclusion announcement

Hindustan Times

JPMorgan Ignites $40 Billion Rush Into Indian Bonds

Bloomberg

India to remain fastest growing Asia-Pacific economy in 2024, predicts Moody's

India TV News

S&P Upgrades India’s Outlook to Positive After 10 Years

Deccan Chronicle

India in trade deficit with nine of top 10 trading partners in 2023-24

The Hindu

India all set to overtake Japan as fourth largest economy by 2025, predicts Amitabh Kant

India TV News

P Chidambaram's ‘no magic’ barb at PM Modi on ‘India becoming 3rd largest economy’

Hindustan TimesIndian economy projected to grow 6.5% in 2024: UNCTAD

The Hindu

Risky premise: On Asian Development Bank forecast, India’s GDP growth

The Hindu

Inclusion in Global Indices to Bring USD 40 bn Foreign and Equivalent Domestic Capital

Deccan Chronicle

How India's economy under PM Modi offers 'real alternative' to China?

India TV News

Bank of America expects India fundraising to be busier than ever

Live MintRBI Governor Shaktikanta Das: CAD for 2023-24, 2024-25 to be eminently manageable

The Hindu

Wall Street snubs China for India in a historic markets shift

Live Mint)

Vantage | What India must do to be a $7 trillion economy by 2030

Firstpost)

India will be $7 trillion economy by 2030

Firstpost

Budget 2024: Can India become a $7 trillion economy by 2030?

India Today

Indian economy to grow close to 7% in FY25, hit $7 trillion by 2030: FinMin

Live Mint

Why India Isn’t the New China

Live Mint

Riding high on the growth momentum

Hindustan Times

India registered strong investment performance in 2023; headwinds in China from struggling property sector: UN

The Hindu

Centre refutes IMF's debt warning, recalls ‘far worse’ conditions of US, China

Hindustan Times

'Still below debt level of 2002,' India terms IMF's latest report 'misconstrued'

India TV News

'India will become USD 5 trillion economy by end of 2025': Amit Shah at Uttarakhand Global Investors Summit

India TV NewsIndia Projected to Become World's Third-Largest Economy by 2030

Deccan ChronicleA $5 trillion economy, but for whom?

The HinduIndia will be third largest GDP by 2027, says Nirmala

Deccan ChronicleDiscover Related

)

)