)

5 years, 11 months ago

Budget 2019: Raising income tax exemption limit to Rs 5 lakh will give relief to many; ensure more savings and investments

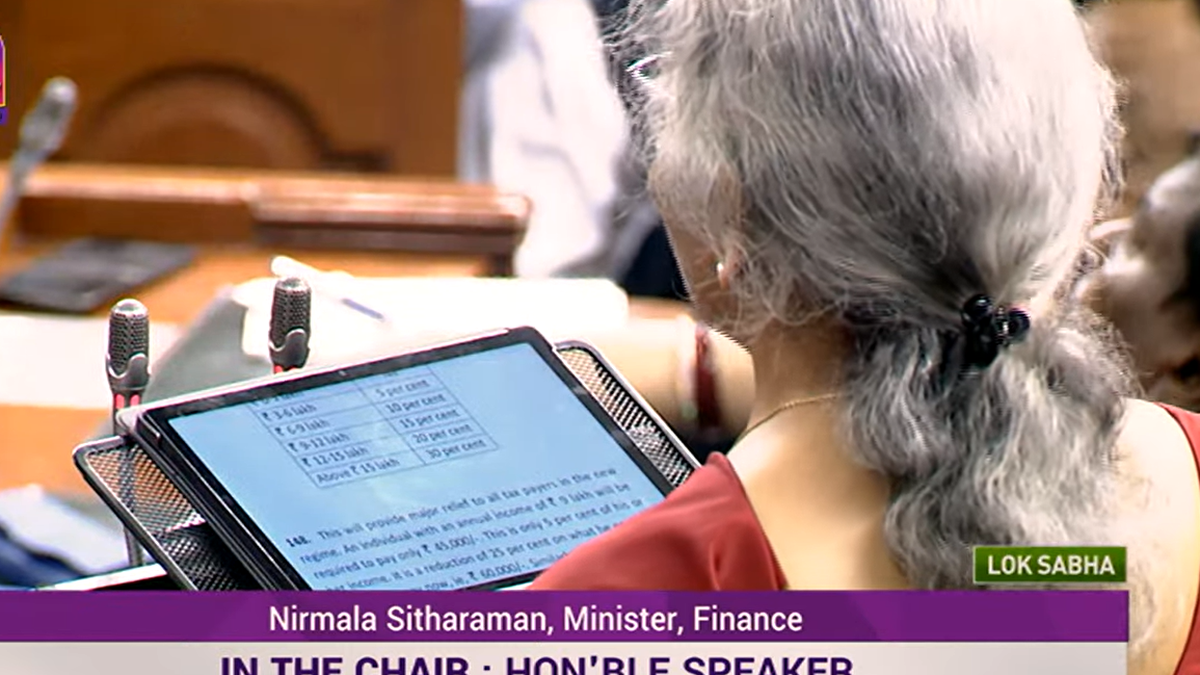

FirstpostOne very important move in Budget 2019 is that income tax returns will now be processed within 24 hours and refunds will be initiated immediately. Individuals with taxable income less than Rs 5 lakh won’t have to pay any tax. Raising of tax exemption limit to Rs 5 lakh was a demand even before this government came to power. This move to give relief to individuals with taxable income less than Rs 5 lakh is as far from being populist as anything can be because more disposable income in the hands of people will ensure more savings and investments.

Tax

Budget

Income

Lakh

Rs 5 Lakh

Taxable Income

returns

limit

raising

crore

income

relief

exemption

budget

investments

tax

yojana

modi

rs

savings

interest

lakh

History of this topic

Trending News

6 days, 11 hours ago

Budget 2025: Higher exemption limit and lower tax rates? Check top expectations

India Today

1 week ago

Budget 2025: Can you expect Rs 10 lakh tax-free income?

India Today

1 week ago

Budget 2025: Salaried earners up to Rs 15 lakh may get tax relief. Details here

India Today

2 weeks, 6 days ago

Government may consider tax relief for income of up to Rs 10.50 lakh: Report

India Today

3 weeks ago

Income tax relief in Budget 2025? Economists push for cuts to help save more

India Today

5 months, 3 weeks ago

Budget 2024: How the changes in new tax regime will benefit the salaried, explained

Hindustan Times

5 months, 3 weeks ago

Revised income tax slab rates, Budget 2024: Salaried individuals stand to save up to ₹17,500, standard deductions hiked

The Hindu

5 months, 3 weeks ago

Budget 2024 Highlights on income tax: FM Sitharaman revises personal income tax slabs; taxation rates remain unchanged

The Hindu

5 months, 3 weeks ago

FM Says Salaried Employees Under New Tax Regime To Save Rs 17,500 Annually, Here's How

News 18

5 months, 3 weeks ago

Budget 2024 Boost To New Tax Regime: Standard Deduction Raised To Rs 75k From Rs 50k

News 18

5 months, 3 weeks ago

Budget 2024: Will common man and salaried class get income tax relief? | Here's what we know

India TV News

5 months, 3 weeks ago

New tax regime slabs revised, standard deduction hiked to Rs 75,000. Details here

India Today

5 months, 3 weeks ago

Budget 2024 announcements on new tax regime: Standard deduction increased, check new tax slabs

India TV News

5 months, 4 weeks ago

Budget 2024: Will Nirmala Sitharaman bring cheer to middle-class with income tax changes?

Hindustan Times

5 months, 4 weeks ago

Budget 2024: Taxpayers, you can expect these 6 income tax benefits on July 23

Hindustan Times

5 months, 4 weeks ago

Budget 2024: What income tax benefits can taxpayers expect on July 23?

India Today

6 months, 3 weeks ago

Budget 2024: Low-income individuals likely to get big tax relief, says report

India Today

6 months, 4 weeks ago

Budget 2024: Exemption limit under new tax regime may be hiked to Rs 5 lakh, says report

India Today

6 months, 4 weeks ago

Budget 2024: Which income categories can expect tax relief?

India Today

9 months, 3 weeks ago

Major Income Tax Reforms Effective From April 1: What You Need To Know

ABP News

11 months, 2 weeks ago

Budget 2024: 6 key changes taxpayers want from FM Sitharaman

India Today

11 months, 2 weeks ago

Interim Budget 2024: Will new income tax regime get another makeover?

India Today

11 months, 4 weeks ago

Interim budget 2024: Can taxpayers expect relief? 5 anticipated changes

India Today

1 year ago

Interim Budget 2024: Will standard deduction of Rs 50,000 get a hike?

India Today

1 year, 10 months ago

Income Tax saving: 5 things taxpayers can do before March 31

India Today

1 year, 11 months ago

Budget 2023: How Nirmala Sitharaman attempted to simplify tax experience

Live Mint

1 year, 11 months ago

Budget 2023: Big hike in tax exemption on encashed leaves for non-govt staff

Hindustan Times

1 year, 11 months ago

Budget 2023 | Those earning up to ₹7 lakh a year need not pay income tax

The Hindu

1 year, 11 months ago

Budget 2023: How are old and new income tax slabs different from each other

Hindustan Times

1 year, 11 months ago

Budget 2023: Govt increases income tax rebate to Rs 7 lakh per annum | 5 major announcements

India TV News

2 years, 11 months ago

Union Budget 2022-23: Why salaried class may not get big income tax relief

India Today

3 years ago

Budget 2022: Will Govt Increase Standard Deduction to Rs 1 Lakh to Help the Salaried?

News 18)

3 years, 11 months ago

Budget: Additional Deduction of Rs 1.5 Lakh on Home Loan Interest Extended Till March 2022

News 18)

3 years, 11 months ago

Union Budget 2021: Reintroduce single tax slab structure, raise minimum taxable income to Rs 7.5 lakh

Firstpost)

3 years, 11 months ago

Budget 2021: Know All About the Existing Income Tax Slabs

News 18)

3 years, 11 months ago

Income Tax Deductions, Work From Home Benefits: 5 Things Middle Class Expects from Budget 2021

News 18)

3 years, 11 months ago

Union Budget 2021: Finance Ministry May Give Relief Up to Rs 80,000 in Total Tax Liability to Encourage Spending

News 18

4 years, 8 months ago

Mega Covid 19 relief package: Income tax returns for 2019-20 can now be filed until November

Hindustan Times

4 years, 11 months ago

Full text of Budget 2020 speech by Finance Minister Nirmala Sitharaman

India Today

4 years, 11 months ago

Budget 2020: Personal Income Tax Rates Slashed

Live Law

4 years, 11 months ago

Budget 2020: Income tax slabs lowered for those who forgo exemptions

The Hindu)

4 years, 11 months ago

Various tax exemptions for salaried class has outlived utility; time for Nirmala Sitharaman to enhance them

Firstpost

4 years, 11 months ago

69 pc want tax free income to be hiked to Rs 5 lakh in the Union Budget

India TV News

4 years, 11 months ago

Govt proposes BIG relief on income tax slabs in Budget 2020: Reports

India TV News

4 years, 11 months ago

Budget 2020: Modi govt's toughest economic test and a tricky equation

India Today)

5 years, 6 months ago

Affordable housing: How to claim Income Tax deduction up to Rs 3.5 lakh on home loans

Firstpost

5 years, 6 months ago

5 key changes in income tax provisions announced in Budget 2019

Live Mint

5 years, 6 months ago

Budget 2019: Rs 1.5 lakh income tax deduction on loans taken to buy e-vehicles

India Today

5 years, 6 months ago

Budget 2019: How two new tax categories will impact Super-Rich

India Today

5 years, 6 months ago

Budget 2019: All eyes on Nirmala Sitharaman as middle class expects raise in tax exemption limit

India TV NewsDiscover Related

2 hours, 55 minutes ago

4 hours, 54 minutes ago

6 hours ago

23 hours, 29 minutes ago

1 day, 11 hours ago

2 days, 6 hours ago

3 days, 1 hour ago

3 days, 19 hours ago

4 days, 5 hours ago

5 days, 5 hours ago

5 days, 11 hours ago

5 days, 11 hours ago

Trending News

6 days, 11 hours ago

6 days, 11 hours ago

6 days, 11 hours ago

6 days, 18 hours ago

1 week ago

Top News

1 week ago

1 week ago

1 week ago

Top News

1 week, 1 day ago

1 week, 1 day ago

1 week, 2 days ago

1 week, 2 days ago

1 week, 2 days ago

1 week, 4 days ago

1 week, 4 days ago

1 week, 5 days ago

Trending News

1 week, 5 days ago

1 week, 5 days ago

1 week, 6 days ago

Trending News

1 week, 6 days ago

1 week, 6 days ago

Trending News

1 week, 6 days ago

2 weeks ago

)

2 weeks ago

Trending News

2 weeks ago

2 weeks, 1 day ago

2 weeks, 1 day ago

Trending News

2 weeks, 2 days ago

2 weeks, 2 days ago

2 weeks, 3 days ago

2 weeks, 4 days ago