Debit, credit card automatic payment rule to change from April 1: All you need to know

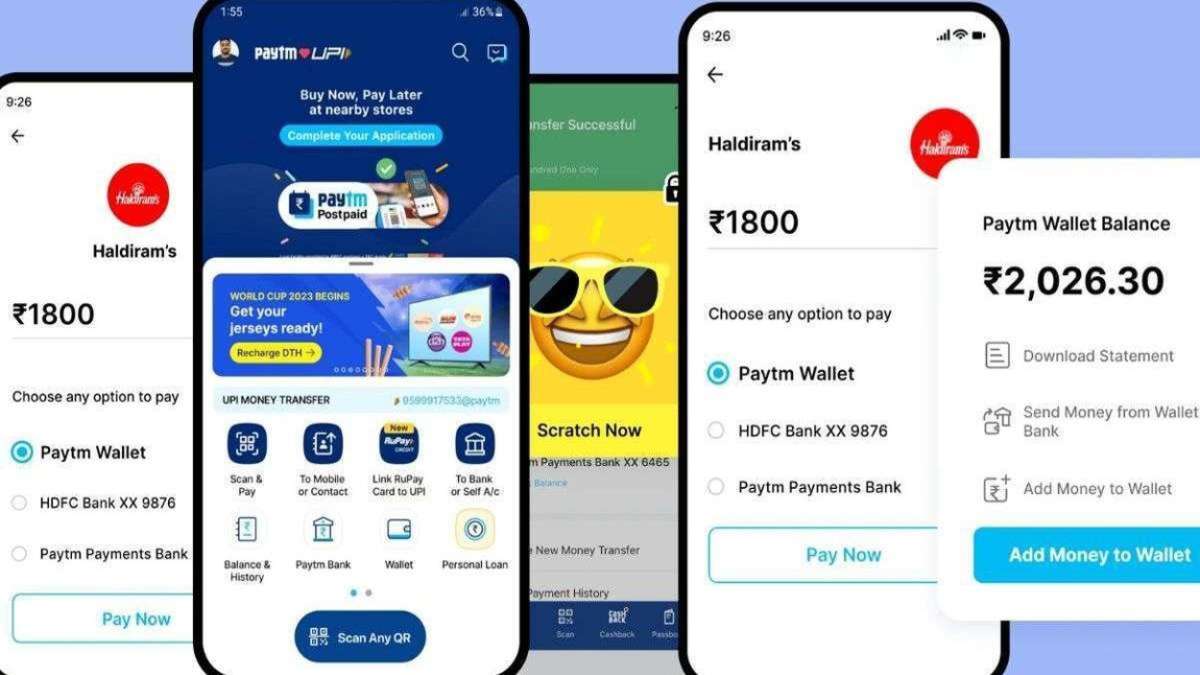

India TodayThe automatic or recurring payment facility for mobile recharges, utility and other bills is likely to be stopped from April as the Reserve Bank of India has made an additional factor of authentication mandatory after March 31. The central bank had earlier stated that recurring or automatic payments using debit cards, credit cards, Unified Payment Interface and other prepaid instruments will need mandatory AFA from April 1. ALL YOU NEED TO KNOW As per the RBI directive, automatic or recurring payments from debit and credit cards or wallets will require additional authentication from the customer. RBI said, "A cardholder desirous of opting for e-mandate facility on card shall undertake a one-time registration process, with AFA validation by the issuer.” It may be noted that the limit for automatic or recurring payments from cards and various wallets has been set at Rs 5,000. As mentioned earlier, the new automatic or recurring payment rule will apply to all types of transactions involving debit card, credit card, UPI, PPI and mobile wallets.

History of this topic

Credit Card: RBI Extends Deadline to Implement New Rules to October 1; Know the Changes

News 18

Debit Card, Credit Card Online Payment Rule Changes from Next Month: Know Details

News 18

Debit, Credit Card Rule Changes Next Month: Enter Card Number for Every Online Payment or Do This

News 18

RBI Policy: Now, no OTP needed for auto-debit recurring payments upto Rs 15,000

India TV News

New Online Card Payment Rules Delayed To July 2022: Details

News 18

New RBI Rule: Confusion Over Auto Debit Payment System Adding To Customers' Woes

ABP News

In Focus: Will your recurring payments fail from today?

Business Standard

Debit Card, Credit Card Auto Payment to Fail from Today If you Don't Follow New Rule

News 18

Automated bill/card payments stop from today

Deccan Chronicle

Credit card, debit card payment: New rule on auto-debit transactions from next month

Live Mint

RBI defers rules on auto debit transactions till Oct

Live Mint)

RBI Extends Deadline for New Guidelines on Auto-Payment of Bills, Subscriptions to Sep 30

News 18)

Your Auto-debit Facility for Bills Might Fail from April 1; Here's Why

News 18)

Auto-Payment Of Bills, Subscriptions May Face Issues From April 1 Due to RBI Direction

News 18

Online automatic transactions will not fail from April 1, RBI extends deadline by 6 months

India Today

Automatic recurring payment to comply with RBI direction from April 1

The Hindu

Debit Card, Credit Card new rules come into force from October 1. All you need to know

India TV NewsDiscover Related

)