Policymakers in a quandary as inflation looks far from ebbing

Live MintRekha Jadhav, 52, a vegetable vendor in Navi Mumbai’s Kharghar, used to make ₹7,000 a day till last December. With demand strengthening and some households having greater visibility on their income outlook, inflation expectations are expected to remain high,” said Aditi Nayar, principal economist, ICRA Ltd. India’s retail inflation based on the Consumer Price Index hit a nearly six-and-a-half-year high of 7.6% in October, with food inflation registering a steep rise. According to the survey findings, while economic recovery will continue to remain the cornerstone of the central bank’s monetary policy focus for the foreseeable future, high inflation, which has hovered at the 6% mark, will likely outweigh other concerns in the upcoming policy review. “Given that consumption is so critical for revival of Indian economy and that the pandemic has resulted in job losses and income destruction, high inflation is the last thing households want,” said Crisil Research in a 13 November note. If it is assumed that retail inflation goes up by 1 percentage point, overall private final consumption expenditure increases by ₹1.23 trillion to consume the same basket of goods and services.

History of this topic

India’s WPI Inflation Drops to 1.89 Percent in November on Food Prices

Deccan Chronicle)

India’s wholesale inflation dips to 1.89% in November after hitting four-month high in October

Firstpost

Wholesale food inflation cooled to 8.9% in November from 25-month high of 11.6%

The Hindu)

India’s retail inflation eases to 5.48%, industrial production rises to 3-month high

Firstpost

Consumer inflation moderates slightly to 5.5% in November

The Hindu

Retail inflation slows slightly at 5.48%

Hindustan Times

India’s retail inflation moderates to 5.48% in November, IIP expands to 3.5% in October

Live Mint

US wholesale inflation surged higher in November

CNN

Retail inflation eases to 5.48% in November from above 6% in October

India Today

Retail inflation data today. 3 things you should know

India Today

Retail inflation eases to 5.48% in November as compared to 6.21% in October, check main reasons

India TV News

Inflation likely eased to 5.5% in November: Mint poll

Live Mint

Staying the course: On the RBI and inflation

The Hindu

RBI MPC verdict today: Repo rate to GDP, inflation forecasts— here are 5 key indicators to watch

Live Mint

RBI cuts growth forecast to 6.6 per cent, revises inflation estimate to 4.8 per cent for FY25

India TV News

RBI MPC meet: Growth needs a boost, but will inflation hold back rate cut?

India Today

India Expects Relief in Food Inflation with Strong Kharif Harvest

Deccan Chronicle

Food Inflation To Calm Down In Next Few Months, Says Finance Ministry’s Report

ABP News

Govt evaluating impact of PDS ration on inflation

Hindustan Times

Unchecked 'sticker shock' from inflation can hurt manufacturing and economy, RBI says

Hindustan Times

India’s central bank should adhere to its inflation-targeting mandate

Live Mint

Tomatoes, Onions, Gold Driving CPI Inflation Says CEA

Deccan Chronicle

Inflation behaving more like a magician who tricks you again and again

New Indian Express

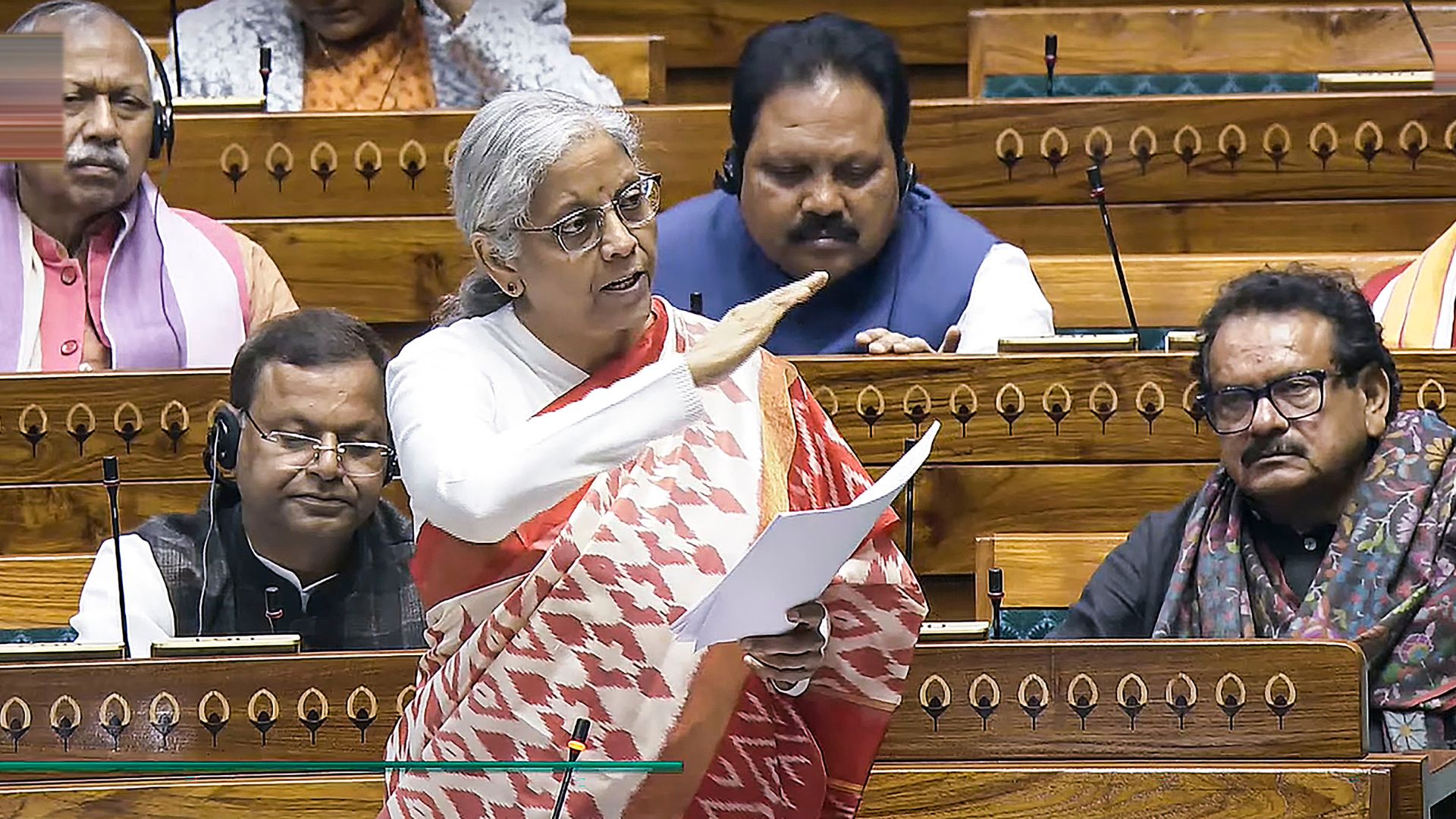

Nirmala Sitharaman acknowledges netizen’s request for relief to middle class. Check her response here

Live Mint

DC Edit | RBI may have to defer rate cut

Deccan Chronicle

‘Absolutely flawed…’: RBI should boost growth with rate cut, says Union Minister Piyush Goyal; Governor Das responds

Live Mint

Rising food prices push India’s wholesale inflation to four-month high in Oct

Live Mint

India trade minister says central bank should cut rates, look through food prices

Live Mint

All about the inflation spike: how, why & when

Live Mint

Wholesale inflation rises to 2.36 per cent in October mirroring retail figures, food costs up 11.59 per cent

India TV News

Why October inflation numbers may delay RBI interest rate cut

India Today

Spectre of food inflation haunts the economy again

New Indian Express

Consumer inflation at 14-month high of 6.2%

Hindustan Times

India’s Industrial Output Grows 3.1 Percent in September Amid Rising Inflation

Deccan Chronicle

Will October inflation push Q3 print above RBI’s forecast?

Live Mint

Retail Inflation Soars To 6.2% In October, Exceeding RBI's Tolerance Limit

ABP News

India’s retail inflation surges to 6.2% in October

The Hindu)

India's consumer inflation at 14-month high of 6.2%, first breach of RBI tolerance band since Aug 2023

Firstpost

India’s 14-month high retail inflation fades hope of December rate cut

Live Mint

Retail inflation at a 14-month high, rises to 6.21% in October

India Today

No relief for Indians, as inflation rise further to 5.81% in October because of food price surge

Live Mint

Inflation hump: Will it continue beyond October?

Live Mint

Why hasn’t RBI cut policy rates despite its lack of control over food inflation?

Live Mint

India's Economy Shows Satisfactory Performance in First Half of FY25, But Risks from Geopolitical Conflicts and Global Factors

Hindustan Times

India's WPI inflation drops to four-month low of 1.31 per cent in August on lower prices

New Indian Express

Last mile woes: On inflation data and the challenges

The Hindu

U.S. inflation reaches a 3-year low as Federal Reserve prepares to cut interest rates

LA Times

Slide in tomato prices aid an 8% dip in vegetarian meal costs, CRISIL says

The Hindu

Avoid haste on shift to core CPI

Hindustan Times

Harris zeroes in on high food prices as inflation plays a big role in the presidential race

LA TimesDiscover Related

)

)

)