IPO markets are hot; may cooler heads prevail

Live MintFrom the ecstatic highs of Nykaa to the despondent depths of Paytm, Indian flippers of initial public offerings have been on a roller-coaster ride through the crowded IPO amusement park squatting on Dalal Street for the past few months. This is compounded further by an information asymmetry that underlies IPO usage, with better-informed insiders and early backers often looking to offload their stakes upon less informed public market investors. During the 2007 cycle, education stocks like Educomp and Everonn had attracted the fancy of IPO investors, who showered them with listing gains of 123% and 241% respectively. For an IPO trader trying to harvest listing gains, these numbers imply a Sharpe ratio of 0.49, which is far lower than that of an average exchange-traded fund tracking the NSE Nifty. Despite such clear evidence against IPO over-exuberance from various stock markets, investors periodically succumb to the euphoria of a “hot" primary market and burn their fingers time and again.

History of this topic

IPO Scorecard: Over 300 stocks debut on Dalal Street in 2024, nearly 70% trade above issue prices

Live Mint

Reality check: Why IPO listings are not making you rich any more

India Today

IPO frenzy fizzling out: What’s behind low subscription rates, tepid listings?

Live Mint

SME IPO Frenzy: Opportunity or bubble? 2024 sees record ₹8,200 crore raised by SME firms

Live Mint

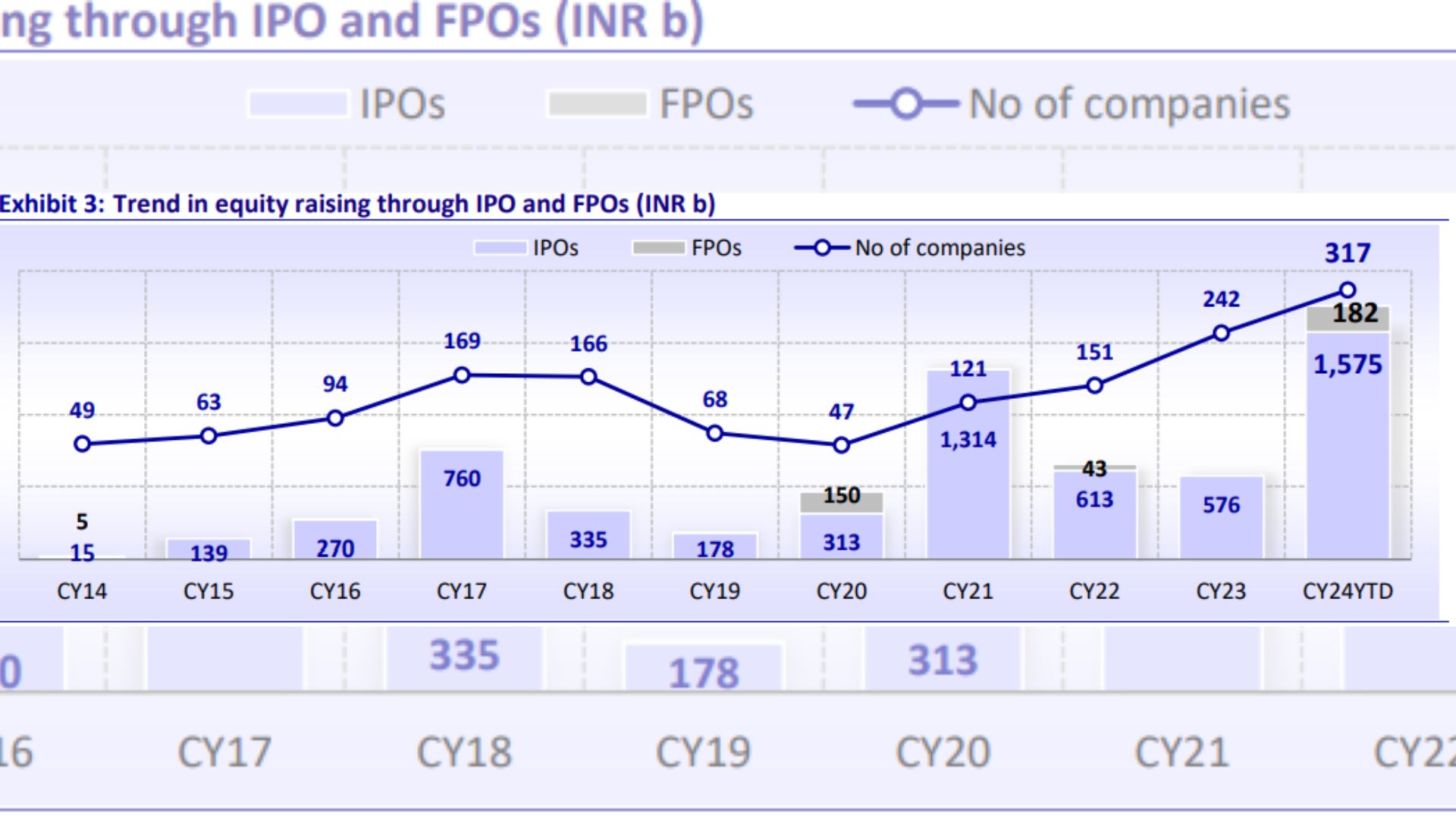

India accounted for 25% of global IPOs in first half of 2024

Hindustan Times)

IPO market in India: Most investors chase listing lottery, sell shares within a week, says Sebi

Firstpost

Most IPO shares sold in 7 days, 70% within a year; top investors from Gujarat

Hindustan Times

The Role Of The Best Trading Platforms In Navigating Upcoming IPOs In India

ABP News

75% IPOs show positive returns in past year: Does IPO investing generate alpha?

Live Mint

IPO fundraising slumps by 26% in H1 FY24 to ₹26,300 crore, shows data

Live Mint

Driven By SME IPOs, India Leads Global IPO Chart With 80 Listings Till June 2023: Report

ABP News

IPO pipeline in India seen active in 2023 on smaller deals

Live Mint)

'High Momentum': India Records 22 IPOs Worth Over $2.5 Billion in January-March Period

News 18

Loaded investors and niche firms keep IPOs shining

Live MintDiscover Related